You probably didn’t notice when mobile games stopped being just games. Maybe it was the first time you bought a battle pass, or when that limited-time skin felt a little too tempting to skip.

And while we’ve been busy chasing trophies and events, the gaming industry has been raking in serious cash. According to mobile game revenue statistics for 2026, the industry generates over $133 billion globally, accounting for more than half of all gaming revenue. That’s not just a record-breaking number; it’s proof that mobile gaming has become the financial backbone of the entertainment world.

Ready to find out if your favorite mobile game is a revenue titan? Our insights as a game development company look into where the money is coming from in mobile gaming and where it is going. We will also map out top-grossing countries, year-over-year growth, genre-specific insights, and trends that could shape the next big hit.

Mobile Game Revenue Statistics: A Global Snapshot

The mobile gaming market has officially crossed the $130 billion mark, making up more than half of the entire video game industry’s earnings worldwide. A mobile game marketing report by IMARC Group forecasts its growth at a CAGR of 8.5%, reaching approximately $217 billion by 2033.

In some regions, mobile games are even outselling console and PC combined. But this explosive growth didn’t just happen overnight. A few key drivers behind the rise of mobile gaming are:

- Accessibility: Everyone has a smartphone. That means low barrier to entry, and billions of potential players.

- Free-to-play (F2P) economics: Most games are free to download, monetized through microtransactions and ads.

- Global rollout of 5G: Faster networks mean smoother gameplay, more competitive experiences, and bigger in-game file sizes.

- Rise of mobile-first developers: Studios are building games optimized for mobile from day one, not as an afterthought.

- Advances in mobile hardware: Smartphones today pack impressive processing power and graphics, rivaling older consoles.

- Social and community features: Mobile games love to bring players together with social play, leaderboards, and special events that keep everyone coming back for more.

How Big Is the Mobile Gaming Market in 2026?

According to Yahoo Finance, the mobile games market is expected to reach 2.5 billion users by 2030. It is nearly 42% of the global population, showing just how huge and fast-growing this audience is. These players aren’t just downloading games; they are the main factors in the mobile gaming market size, driving billions in revenue every year.

Mobile Game Revenue Statistics by Year (2021–2027)

Mobile game revenue continues its rapid ascent, topping $126 billion by 2025 and projected to reach $140 billion by 2027, as per Statista. Let’s take a look at how global mobile game revenue grew from 2021 and how it’s expected to trend in the next few years:

| Year | Global Mobile Game Revenue |

| 2021 | $93.2 billion |

| 2022 | $96.2 billion |

| 2023 | $101.3 billion |

| 2024 | $111.4 billion |

| 2025 | $125+ billion |

| 2026 | $133 billion (proj.) |

| 2027 | $140 billion (proj.) |

Between 2021 and 2027, mobile gaming is projected to grow by nearly $47 billion in annual revenue, which is a 50% jump in just six years.

Mobile Gaming Average Revenue Per User (ARPU): 2021–2027

The average amount a mobile gamer spends each year is known as ARPU. It has been climbing steadily. Back in 2021, players spent about $89.38 on average, which increased to $95.41 in 2025. Bank My Cell data suggests that ARPU will climb to about $94.53 in 2026, reflecting sustained growth in in‑app purchases, ads, and other revenue streams.

| Year | ARPU (USD) | Year-over-Year Change |

| 2021 | $89.38 | — |

| 2022 | $90.21 | +0.9% |

| 2023 | $91.12 | +1.0% |

| 2024 | $92.31 | +1.3% |

| 2025 | $93.42 | +1.2% |

| 2026 | $94.53 | +1.2% |

| 2027 | $95.41 | +0.9% |

It might not sound like much when you are just one player tapping away, but when millions join in, that adds up to a huge boost for the mobile gaming industry.

Now, players are more open than ever to splurging on in-app goodies, subscriptions, and ads that reward them. Well-made mobile game marketing strategies are fueling this surge:

- Free-to-play dominance: Games are built around monetizing long-term engagement instead of upfront sales.

- Stronger devices and better networks allow for more complex games and more ways to spend.

- Cloud integration and 5G rollout have expanded access to high-quality gaming without console-level hardware.

- More efficient ad networks mean even free users can generate consistent revenue.

- Got a Game Idea Stuck in Your Notes App?

- We help turn that into your first revenue milestone.

Mobile Game Revenue Statistics Worldwide: Who’s Dominating the Market?

The race for mobile gaming dominance in 2026 isn’t just about who has the most players. It is about who’s turning those players into serious revenue. Globally, mobile gaming revenue is becoming more concentrated, with a handful of countries pulling in the lion’s share of profits.

This section unpacks the top-earning countries, the numbers behind their success, and the regions rising fast behind them.

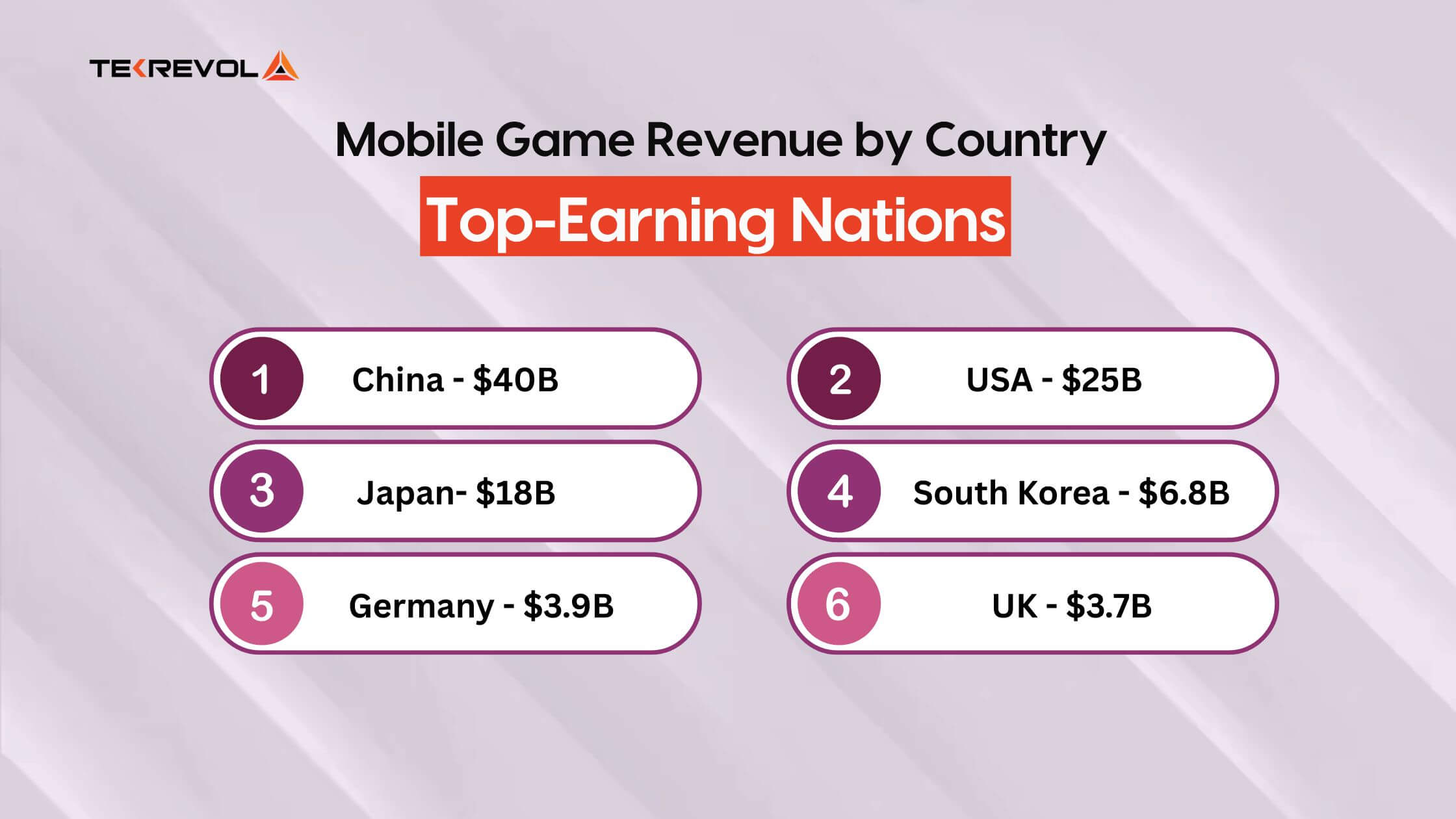

Mobile Game Revenue by Country: Top-Earning Nations in 2026

When it comes to mobile game revenue statistics by country, the USA, China, and Japan remain the industry’s powerhouses, with earnings of $25B, $40B, and $18B in 2025.

Other notable players in the global rankings include South Korea, Germany, and the UK. They all continue to show steady mobile game revenue growth, especially in genres like esports, puzzle, and simulation. Here’s a detailed breakdown of the mobile game market size by country:

| Country | Revenue (USD) | 2026 Proj. Revenue (USD) | Key Drivers |

| China | $40B | $43.4 B | Homegrown hits, loyalty-based monetization |

| USA | $25B | $37 B | Mid-core titles, cosmetic spending, live events |

| Japan | $18B | $20 B | High ARPU, gacha RPGs, strong IP fandom |

| South Korea | $6.8B | $7.8 B | Competitive play, esports, polished UX |

| Germany | $3.9B | $7.0 B | Strategy, simulation, and hybrid monetization |

| UK | $3.7B | $6.6B | Puzzle, sports, and casual genres |

Mobile Gaming Industry Report: Regional Stats to Watch

Beyond the usual heavyweights, several regions are gaining ground fast. These emerging markets may not top the revenue charts yet, but their growth rates are nothing short of impressive. Have a glance at a few hotspots turning heads:

| Region | 2025 Revenue | Why It’s Growing |

| India | $5B | Massive user base, vernacular content, casual gaming boom |

| Brazil | $2.5B | Youth-driven market, 5G expansion, esports appeal |

| MENA Region | $4B | Government support, cultural content, and rising ARPU |

| Indonesia | $2B+ | Fast mobile adoption, social gaming, live streaming |

So while the global leaderboard is still topped by familiar faces, the mobile gaming market is spreading out fast.

Mobile Gaming Market Share by Platform

You know how some friends favor Android phones, while others are all about that sleek iPhone experience? Turns out, this Android vs iOS split is huge for mobile gaming revenue, too.

Now, look into how the mobile game revenue statistics shape up by platform in 2026:

| Platform | Player Share | Revenue Share | What’s Driving It? |

| Android | 70%+ | 42% | Huge user base, ads dominate |

| iOS | 28% | 55% | Smaller but big spenders |

| Hybrid/Cloud | 2% | 3% | Emerging tech, watch this space |

Android game developers’ strength lies in its massive audience, particularly in Asia and Latin America, which drives a majority of game downloads and ad revenue. Meanwhile, iOS players aren’t shy about splurging on in-app purchases and subscriptions, especially in North America and Europe.

And don’t forget the new kids on the block: hybrid and cloud platforms offering cross-device play and easy access without downloads. Although still small, their growth hints at shifting player preferences and new revenue opportunities.

Mobile Gaming Revenue Statistics: Market Segmental Insights

The mobile gaming market in 2025 is anything but one-size-fits-all. It is a layered ecosystem with diverse segments, each driving revenue in different ways.

Mobile Gaming Segment Revenue Breakdown (2026)

Each segment of the mobile gaming industry brings its flavor and its revenue stream. Here’s a quick breakdown of who’s earning what in 2026:

| Segment | Estimated Market Share | Key Growth Region |

| Online Mobile Games | 65% | North America, East Asia |

| Offline Mobile Games | 12% | India, LATAM |

| Gaming Live Streaming | 8% | Southeast Asia, EU |

| Cloud Gaming (Mobile) | 10% | US, Japan, South Korea |

| Other (AR, Hybrid, etc.) | 5% | Global |

Online Mobile Games

Online games are still the revenue kings in mobile. Genshin Impact, PUBG Mobile, and Clash Royale are games that thrive on real-time multiplayer experiences.

- Market Share (2025): 65%+ of all mobile gaming revenue

- Top Regions: North America, East Asia, and Europe

- Drivers: 5G adoption, competitive gameplay, and social engagement features

Offline Mobile Games

Offline games may seem simple, but they still hold a strong global presence, especially in regions with inconsistent connectivity.

- Global Revenue Contribution: ~12% of mobile game revenues

- Popular Genres: Puzzles, simulations, and hyper-casuals

- Top Markets: India, Brazil, and parts of Southeast Asia

Cloud Gaming on Mobile

Cloud gaming on mobile isn’t just hype anymore; it is gaining real traction. As 5G becomes standard, streaming console-level experiences to smartphones is finally seamless.

- 2025 Market Value: $4.1 billion

- YoY Growth Rate: 34%

- Top Providers: Xbox Cloud Gaming, NVIDIA GeForce NOW, NetEase

Gaming Live Streaming

Streaming has transformed how people interact with games. Platforms like YouTube Gaming and Twitch are now home to mobile streamers pulling in six-figure audiences.

- Watch Hours (2025): Mobile games make up 30% of all gaming livestream hours

- Leading Titles: Free Fire, Brawl Stars, Mobile Legends

- Key Growth Driver: In-game spectator modes and influencer partnerships

And let’s be honest! It’s sometimes more fun to watch the chaos than play it yourself. Next, let’s explore which genre leads the mobile game revenue charts this year.

Mobile Game Revenue by Genre: Which Game Types Make the Most Money?

Not all mobile games play the same, and neither do their revenue models. From bite-sized casual games to deep, strategic epics, every genre brings a different kind of player (and wallet) to the table.

Some genres rake in billions through sheer volume, while others rely on fewer but more loyal, high-spending users. Let’s break it down.

Top Revenue-Generating Genres: Casual, Strategy, or RPG?

Here’s how the mobile gaming genre wars are playing out in 2026:

| Genre | Estimated 2026 Revenue | Top Examples | Why It Performs |

| RPG | $24B+ | Genshin Impact, Fate/Grand Order | Deep monetization, loyal fanbase, gacha mechanics |

| Strategy | $19B | Clash of Clans, Rise of Kingdoms | Long play cycles, IAP-heavy, competitive gameplay |

| Casual | $16B | Candy Crush Saga, Township | Massive player base, ad revenue, and in-game boosts |

| Shooter | $11B | Call of Duty: Mobile, PUBG Mobile | Battle passes, skins, seasonal content |

| Simulation | $9B | The Sims Mobile, Hay Day | Time-based mechanics, community-driven growth |

| Sports & Racing | $6B | FIFA Mobile, Asphalt 9 | Niche audience, strong licensing, and event monetization |

Which is the fastest-growing genre in 2026?

Shooter games and casual hybrid games are leading the charge. Battle royale formats continue to dominate live ops and event-based monetization, while casual games are evolving with narrative layers and social features to increase playtime and spend.

Interesting Shift:

Casual isn’t just “tap and go” anymore. Titles like Royal Match and Survivor.io blur the lines between casual and mid-core, pulling in revenue through the implementation of advanced growth strategies for gaming apps.

Now that we know which game genre brings in the most money, let’s see which mobile title is raking in the biggest bucks this year.

Which Mobile Game Brings in the Most Revenue in 2026?

Based on the latest mobile game revenue statistics, Honor of Kings leads the pack, generating over $2.5 billion in 2025.

Right behind it, we’ve got PUBG Mobile, raking in around $2 billion, no surprise, considering its loyal fanbase and ever-evolving seasonal content.

Other heavy hitters? Genshin Impact, Candy Crush Saga, and Roblox are all cashing in big-time, too, each using their unique approach to keep players hooked and spending.

Here is a quick snapshot of the top games and what they’re earning

| Mobile Game | Genre | Estimated Revenue | What Keeps Players Spending |

| Honor of Kings | MOBA | $2.5 billion+ | Battle passes, in-app purchases, and events |

| PUBG Mobile | Battle Royale | $2 billion+ | Seasonal passes, skins, in-app purchases |

| Genshin Impact | Action RPG | $1.8 billion+ | Gacha system, in-app currency |

| Candy Crush Saga | Puzzle | $1 billion+ | Lives purchases, boosters, and ads |

| Roblox | Sandbox/Metaverse | $900 million+ | Premium memberships, in-game purchases |

This breakdown not only highlights where the money is but also offers insights for anyone interested in the mobile gaming market’s revenue potential. Also, check our insights on Fortnite revenue statistics,

revealing how a successful game generates revenue and reinvests it into growth

Mobile Gaming Monetization in 2026: Where the Money Comes From

Ask any mobile gamer, and chances are they have dropped coins on skins, sat through a reward ad, or debated a subscription bundle. The reason? Today’s mobile game costs aren’t just about gameplay; they are carefully designed revenue engines.

From subtle nudges to full-blown VIP passes, mobile gaming monetization strategies are more advanced (and player-friendly) than ever. So what is working and what’s fading out? Find out below!

In-App Purchases, Ads, Subscriptions: What Works in 2026?

The mobile gaming industry leans on three core revenue models, often used in tandem:

1. In-App Purchases (IAP) – Still the MVP

Whether it’s a bundle of gems, a season pass, or a rare weapon skin, in-app purchases remain the biggest revenue driver.

- Why it works: Players want customization, shortcuts, and status.

- Top genres: RPG, shooter, strategy.

- 2026 trend: Personalization-based offers and “gacha-lite” mechanics.

2. Rewarded & Interstitial Ads – Powering Casual Titles

Love them or hate them, ads aren’t going anywhere. Ad-focused game monetization works especially well for casual and hyper-casual games.

- Why it works: Ads offer instant rewards without spending money.

- Top genres: Puzzle, idle, arcade.

- 2026 trend: Shorter, skippable ads with gamified elements to reduce drop-offs.

3. Subscriptions – Steady, Predictable Revenue

Monthly passes and “VIP clubs” are now mainstream, offering exclusive perks, ad-free play, or premium currency.

- Why it works: Keeps players engaged and loyal.

- Top genres: Simulation, racing, and hybrid casuals.

- 2026 trend: Bundled subscriptions (e.g., cross-game passes) and family plans.

Monetization Breakdown by Revenue Share (2026)

| Model | % of Total Revenue | Notes |

| In-App Purchases | 62% | Dominates mid-core and competitive games |

| Ads (All Types) | 26% | Casual games rely heavily on ad-based income |

| Subscriptions | 12% | Growing in popularity, especially in simulations |

Worth noting: Hybrid monetization (e.g., IAP + ads) is becoming the new standard. Games that give players both paid and ad-supported paths tend to see higher retention and broader reach.

- Not sure what revenue model fits your game?

- From ads to IAPs, we will help you choose smart.

Mobile Game Industry Trends 2026: What’s Shaping the Market?

Going through the above mobile game revenue statistics 2026, the industry feels less like an app store and more like a living, breathing entertainment universe.

The numbers are booming, but it’s the trends behind those numbers that point to where the next big hits (and revenues) will come from.

Here is what’s driving the mobile gaming market growth this year and what’s likely next.

1. Cross-Platform Play Is the Norm

Gamers don’t want to be stuck on one screen. From mobile to console to PC, seamless gameplay is becoming a standard, and studios that ignore it are falling behind.

2. Web3 Gaming Is on the Rise

Blockchain and decentralized tech are starting to reshape mobile games. Web3 game development services introduce true ownership of in-game assets and new ways for players to earn.

3. Cloud Gaming Is Gaining Ground

Thanks to 5G and better infrastructure, mobile cloud gaming is finally catching on. It’s changing how games are developed and who can play them.

4. AI-Driven Personalization

From smarter NPCs to adaptive in-game stores, AI is making games feel more personalized and more profitable.

5. Hybrid Monetization Models

Remember when it was IAP or ads? Not anymore. Developers are blending subscriptions, ads, and microtransactions to maximize revenue without frustrating players.

6. Hyperlocal Content & Regional Game Design

Games tailored to specific cultures and regions are exploding in popularity, especially in Southeast Asia, Latin America, and MENA.

What’s Next in Mobile Gaming?

- More AAA Mobile Titles: Big studios are no longer treating mobile as a “side project.” Expect console-quality games designed for mobile-first.

- Creator-Driven Games: Think UGC (user-generated content) meets game development, a Roblox-style future where players also help build.

- AR/VR Integration: Still early, but gaining traction with Gen Z audiences looking for immersive mobile-first experiences.

The takeaway? The mobile gaming market isn’t just growing, it is evolving fast. And staying ahead means building smarter, faster, and more globally.

Why Choose Tekrevol for Mobile Game Development?

The mobile gaming market in 2026 is fast, competitive, and saturated with copycats. Success now requires more than a good idea and clean code.

That’s where Tekrevol comes in. As an experienced app development company, our approach to launching a product focus ROI from day one. One built to scale, monetize, and lead in its genre. Our cross-functional teams combine:

- Market Strategy & Player Psychology: Every game we develop is rooted in player behavior analytics, genre trends, and revenue models that work in 2026.

- End-to-End Game Engineering: From concept art to deployment and post-launch updates, we cover the full stack gameplay mechanics, server-side logic, cloud integration, and beyond.

- Globalization from Day One: We localize not just language but entire player experiences. So your game isn’t just playable, it feels native in every major market.

- Future-Proof Tech Stack: Using AR, AI, multiplayer sync, and in-app economy, our developers ensure your game doesn’t get left behind six months after launch.

- Turn your game idea into the next big hit?

- We design and develop mobile games that thrive across every platform.