There was a time when sending money meant standing in long bank lines, waiting on slow wire transfers, or worse, mailing a check and hoping it arrived safely. That’s no longer the case. Today, P2P payment apps have become essential tools, allowing us to quickly split the cost of dinner with friends, transfer cash to loved ones worldwide, or make purchases effortlessly with just a tap on our phones.

Let’s be real: Convenience is awesome, but when you’re dealing with people’s money, the stakes are sky-high. The biggest challenge in mobile payment app development is keeping everything locked down and secure.

One slip, and that trust is gone. So, how do you keep users happy and their money safe?

It may look like it is difficult to build a payment app, but this guide breaks it down into simple, actionable steps you can start using right away. We will walk you through how to build a p2p payment app that balances usability with security.

What Are Payment Apps?

Payment apps are digital platforms that let you send, receive, and track money directly from your phone or computer. Whether you’re paying back a friend for coffee, shopping online, or sending funds to family abroad, they make the process simple and cash-free.

As part of P2P payment app development, these solutions often include account, card, or digital wallet linking, so users can safely transfer money with just a few quick taps.

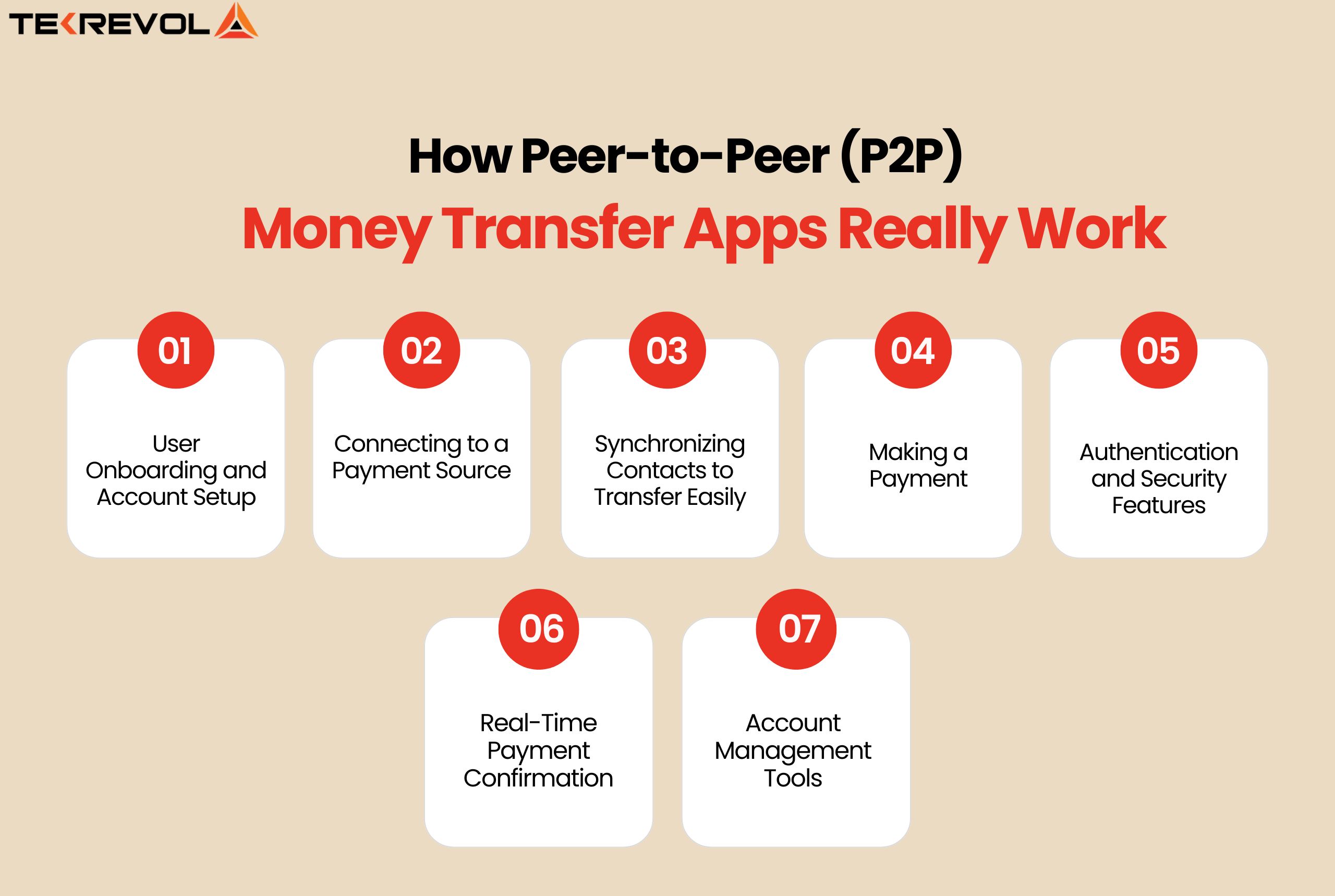

How Peer-to-Peer (P2P) Money Transfer Apps Really Work?

Most P2P give users the option to link their bank accounts or digital wallets. This option is essential for mobile payment app development, as it allows money transfers to happen with just a few simple actions, with no need to visit a bank or handle cash.

Let’s review what happens behind the scenes that makes the app work properly.

1. User Onboarding and Account Setup

First, users are required to register on the app, which usually involves sharing their name, phone number, and email. Some apps may require identity verification to remain compliant with rules, especially if large amounts are involved.

2. Connecting to a Payment Source

Once your account is set up, you link a funding source, typically a bank account, debit card, or credit card, with bank accounts being the most common. This connection allows for fast and seamless transfers directly between the app and your bank.

3. Synchronizing Contacts to Transfer Easily

Most P2P apps allow you to sync your phone contacts or search manually using an email address or phone number. This makes sending money almost as simple as texting a friend. When you learn about how to build a P2P payment app, consider this feature to improve user convenience.

4. Making a Payment

To transfer money, the user starts by selecting a contact from their list, typing in the amount they want to send, and finally pressing the “send” button. Most apps also offer the option to include a brief note or description for the transaction, which helps in keeping track of payments.

5. Authentication and Security Features

Before making the payment, security checks are carried out by the app. These normally involve:

- Two-factor authentication (2FA) for access and confirmation of payment.

- Encryption of sensitive data.

- Fraud detection systems are used to flag potential fraud.

6. Real-Time Payment Confirmation

After the transfer is processed, both sender and recipient receive real-time notifications confirming the transaction. This transparency adds trust and clarity to the exchange.

7. Account Management Tools

Users can view their transaction history, check app wallet balances, and track payment statuses directly within the app dashboard. This helps in budgeting and managing personal finances efficiently.

Build a Smarter Payment App With These Key Features

Thinking of building a payment app today? You need to focus on features that make transactions effortless, protect user data, and deliver real convenience. The global P2P payment market is expected to reach $9.87 trillion by 2030, growing at a CAGR of 20.16% from 2022.

Here are some of the most common but essential must-have features that you need to consider in P2P payment app development:

| Features | Description | Why It Matters |

| P2P Transactions | Allows users to send or receive money easily between individuals. | Makes everyday transfers quick and hassle-free. |

| Bill Payments | Let’s users schedule and pay bills from within the app. | Builds user habit and increases retention. |

| Transaction Notifications | Sends real-time alerts for every transaction. | Improves user trust and app transparency. |

| International Remittance | Supports sending money across borders. | Attracts global users and broadens market reach. |

| Multi-Currency Support | Allows users to send and receive money in different currencies. | Supports global usage and enhances flexibility. |

| Expense Tracking | Categorizes and tracks user spending behavior. | Encourages financial awareness and app stickiness. |

| Customer Support | Offers users multiple support channels within the app. | Ensures smoother issue resolution and user satisfaction. |

| Biometric Authentication | Enables fingerprint or facial recognition for app access. | Adds an extra layer of security and ease of use. |

| Secure Payment Gateway Integration | Connects to trusted payment processors to handle transactions securely. | Guarantees safe, compliant financial transfers. |

| In-app Wallet | Stores funds within the app for instant payments without external bank involvement. | Improves transaction speed and user convenience. |

| Fraud Detection & Prevention | Monitors transactions for suspicious activity using AI and machine learning. | Protects users and reduces financial risk. |

| Loyalty & Rewards Programs | Offers cashback, points, or discounts for frequent use. | Boosts user engagement and retention. |

| Offline Mode | Enables certain app functions without internet connectivity. | Enhances usability in low-connectivity areas. |

10 Proven Stages for Building Secure & Scalable Mobile Payment Apps

Want to launch a successful fintech product? Here’s your step-by-step roadmap that explains how to build a p2p payment app, which is secure and easy to use, while adapting best practices in mobile payment app development.

1. Define Clear Goals and Understand Your Audience

Before getting into development, define the purpose of your P2P payment app and target users.

- Figure out the main goal: Will your app let users send money to friends, pay bills online, or act as a digital wallet?

- Determine your audience: Focus on who your audience is by considering demographics, location, income, and online actions.

- Know who your users are: What audience are you targeting? Millennials, working freelancers, or CEOs?

- Collect user insights: Conduct surveys, interviews, or focus groups to uncover pain points, preferences, and expectations.

- Align goals with user needs: Use insights to prioritize features that address real problems and improve usability.

2. Research the Market and Study the Competition

To be different, you must have an idea of what is already out there. Observe highly used apps such as Apple Pay, Venmo, Google Pay, and Cash App to see what consumers adore and what they grumble about.

Go a step further and establish trends such as:

- Contactless transactions

- Buy Now, Pay Later (BNPL) features

- Crypto wallet support

These findings may enable you to identify gaps and create a more competitive and innovative product.

3. Define Your Payment App’s Features & Technical Requirements

Once your goals and users are clear, outline your app’s core features and tech requirements, and explain how you are going to build them. Start by determining the main features your users will need and which ones fulfill the aim of your app.

- List essential features: Features like secure profiles, multi-factor authentication, real-time notifications, and transaction receipts are non-negotiable in P2P mobile app development.

- Identify advanced features: Contactless payments (NFC/QR), biometric authentication, social payments, and crypto wallet integration can improve the user experience.

- Determine technical requirements: Choose your tech stack, payment gateway APIs, security measures (such as PCI-DSS), and scalability solutions.

- Platform compatibility: Decide whether the app will launch on iOS, Android, or both, and if a web dashboard or merchant portal is needed.

4. Focus on Legal Compliance and User Security

Handling funds data entails a legal obligation. Your app should uphold local and global legislation, like:

- GDPR (EU data privacy)

- PCI-DSS (payment security standards)

- AML and KYC policies (for anti-fraud purposes)

Add functionalities such as biometric sign-in, encryption, fraud protection, and identity verification tools from reputable service providers to uphold compliance and user trust.

5. Choose the Right Development Approach

Selecting the correct approach for fintech software development impacts your app’s performance, its ability to grow, the time it takes to produce the app, and its future care. The development model you choose will depend on your budget, deadline, and what you want to achieve.

| Approach | Description | Best For | Considerations |

| Native Development | Separate apps for iOS and Android using platform-specific languages (Swift, Kotlin/Java). | High performance, access to native features | Higher cost, longer development time |

| Cross-Platform | One codebase for both iOS and Android using frameworks like Flutter or React Native. | Faster development, cost efficiency | May have limited access to some native capabilities |

| Hybrid Development | Web technologies (HTML, CSS, JavaScript) wrapped in a native shell (e.g., Ionic). | Quick MVPs or simple apps | Lower performance, not ideal for complex or resource-heavy apps |

| Progressive web apps (PWAs) | Web app that behaves like a mobile app via browser, with offline access and push notifications. | Lightweight apps, wide reach, budget-friendly | Limited native functionality, reduced device hardware integration |

Note: We’ll work with you to assess technical needs, uncover user insights, and align your future goals, guiding you through how to build a p2p payment app using the most effective development method.

- Technical challenges holding your app idea back?

- We’ll help you define the right tools, architecture, and features.

6. Design an Intuitive UI and UX

A simple, intuitive interface and seamless user experience can differentiate your payment app and sustain long-term engagement.

Critical steps to successful UI/UX design:

Gather demographic and behavioral insights through surveys or interviews to create comprehensive profiles that guide design choices.

- Establish user personas: Gather demographic and behavioral insights through surveys or interviews to create comprehensive profiles that guide design choices.

- Map user journeys: Outline how different user groups will navigate your app from beginning to end. Determine their goals, expectations, and pain points.

- Create wireframes and prototypes: Begin with low-fidelity sketches for mobile payment app development to sketch out the layout and flow. Move on to high-fidelity mockups and a consistent UI kit, including your brand’s visual elements.

7. Design for Scalability and High Performance

Make sure that your P2P app can handle user growth without compromising speed or dependability.

Here’s how to design a scalable and high-performance payment app:

- Pick event-driven architecture: Real-time payment processing, coupled with asynchronous background operations, keeps your application responsive.

- Use database sharding and replication: Spread data across multiple servers for speed, scalability, and fault tolerance.

- Cloud autoscale: Automatically scale compute resources according to transaction volume so that performance stays in line.

- Implement a caching solution: Use software like Redis or Memcached to temporarily relieve the database by caching frequently used data.

8. Thorough Testing and Quality Assurance

Launching your app without proper testing can frustrate users and harm your reputation. That’s why quality assurance (QA) is absolutely crucial, especially when you’re handling sensitive financial information.

Key QA tasks involve:

- Functional testing: Confirm all features work as intended

- Security testing: Detect vulnerabilities to safeguard user data and meet financial regulations.

- Performance testing: Make sure the app is responsive under different loads.

- Usability testing: Collect feedback on the user interface and experience to identify any points of confusion or friction.

9. Launch and Iterate

Your Minimum Viable Product (MVP) is set to make a debut, but the real work comes after this. User feedback is like a secret weapon that helps you refine your P2P payment app development.

Post-launch priorities:

- Monitor user engagement and behavior closely.

- Identify feature requests and usability issues.

- Update the P2P payment app regularly to repair bugs for improved performance and introduce new functionality as per users’ demand.

10. Continuous Improvement and Support

Releasing your payment app is just the start of an ongoing journey. Maintaining top-notch service and strong data security is equally essential for long-term success, especially when planning how to build a P2P payment app that users trust.

Key areas of focus for sustained growth:

- Active user feedback gathering: Use surveys, reviews, and analytics to understand how users interact with your P2P app and mark areas that require improvement.

- Constructively respond to criticism: Even negative reviews can highlight all the important opportunities to enhance your app.

- Frequently improve features and UI: Keep your P2P payment app updated and modern by introducing new features and design elements.

Explore the Range of Payment Apps You Can Develop with TekRevol

At TekRevol, we develop secure, scalable, and user-centric payment apps tailored to your business needs, whether you’re a fintech startup or an international brand. We’ve shown you how to build a P2P payment app, and now it’s time to give you an overview of how we can assist with other types of mobile app development.

Here’s a look at the different types of payment applications we can help you create:

1. Bank-Integrated Payment Apps

These apps integrate smoothly with legacy or digital banking infrastructure, connecting to payment gateways, core banking systems, and settlement services for fast and secure fiat transactions. Leveraging existing banking infrastructure can reduce development complexity for companies looking for online payment app development.

Best suited for: Legacy banks and neobanks looking to offer digital-first services without starting from scratch.

2. Standalone P2P Payment Apps

Standalone platforms operate independently of traditional banks, allowing users to send and receive money directly within the app. Designed for speed, affordability, and convenience, they are perfect examples of modern P2P payment app development.

Best for: Fintech startups, digital wallet services, and crypto-based platforms.

Popular examples: Venmo, Cash App, PayPal

3. Social-Payment Apps

Embedded within social media platforms, these apps let users transfer money without leaving their most loved social networks. Built-in wallets and instant transactions redefine the meaning of convenience.

Best for: Social media sites looking to drive more engagement and grow monetization.

4. Mobile OS-Integrated Wallet Apps

These apps are built to operate alongside mobile operating systems, supporting online and offline payments via NFC, QR codes, or contactless technology. They offer a secure experience across devices, aligning with best practices in mobile payment app development.

Best suited for: Mobile device manufacturers or platform providers looking to extend into payment ecosystems.

5. Retail Payment Apps

These apps are designed specially for merchants and retailers to facilitate purchases, provide loyalty rewards, and process customer payments within the app. They provide a single shopping and checkout experience.

Best suited for: E-commerce businesses, brick-and-mortar retailers, and subscription services.

Well-known examples: Amazon, Starbucks, Walmart

6. Cryptocurrency Payment Apps

Designed to support digital assets, these apps enable users to store, send, and receive cryptocurrencies safely. They integrate blockchain, provide real-time wallet balance, and are multi-coin compatible.

Suitable for: Crypto exchanges, blockchain startups, and companies embracing Web3 technologies.

7. Mobile Payment Apps

These payment apps enable consumers to make payments for goods and services directly from their smartphones. From tapping at a shop terminal to scanning a QR code, payment apps keep regular purchases quick and hassle-free. These apps often involve Android and iOS app development for a smooth performance across all mobile devices.

These apps enable consumers to make payments for goods and services directly from their smartphones. From tapping at a shop terminal to scanning a QR code, payment apps keep regular purchases quick and hassle-free.

Most well-known examples: Apple Pay, Google Pay, Samsung Pay

Ideal for: Businesses aiming to offer convenient, on-the-go payment experiences.

8. Digital Wallets

Digital wallets store payment information securely and enable online and offline transactions. They bring multiple cards and accounts under one platform access and pay easily, a key component in modern P2P payment app development.

Popular examples: PayPal, Apple Wallet, Google Wallet

Ideal for: Fintech companies, banks, and businesses offering diverse payment options.

- Have a payment app concept in mind?

- Talk to our mobile app experts, share your vision, and we’ll build a custom development strategy just for you.

Major Challenges in P2P Payment App Development

Developing a secure and stable peer-to-peer (P2P) payment application might appear to be an easy feat, but there are a variety of challenges behind the scenes. Here are the most important barriers that developers need to overcome:

-

Cross-Border Constraints

The majority of P2P payment applications operate within a country’s boundaries. Facilitating cross-border transfers is complicated owing to currency, regulation, and infrastructure disparities.

-

Interoperability Constraints

Many apps require both users to be on the same platform, which can make occasional or one-time transfers frustrating. With cross-platform app development, your payment app works smoothly across devices, reducing friction.

-

Transaction Mistakes and Conflicts

Incorrect payments or transactions that do not work can infuriate users. P2P payment apps need to provide validation processes, cancellation, and good tracking.

-

Slow User Take-up

Even with increasing interest, security concerns mean that some users are still more inclined to use cash or cards. Trust-based functionality and education are crucial.

-

Security Threats

P2P apps are the biggest target of cyberattacks. Developers working on online payment transfer app development need to implement encryption, multi-factor authentication, and active monitoring to keep user data safe.

-

PCI DSS Compliance

Card data handling mandates strict security norms. PCI DSS compliance prevents legal issues and enhances user confidence.

-

Currency Conversion Issues

Cross-platform real-time currency conversion over 180+ currencies is cumbersome. Apps have to provide instant, accurate, and low-fee conversions for global usability.

- P2P apps demand bulletproof security and compliance.

- We help you build fintech apps that meet global standards with robust data protection!

Cost Factors to Consider When Developing a P2P Payment App

If you’re planning to create a P2P app, understanding the potential costs is essential. Knowing how to build a p2p payment app helps you anticipate expenses, which will vary depending on the features and complexity of your project. Here’s a clear cost breakdown by app type:

| App Type | Description | Estimated Cost |

| Basic P2P Payment App | Core money transfer functions with essential features only | $40,000 – $120,000 |

| Medium-Complexity App | Adds security, a user-friendly design, transaction history, and extras like bill splitting | $120,000 – $200,000 |

| Advanced P2P Payment App | Enterprise-level with global gateways, multi-currency support, integrations, and admin tools | $200,000+ |

- Need a clear cost estimate for your P2P app?

- Talk to our experts to discuss your ideas and get a personalized quote — or try our cost calculator!

Build a Secure, Scalable Payment App with TekRevol

TekRevol builds and implements custom financial solutions for modern businesses to satisfy the changing demands of today’s business. With emphasis on MVP creation, user-centric UI/UX design, and open project management, we enable startups and businesses to roll out innovative payment apps at speed and with confidence.

Our MVP development process enables you to launch your product to market within 2-3 months, enabling you to prove ideas cheaply and quickly without sacrificing quality or user experience. Whether you’re a startup or a large-scale business, we guide you through how to build a P2P payment app for your business needs.

Supported by a talented fintech development team, TekRevol has been able to design an array of high-performing financial products, some of which you may view in our portfolio. From digital wallets and peer-to-peer payment systems to fully integrated mobile banking applications, we provide solutions that are secure, scalable, and industry-compliant.

- Get your mobile wallet ready 70% faster

- Bring your fintech vision to life with rapid MVP development.