Fortnite was supposed to be a co-op survival game. Then someone added a Battle Royale mode, and the rest is a $40 billion history.

It is not just a game anymore; it is a cultural sandbox with a very profitable twist. One minute, you are fending off zombies; the next, you’re building towers mid-air while dressed as a taco, dodging lightsabers, and watching Eminem perform live in-game.

While players were perfecting their emote timing, Epic Games was quietly stacking revenue. And not small change, Fortnite revenue has turned it into one of the most successful entertainment properties on the planet.

In this blog, we’ll break down how much Fortnite makes per day, its revenue by year and region, and how it became a $40+ billion phenomenon.

We will also dig into regional stats, player count graphs, net worth, and key takeaways for the gaming economy.

What Is Fortnite Revenue in 2026?

Fortnite is on track to generate around $6 billion plus in revenue in 2026, all thanks to smart use of in-game purchases, live events, and smart cross-platform development strategies. 8 years in, it’s still one of the most profitable free-to-play games out there.

The game didn’t arrive with much fanfare. In fact, it started off as a low-key co-op survival game that most people ignored. But once Epic Games added a Battle Royale mode, at just the right time, everything changed.

Suddenly, it wasn’t just a game. It was a place that started printing money. From battle royale matches and in-game concerts to brand collaborations with Marvel, LEGO, and Ariana Grande, Fortnite constantly reinvents itself.

Its accessibility, frequent content updates, and player customization options keep users coming back, whether they’re in it to win or just to dance in banana suits.

How Did Fortnite Revenue Grow So Fast After Launch?

Fortnite’s revenue scaled rapidly after 2017, driven by its Battle Royale mode, the Twitch boom, and Epic’s frequent content updates. It reached $5.5 billion in 2018 alone, and as of 2026, it continues to stand out for its high revenue.

Initially launched on July 25, 2017, as a co-op survival game with crafting mechanics, Fortnite’s PvE mode (Save the World) didn’t generate much buzz.

The game didn’t catch fire until Epic Games introduced Fortnite Battle Royale in September 2017, just months after the launch of PUBG popularized the genre.

That pivot changed everything, and within just two weeks, Fortnite’s Battle Royale mode had already attracted over 10 million players.

Who Created Fortnite and How Did They Build a $40B Revenue Stream?

Fortnite was created by Epic Games, a studio led by Tim Sweeney. What made it different was their ability to move fast, build community-first features, and turn virtual cosmetics into a global revenue stream.

Epic Games didn’t just make a hit game; they treated it like a service. They saw where attention was going and followed it fast. The launch of Fortnite Battle Royale was timed perfectly with the rise of Twitch, YouTube gaming content, and a younger demographic hungry for accessible, cross-platform experiences.

Add in regular updates, seasonal content, and endless cosmetic customizations, makes Fortnite becomes more than a game. It became a service.

Key stats that show just how massive its reach became:

- 2018: Over 125 million players

- 2020: Surpassed 350 million registered accounts

- 2023: Consistently pulled 70–80 million active monthly players

- 2025-2026: Events push Fortnite peak player count to over 44 million in a single day

Today, Fortnite runs on everything from high-end PCs to mobile devices and even the cloud. Its reach spans more than 100 countries, and its popularity shows no signs of fading, even eight years in.

- Got a game idea ready to grow?

- Our experts know what it takes to win players over on a budget.

Fortnite Revenue By Year: 2018 to 2026

Between 2018 and 2026, Fortnite brought in over $42.2 billion in total revenue, with annual numbers ranging from $3.7 billion to $6.2 billion.

It’s biggest year so far? 2023, with an estimated $6.2 billion in earnings.

Not bad for a free game, right? Fortnite didn’t just have one good year; it built a revenue streak that most AAA titles would dream of.

The game’s peak years lined up with major in-game events, franchise crossovers, and tech innovations that kept players spending year after year.

Let’s break down how much money Fortnite makes a year:

Fortnite Annual Revenue Breakdown: Yearly Highlights

Below is Fortnite’s revenue performance year over year, from its first blockbuster year in 2018 to the projected numbers for 2025.

| Year | Estimated Fortnite Revenue |

| 2018 | $5.5 billion |

| 2019 | $3.7 billion |

| 2020 | $5.1 billion |

| 2021 | $4.2 billion |

| 2022 | $5.8 billion |

| 2023 | $6.2 billion |

| 2024 | $5.7 billion |

| 2026 (Projected) | $6 billion |

| Total Revenue (2018–2026) | ~$42.2 billion |

These are estimated figures based on public data, financial reports, and analytics platforms.

How Much Money Does Fortnite Make in 2026?

Fortnite revenue is projected to hit $6 billion in 2025, matching or even slightly exceeding its highest-earning years.

What’s fueling this?

- Live events: Fortnite’s crossover with LEGO, anime franchises, and in-game concerts keeps the fanbase engaged and spending.

- Microtransactions: Skins, emotes, and battle passes remain the backbone, with the average player spending $102 annually.

- Seasonal refreshes: Frequent updates and limited-time modes drive fear of missing out (FOMO) and purchases.

On a micro level, Fortnite makes over $16 million per day. That is roughly $190 per second. Yes, you read that right, every second you’re reading this, Fortnite just pulled in a few hundred bucks.

Fortnite Total Revenue & Lifetime Sales Estimate

So you asked how much money has Fortnite made in total?

By mid-2025, Fortnite has raked in over $42 billion in lifetime revenue, putting it ahead of some of the biggest movie franchises in history.

Not bad for a game that’s free to download. Its success comes from a perfect mix of player-driven content, digital status symbols, and seasonal events that keep fans coming back (and spending).

While Fortnite is technically free-to-play, its total sales and in-app transactions demonstrate the power of user-driven content, social currency, and well-timed seasonal events.

Key milestones:

- $9.2 billion in its first two full years.

- Reached over $20B milestone by 2022

- Crossed $40B in early 2025

And it shows no signs of slowing. With Epic continually evolving its creative mode, adding branded collaborations, and turning Fortnite into one of the best NFT gaming platforms to invest in, the ceiling is still rising.

How Much Money Does Fortnite Make Per Day?

Ever wondered how much cash Fortnite racks up while you are dropping into a match? The answer: a lot.

Fortnite’s revenue engine is built on a foundation of microtransactions, cosmetic skins, Battle Passes, and Crew subscriptions, all adding up to eye-watering figures.

Average Daily Fortnite Revenue & Microtransaction Impact

On average, Fortnite revenue per day hits approximately $2.74 million, driven mostly by in-game purchases. That translates to about $1.90 every single second, which is more than some people make in a day.

In one blink, Epic Games just cashed another $200. And yes, people are still happily spending on V-Bucks for banana suits and Marvel skins.

Here is a quick snapshot:

| Revenue Type | Estimate (USD) |

| Average Daily Revenue | $2.74M |

| Revenue Per Hour | $114,000 |

| Revenue Per Minute | $1,900 |

| Revenue Per Second | $1.90 |

| Event Day Revenue | $5.2M |

| Event Revenue Per Second | $60.00 |

It’s not just about volume, it’s about consistency. The game generates this revenue 24/7, across all time zones, on multiple platforms, from kids on iPads to streamers on high-end rigs.

How Much Money Does Fortnite Make a Second During Events?

Fortnite’s revenue surges dramatically during live events or seasonal launches.

Remember Travis Scott’s in-game concert, the “Chapter” resets, or Marvel-themed crossovers. On such days, Fortnite revenue spikes to more than $5 million, which works out to over $60 per second.

The spikes mainly come from:

- Massive login surges (more than 20M users concurrently)

- Limited-time offers and exclusive cosmetics

- Increased Battle Pass purchases at reset.

These strategies echo broader app monetization trends shaping the future of gaming commerce.

Fortnite Revenue by Country: What Are The Top-Grossing Regions in 2026

Now that we have looked at Fortnite’s global earnings, let’s zoom in. Where is this revenue coming from?

While Fortnite has a worldwide audience, a few countries consistently dominate the spending charts. Cultural habits, regional pricing, and platform preferences all play a role in how much players are willing to spend and where Epic Games earns the most.

Which Countries Spend the Most on Fortnite?

The US alone contributes nearly 40% of global Fortnite revenue, a testament to its console-heavy, content-loving player base.

Here is how the top 5 revenue-contributing countries break down:

| Country | Platform Dominance | Global Revenue Share | Spending

Traits |

| United States | Console & PC | ~40% | High-ticket bundles, Battle Pass |

| Brazil | Mobile & Console | ~12% | Mobile-driven, high engagement |

| Russia | PC & Android | ~7% | Large user base, lower per-user spend |

| United Kingdom | Console | ~6% | Strong Battle Pass uptake |

| Germany | Console & PC | ~5% | Steady seasonal & subscription purchases |

USA, Brazil, Russia: Regional Fortnite Revenue Leaders

The USA is undeniably Fortnite’s financial backbone, but Brazil and Russia offer surprisingly strong revenue streams too, largely from mobile and Android platforms.

Each country’s platform preferences shape their purchasing behavior:

- US: Dominated by console purchases, especially during Battle Pass and event drops.

- Brazil: A mobile-heavy market with fast adoption of skins and seasonal events.

- Russia: Huge install base, often more casual spenders, but high activity overall.

This global spread explains Fortnite’s $40B above lifetime revenue and why Epic Games tailors events and cosmetics to regional tastes.

Which Devices Generate the Most Revenue for Fortnite? Mobile vs Console vs PC

Different devices, different spending habits.

Console players account for the lion’s share of Fortnite revenue, thanks to a user base more likely to buy Battle Passes and exclusive cosmetics. Mobile users, especially pre-App Store removal, also contributed significantly.

Meanwhile, PC players, though fewer in number, tend to spend on high-value items and customizations. Each platform has distinct user behavior and monetization patterns, and understanding this dynamic is crucial if you’re planning to launch cross-platform games.

| Platform | Revenue Share (Approx.) | Notable Traits |

| Console | 60% | Highest spending per user |

| PC | 25% | Steady engagement, lower monetization |

| Mobile | 15% (pre-2021) | High install base, micro-purchase driven |

While Fortnite was removed from the iOS App Store in 2020 due to the Apple-Epic legal dispute, Android APK downloads and previous mobile revenue still reflect substantial user investment.

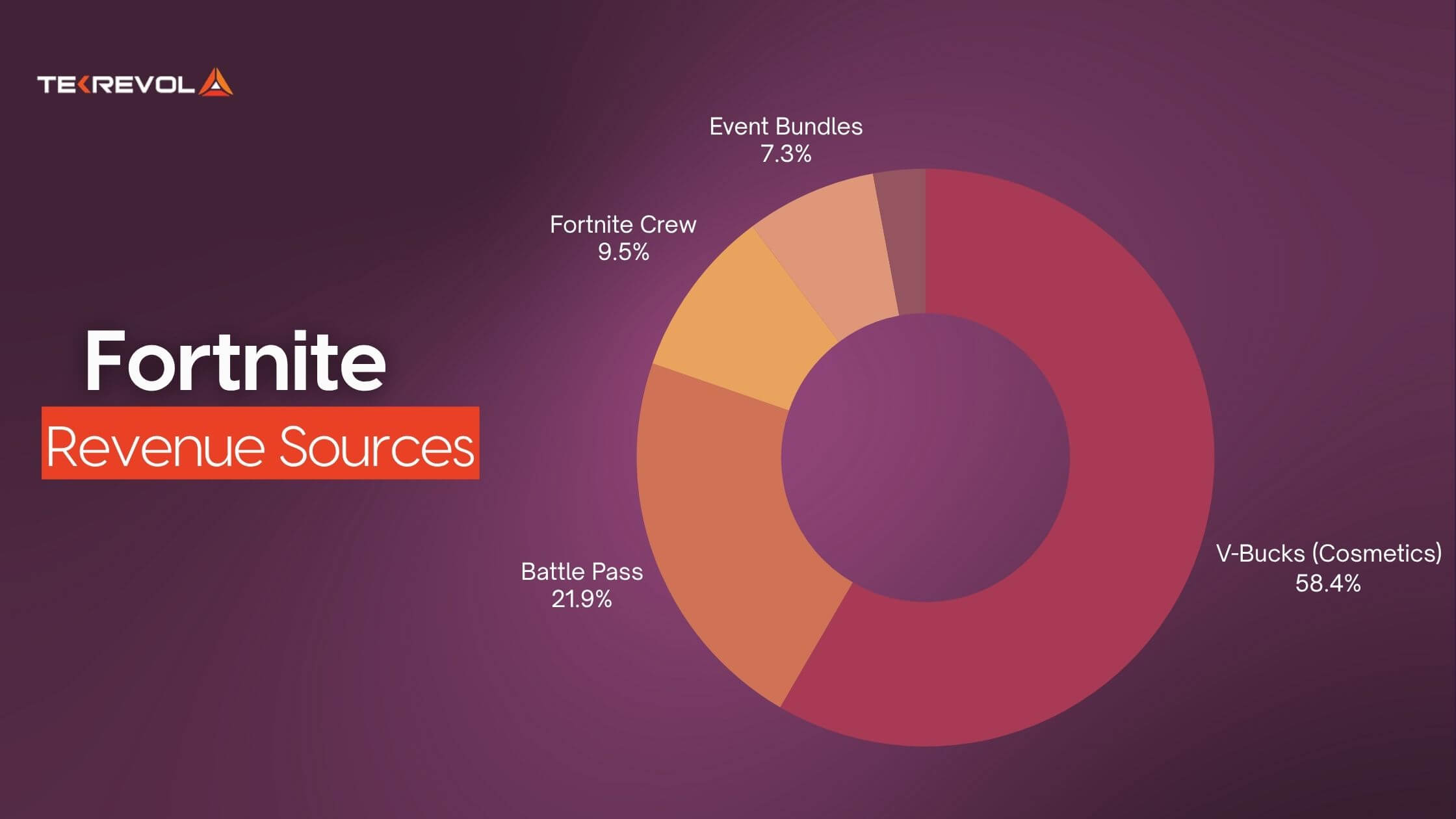

Where Does Fortnite Make Its Money? Revenue Sources Explained

So where exactly does Fortnite’s $6 billion-a-year haul come from?

Despite being free-to-play, Fortnite is a monetization masterclass, blending in-game psychology, cultural trends, and timed scarcity to drive spending.

Here’s a breakdown of the primary revenue streams:

In-Game Purchases (Skins, Emotes, Bundles)

This is where most of the money flows. Skins and cosmetics (including branded collaborations with Marvel, Star Wars, and Naruto) account for a majority of player spending.

Players aren’t paying to win; they are paying to be seen. On average, users spend $102/year on cosmetics and items.

Battle Pass (Seasonal Model)

Every new season comes with a revamped Battle Pass, priced at around $7.99. It incentivizes consistent play and layered progression.

Over 70% of Fortnite’s paying users buy the Battle Pass every season. It also serves as a gateway to additional cosmetic purchases and boosts engagement metrics.

Fortnite Crew Subscription

Launched in December 2020, Fortnite Crew is a monthly subscription service offering:

- Exclusive skins

- 1,000 V-Bucks

- Battle Pass access

At $11.99/month, this passive revenue model has attracted a dedicated subset of players, making it a steady earner.

Here’s a simplified revenue breakdown by source (based on available estimates):

| Revenue Source | Contribution (%) | Key Drivers |

| V-Bucks (Cosmetics) | 58% | Skins, emotes, weapon wraps |

| Battle Pass | 22% | Season-based rewards |

| Fortnite Crew | 10% | Monthly skin packs + perks |

| Event Bundles | 7% | Collab bundles, exclusive offers |

| Other (Licensing, etc.) | 3% | Merchandising, third-party licensing |

What’s fascinating? None of this affects gameplay; players spend purely for aesthetics and identity.

Fortnite Sales: How Many Copies Has Fortnite Sold?

Here is where things get interesting!

Fortnite hasn’t “sold” any copies in the traditional sense. It is a free-to-play game, meaning anyone can download and play without paying upfront.

So when people ask, “How many copies has Fortnite sold?” the answer is: Zero, but over 650 million registered users.

Instead of sales, here’s what matters:

- Registered Players: Over 650M globally (as of 2025)

- Active Users (Monthly): 225M

- Peak Concurrent Players: 30M plus during major events

So while Fortnite has technically sold nothing, it earned more than most paid games ever will, purely through optional spending.

- Want to monetize like Fortnite?

- At Tekrevol, we help scale mobile games from MVP to millions in revenue.

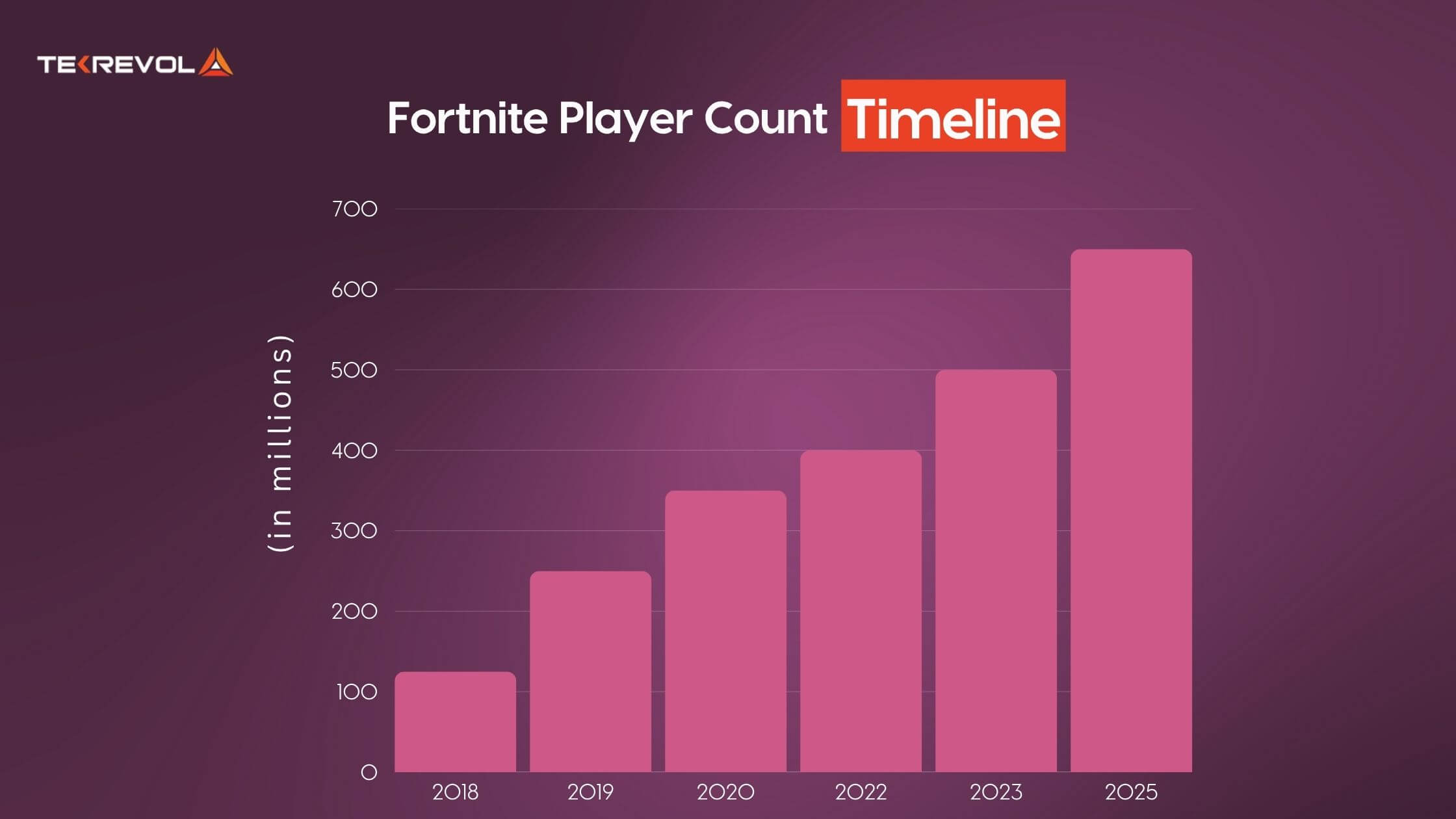

Fortnite Player Count 2026: How Many People Play Fortnite Today?

While Fortnite revenue tells the financial story, the player count reveals its true cultural dominance. After all, money doesn’t move unless millions are actively logging in, competing, customizing, and, let’s be honest, flossing.

So, how many people are still building, battling, and binge-playing Fortnite in 2025? The answer: more than you might think.

As of early 2026, Fortnite has surpassed 650 million registered players globally. But registration doesn’t tell the full story, so let’s dig into how many of those players are still actively engaged today.

Fortnite Player Count & Peak Usage Statistics

Below is a snapshot of Fortnite’s player growth over time, from its breakout year to today:

Peak concurrent player count:

In December 2025, Fortnite hit a peak of 44.7 million concurrent players during the Big Bang event, one of the most significant real-time online player events ever recorded.

Epic Games has mastered event-driven engagement, routinely drawing tens of millions with limited-time seasons, concerts, and game mode drops. These peak usage spikes are a key factor behind Fortnite’s staggering revenue jumps year after year.

How Many People Are Playing Fortnite Right Now?

As of Q4 2025, Fortnite has around 110 million monthly active users, with 35 to 40 million playing every single day.

That’s not just impressive, it is market-defining. Here is what real-time engagement often looks like:

- 2–3 million concurrent players at any given time globally.

- Higher spikes during weekends, updates, and seasonal launches

- Daily log-ins from over 100 countries, led by the United States, Brazil, the UK, and Japan.

These figures place Fortnite among the top 3 most-played games in the world across platforms, even seven years after its debut.

Fortnite Monthly Players & Daily Engagement Trends

Let’s break down user behavior further:

- Average Fortnite player engagement: 6–10 hours per week (based on Epic usage data and independent trackers)

- Average spend per user per year: $102 (on skins, battle passes, and custom content)

Not just kids:

- 41% of players are aged 18–24

- Nearly 30% are 25 and older, indicating the game’s aging fan base and wider appeal.

Fortnite has become more than just a Gen Z phenomenon. It’s a cross-generational digital hangout, especially with the introduction of modes like Fortnite Creative and LEGO Fortnite.

And thanks to constant updates and integrations with trends (from anime to NFL crossovers), users stay longer and return more often.

What Are the Gender Demographics of Fortnite Players?

While Fortnite has long been seen as a male-dominated title, the gender gap is slowly narrowing.

According to recent estimates:

| Gender | Percentage of Players |

| Male | 72% |

| Female | 28% |

Female player participation has risen thanks to improved character diversity, inclusive cosmetics, and broader cultural reach, especially through collaborations with mainstream celebrities and franchises.

Interestingly, Epic Games reports stronger engagement from female players during events like virtual concerts and narrative-driven experiences. This highlights Fortnite’s ability to attract different audience segments beyond traditional shooter fans.

Fun Fact: Skins like Ariana Grande and Wonder Woman have helped Fortnite tap into lifestyle and fashion-forward gaming, making it more appealing to non-core gaming audiences.

How Popular Is Fortnite on Streaming Platforms? [Streaming Stats & Viewer Behavior]

Watching Fortnite isn’t just a pastime; it is part of the game’s cultural footprint. People don’t just play; they tune in, too, and in a big way.

Here is how streaming viewership breaks down:

| Metric | Value (2025) |

| Total Hours Watched (on Twitch) | 239 million hours |

| Avg Viewers per Stream (Fortnite) | 62,400 |

| Peak Concurrent Viewers (Fortnite) | 430,000 |

| Total Hours Streamed (Fortnite) | 22 million hours |

| Fortnite’s Twitch Rank (by hours) | #11 most watched game in May–June 2025 |

| FNCS Pro-Am 2025 Event | 643,995 peak viewers, 2.3M+ hours watched |

What This Means

- Fortnite’s streaming numbers, especially 239 million hours watched, demonstrate immense engagement that extends beyond actual gameplay. It’s part entertainment, part community showcase, and part marketing machine.

- An average of over 62K viewers per Fortnite stream is comparable to mid-tier TV sports broadcasts, making it a goldmine for sponsors and brand presence.

- During major events like the FNCS Pro-Am, Fortnite hits live broadcast numbers that rival major league sports, a testament to its cross-sector appeal.

- With streaming engagement this high, Fortnite’s live events become content drivers, creating additional value for sponsors, creators, and Epic Games itself.

Fortnite Player Spending Stats: How Much Do People Spend on Fortnite?

Let’s talk numbers, not from Epic’s balance sheet, but from the wallets of Fortnite players themselves.

Even though Fortnite doesn’t charge players to download the game, it has built one of the most profitable in-app purchase systems the gaming world has ever seen.

How Much Money Has Fortnite Made from In-App Purchases?

Since launching in 2017, Fortnite has pulled in a jaw-dropping $40 billion, mostly from in-app purchases (IAP). Players are buying V-Bucks, skins, Battle Passes, and exclusive event bundles.

So, how much are individual players spending?

| Spending Bracket | % of Players

(Approx.) |

What They Usually Buy |

| $0 (Free Players) | 38% | Play casually without purchases |

| $1 – $50 | 34% | Battle Passes, a few skins |

| $51 – $200 | 20% | Seasonal purchases, bundles |

| $200+ | 8% | Dedicated players or collectors |

- Average spending per paying user: ~$84

- Average revenue per user (ARPU): $20–30 globally

- Top-spending day (Travis Scott event): $5.2 million in 24 hours

In short, even a small fraction of paying users is enough to drive massive revenue when scaled across hundreds of millions of players.

What Is Fortnite Net Worth & Monetization Model?

While Fortnite as a game doesn’t have its own stock ticker or direct valuation, its estimated net worth is pegged between $35 to and $45 billion in terms of brand value, lifetime earnings, and future monetization potential.

Monetization model at a glance:

| Revenue Stream | Description | Scales With |

| Cosmetic Microtransactions | Skins, emotes, gliders, etc. | Player base size & new content |

| Battle Passes | Seasonal reward system (subscription-like) | Engagement & progression loops |

| Fortnite Crew | Monthly subscription for dedicated users | Long-term retention |

| Event-based Sales | Live concerts, crossovers, promotions | Hype cycles & brand collabs |

| Licensing & IP Deals | Marvel, Nike, and Star Wars collaborations | IP partnerships |

This model is future-proof. It doesn’t rely on one-time purchases but builds on recurring engagement, emotional attachment to digital identity, and cultural relevance.

Fortnite vs Competitors: Is Fortnite Bigger Than GTA 5?

It is the kind of debate that lights up gaming forums and Reddit threads.

While both games have redefined the industry in their own ways, Fortnite’s real-time, community-driven model stands in contrast to GTA’s narrative and open-world design.

But when it comes to engagement and earnings, let’s look at the data.

Fortnite Usage Time vs Other Top Games

If you think only hardcore FPS or MMO players rack up hundreds of hours, think again. Fortnite’s event-driven model, Battle Pass grind, and creator ecosystem have made it one of the most time-consuming games of the decade, and that’s saying something.

| Game Title | Avg. Monthly Active Users (2025) | Avg. Hours Played Per Week | Total Hours Per Year |

| Fortnite | 240M+ | 6–10 hrs | 450 hrs |

| GTA V / Online | 100M+ | 4–6 hrs | 300 hrs |

| Call of Duty: Warzone | 85M+ | 5–7 hrs | 340 hrs |

| Roblox | 210M+ | 5–8 hrs | 400 hrs |

| Minecraft | 170M+ | 4–6 hrs | 310 hrs |

Insight: Fortnite’s weekly challenges, frequent updates, and event incentives (like live concerts and crossover drops) encourage habitual play. This means higher average playtime, especially among younger and mid-core audiences.

How Does Fortnite Compare to Gaming Giants Like GTA 5 and Minecraft?

When it comes to making money, where does Fortnite stand next to big names like GTA 5, Call of Duty, and Minecraft? Let’s break it down.

| Game Title | Estimated Total Revenue | Primary Revenue

Model |

| Fortnite | $40B+ | Free-to-play plus microtransactions |

| GTA 5 + Online | $10B+ | Premium game with microtransactions |

| Call of Duty | $30B (franchise total) | Premium titles and seasonal passes |

| PUBG | $13B | F2P and in-game sales (esp. mobile) |

| Minecraft | $4B | Premium purchase and Marketplace |

What sets Fortnite apart isn’t just the raw revenue; it is the velocity and consistency. Most of Fortnite’s revenue was earned within a 5–6 year window, while others like GTA 5 have been monetizing over a full decade.

What Can Businesses Learn From Fortnite’s Revenue Strategy?

Fortnite isn’t just a game; it’s a revenue-generating ecosystem. Its success story offers real-world strategies for brands, digital creators, and startups looking to scale, monetize, and build communities.

This isn’t about copying Fortnite’s mechanics; it’s about understanding the psychology, structure, and scalability behind its $40B success.

What Fortnite’s Revenue Model Can Teach Aspiring Brands

At its core, Fortnite mastered the art of free to play, pay to flex. Players didn’t have to buy the game, but many chose to spend on customization, status, and belonging. That insight is gold for any digital product.

Key takeaways for brands:

- Lower friction, increase volume: Free or freemium entry reduces the barrier to adoption.

- Microtransactions add up: Instead of one big purchase, small repeatable buys increase lifetime value.

- Emotional utility sells: Skins, emotes, and cosmetics aren’t needs; they are wants. That distinction builds aspiration and loyalty.

Whether you’re selling a SaaS subscription, NFT development services, or access to exclusive content, value perception is everything.

Lessons in Monetization, Engagement, and Scaling

Fortnite didn’t just drop a product; it built a platform. Here is how its strategy unfolds into a framework any digital innovator can adapt:

| Fortnite Strategy | Brand/Creator Application |

| Seasonal Battle Pass system | Subscription models with evolving content |

| Limited-time events & collabs | Brand drops, influencer co-creations, flash campaigns |

| Player progression & status systems | User tiers, badges, and gamified loyalty programs |

| Community-driven creation (Creative Mode) | UGC platforms, affiliate programs, and co-building |

Think beyond product. Think experience.

Fortnite scaled not just through marketing but by turning players into fans, and fans into ambassadors.

How Businesses Can Apply Fortnite’s Strategy to Digital Products

If you are building a digital app, platform, or online service, here’s how Fortnite’s strategy can guide your roadmap:

- Monetize through emotion, not necessity: Sell upgrades, not access.

- Create urgency: Time-limited offers (like Fortnite’s seasonal skins) drive action.

- Build around engagement loops: Fortnite players come back weekly for new quests; you can do the same with fresh value-adds.

- Stay culturally relevant: Fortnite thrives on real-world collaborations (Travis Scott, Marvel, Nike). Tie your brand to what your audience already loves.

Whether you’re a solo creator or a growing tech startup, Fortnite’s success proves engagement is the new currency, and loyalty is earned through value, not volume.

How Tekrevol Helps Game Creators Scale Like Fortnite

Fortnite didn’t just become a billion-dollar game by accident. It was built on the right foundation, backed by a strategic monetization model, and scaled with the future in mind.

At Tekrevol, we help game creators, tech founders, and visionary brands do exactly that. Whether launching your first indie title or scaling a live-service multiplayer game, our custom game development solutions are built to help you grow from day one.

What sets Tekrevol apart?

- Custom Game Engines & Architecture – Optimized for real-time multiplayer, seamless in-game economies, and platform flexibility (iOS, Android, PC, console).

- Built-In Monetization Strategies – From battle passes to in-app purchases and ad integrations, we help you earn while you scale.

- Post-Launch Support & Scaling – Get analytics, engagement loops, user retention strategy, and regular feature rollouts all handled by our expert teams.

We don’t just build games. We build gaming ecosystems designed to grow, engage, and monetize just like Fortnite did.

- Ready to build your Fortnite-level hit?

- We bring your vision to life with the tech, talent, and monetization insight to match.