A few years ago, sending money in Bahrain meant delays, paperwork, and frustration. Then came BenefitPay, and suddenly, paying bills or splitting lunch was just a tap away.

It wasn’t just a lucky app but the result of smart, user-first finance app development tailored to Bahrain’s digital habits. BenefitPay didn’t just bring tech to the table. It brought convenience, trust, and a better way to move money.

Now, fintech in Bahrain is booming, and the window of opportunity is wide open. But if you want to build a BenefitPay alternative in Bahrain, you can’t wing it. You need to know what is working, what users expect, and how to deliver it with precision.

In this article, we will unpack why Bahrain is the perfect place for fintech app development. You will also learn what made BenefitPay a success, and how to build the best finance app for Android/iOS that sticks.

The Rise of Fintech in Bahrain

When you think about launching a finance app for iPhone or Android in the Gulf region, Bahrain might not be the first place that jumps to mind. But it should be.

Why? Because Bahrain isn’t just catching up with fintech trends, it is sprinting ahead. From how people pay for coffee to how they send money abroad, the country is going digital fast.

The numbers back it up, and if you’re exploring Bahrain mobile payment app development, the timing couldn’t be better.

Key Fintech Growth Stats

- Bahrain’s fintech sector has grown 80% in the last five years, according to the Bahrain Economic Development Board.

- Over 40 licensed fintech firms now operate across digital banking, crypto, and cross-border payments.

- Bahrain FinTech Bay has collaborated with 100+ global firms to launch next-gen solutions.

- The Central Bank of Bahrain (CBB) has adopted open banking frameworks, making API integration seamless.

- Mobile internet penetration exceeds 90%, offering a built-in digital audience for finance apps.

Digital Payment Trends in Bahrain

Today, 60% of Bahrain’s population prefers cashless payments. For most daily purchases like groceries, gas, rent, even weekend shawarma, people are tapping phones, not swiping cards or handing over cash.

Add to that fact, over 90% of Bahrainis have mobile internet access. It is one of the key reasons business in Bahrain needs a mobile app that is tailored to the country’s digital-first consumers and regulatory landscape.

BenefitPay – A Local Success Story

BenefitPay isn’t just another finance app development example. It is Bahrain’s digital wallet that makes money management simple and hassle-free. Since its launch, BenefitPay has completely changed how Bahrainis pay bills, send money, and shop both online and in stores.

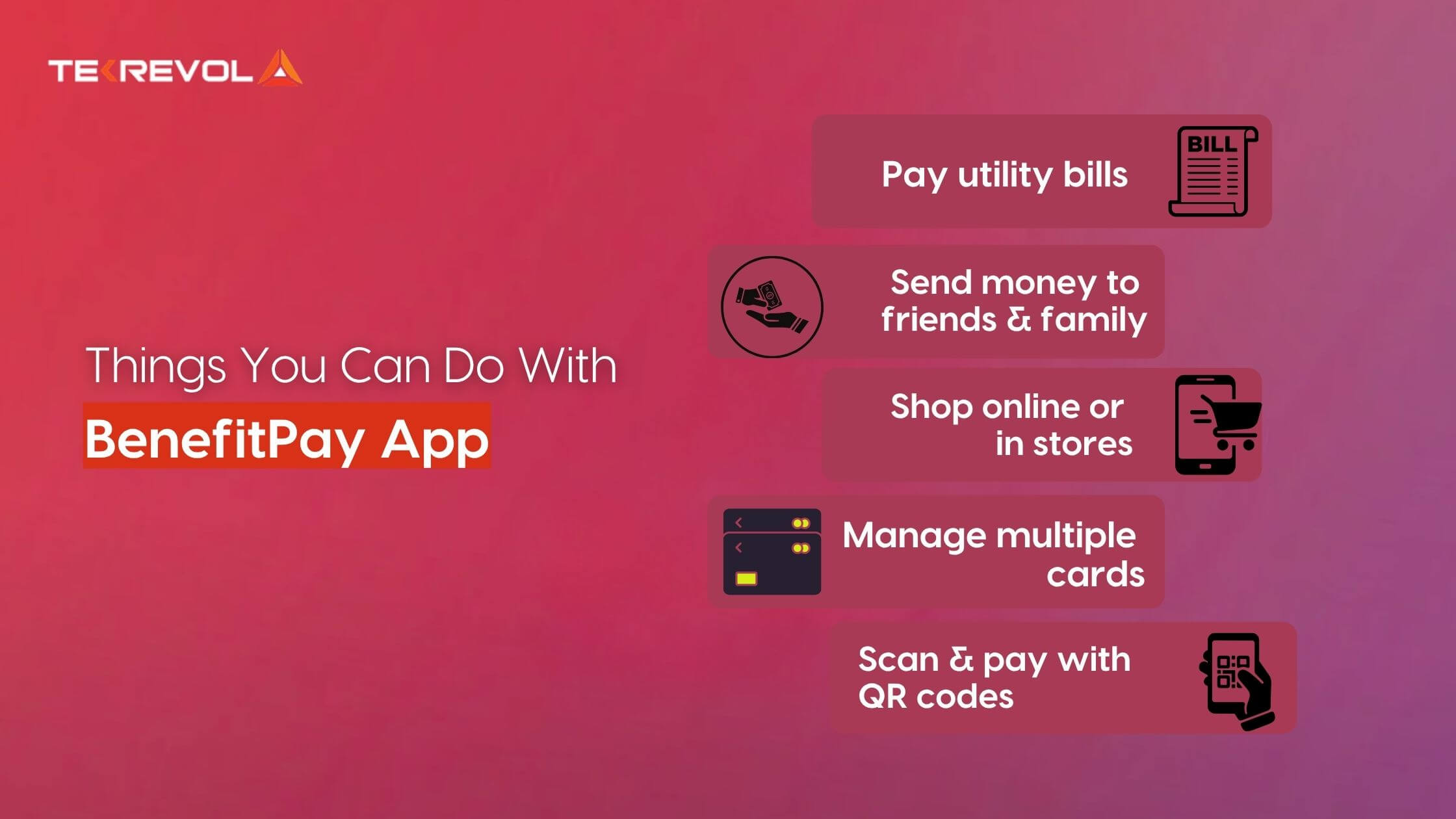

What You Can Do With BenefitPay?

BenefitPay is a Bahrain fintech payment gateway solution, eliminating the need for physical cash or cards. With BenefitPay, you can:

- Pay utility bills quickly; no more long lines or paperwork

- Send money instantly to friends, family, or businesses

- Shop online or in physical stores without digging for your credit card

- Scan and pay via QR codes at participating merchants

- Manage multiple cards and keep track of your spending all in one place

Why It Works for Bahrain

BenefitPay works because it is built with Bahrain’s needs in mind. Like the best finance app, it perfectly fits the local market and habits, making it a natural choice for everyday use. Plus, Bahrain’s big push toward a cashless economy means BenefitPay is right on time to lead the way.

One standout feature is its open platform remittance service, a first in the GCC for sending money abroad. That’s a huge plus for Bahrain’s large expatriate community, who regularly send money home.

Key Features That Made BenefitPay Popular

What puts BenefitPay ahead is its user-friendly features that make daily life easier:

- QR Code Payments: Just scan and pay instantly at supported shops—super fast and contactless

- Bill Payments: Take care of your utility bills, traffic fines, and government fees in a snap

- Remittance Services: Send money locally or internationally with ease—great for expats

- Secure Wallet: Link your cards or bank accounts safely and pay hassle-free

- Government Services: Pay for licenses, fines, and other government fees directly from the app

All these features combine to make BenefitPay not just a payment tool, but a trusted part of Bahrainis’ daily financial lives.

Why Should You Build a Finance Solution App Like BenefitPay?

Bahrain is going cashless fast; therefore, building a finance solution app like BenefitPay is becoming essential. Here is why now is the perfect time to build a secure financial app in Bahrain like BenefitPay:

1. Cashless Is the New Normal

Over 60% of Bahrain’s population prefers cashless transactions. Whether it is paying for groceries, fuel, or splitting dinner bills, consumers want speed and convenience, without physical cards or cash.

2. Consumer Behavior Has Shifted

People expect everything on mobile, from banking to bill payments. BenefitPay’s success shows that Bahrainis are not just open to fintech, they are actively embracing it.

3. Proven Product-Market Fit

BenefitPay didn’t create demand; it responded to it. Its millions of monthly transactions are proof that there is a strong, growing appetite for seamless mobile payment apps. If you are planning to create a secure financial app in Bahrain, the demand is already validated.

4. Multiple Monetization Models

BenefitPay opens doors to various revenue streams such as transaction fees, partner integrations, premium features, and even data-driven business insights. Your finance solution can be more than a utility. It can become a revenue-generating engine.

5. Unlock Loyalty and Brand Stickiness

In Bahrain, apps like Fetch and BenefitPay become part of a user’s daily life. With the right UX and value-added features (like bill splitting, instant transfers, or loyalty rewards), your app can earn long-term loyalty.

6. Easy Integration with Local Banks and Merchants

Thanks to Bahrain’s open banking efforts, users can now integrate more easily with banks, POS systems, and payment gateways. You can tap into existing financial infrastructure without reinventing the wheel.

7. Regulatory Support Is on Your Side

The Bahraini government is all in on fintech. From flexible regulations to innovation sandboxes and funding programs, they are making it easier for startups to jump in. It is a big win for new players who have less red tape and a smoother path to compliance.

8. Expand Beyond Payments

Once you have your user base, you can expand into other services: insurance, microloans, investments, and personal finance management. This is where fintech developers come into play, turning ideas into robust, user-friendly solutions.

- Got a Fintech app idea like BenefitPay?

- We help you turn it into Bahrain’s next fintech success story.

Must-Have Features For Finance Solution Apps

Building an error-free finance app like BenefitPay isn’t about cramming in features. Here’s a checklist of features every serious app should include.

1. Wallet & QR Payments: A digital wallet to store cards and funds all in one place. QR payments make checkout super fast, just scan and pay without cash or cards.

2. Bill Pay & Remittances: Paying bills like utilities and government fees should be quick and hassle-free. Remittance features let users send money locally or internationally, which is a big help for expats.

3. Security & Trust Builders: Features like two-factor authentication, biometric logins, and encryption keep money and data safe. Clear fees and responsive support build trust.

4. UX Features for User Loyalty: An easy-to-use, secure financial app in Bahrain keeps users coming back. Think simple menus, personalized dashboards, and instant notifications. Extra tools like budgeting insights add real value.

5. Spending Insights & Budgeting: Smart finance apps for Android/iOS offer more than transactions, and help users understand their spending. Tools that categorize spending, set saving goals, and send alerts create long-term value.

6. Multi-Language Support: In multicultural regions like Bahrain, multilingual options (Arabic and English, at minimum) are key for wider adoption and user comfort.

7. Open API Integration: Open API allows your app to integrate with banks, fintech services, and government systems, driving more utility for end users.

8. Customer Support Chat: Live chat or AI-driven in-app support makes a big difference when users need help fast. No one wants to dig through FAQs for urgent issues.

Finance Solution App Development: Step-by-Step Process

Building a finance app may seem complex. But with the right roadmap (and of course reliable Bahrain app development partner), it is a structured, achievable process.

Let’s break it down.

1. Idea Validation

Start with your target user, the gap your app fills, and a niche that BenefitPay hasn’t tapped into yet, maybe B2B payments or remittances with lower fees?

2. Find the Right Developers

Don’t just hire coders. You need fintech specialists who understand compliance, payments, and finance app performance plus are familiar with Bahrain’s local APIs and frameworks.

3. Design with the User in Mind

A sleek, intuitive UI will make or break your fintech app. Good design builds trust. Great design builds loyalty.

4. Build the Backend and Payment Integrations

Integrate with local gateways, including the BenefitPay API, and ensure your backend can scale securely. You’ll also need a solid architecture to support real-time transactions and user management.

5. Test, Launch, and Scale

Run penetration tests, QA sprints, and user pilots. Once launched, listen to feedback and roll out regular updates. Fintech apps are living platforms, not “set it and forget it” tools.

That is why full-cycle Bahrain mobile app development services matter. It covers everything from idea to launch and beyond, all tailored for fintech needs.

Bahrain’s Fintech Development Ecosystem

Bahrain’s fintech scene isn’t just thriving because of demand. It is also supported by a robust ecosystem that startups can lean on.

Supportive Government Regulations

Bahrain’s government has been proactive in crafting fintech-friendly regulations. These rules encourage innovation that makes fintech app development in Bahrain easier and safer for startups. Moreover, the surety of consumer protection creates a balanced environment where fintech startups can thrive without unnecessary roadblocks.

Startup Support Programs and Incubators

Bahrain isn’t just setting rules and stepping back. Plenty of incubators and support programs offer mentorship, funding opportunities, and valuable connections to those building something in fintech.

The Value of Local Expertise

Of course, success here takes more than just solid tech. Knowing the ins and outs of Bahrain’s market and regulations is a big deal. Team up with experienced app development companies in Bahrain who know the landscape to help you stay compliant while avoiding costly mistakes.

What Makes Finance Solution App Development in Bahrain Challenging?

Building a finance app in Bahrain definitely comes with its challenges, especially in a market that takes regulations and security seriously.

Navigating Security and Compliance

Security isn’t just a checkbox; it is the foundation of trust for any finance app. Meeting regulatory requirements, implementing strong encryption, and ensuring data privacy can feel like a maze. But overlooking these can lead to costly penalties and lost users.

Building User Trust and Driving Adoption

Convincing users to switch to your app involves proving reliability and transparency. A clunky user experience or unclear security can tank adoption.

Payment Gateway Integration

Bahrain has its payment gateways and local platforms like BenefitPay. Integrating these smoothly can be technically complex.

How Tekrevol Helps You Avoid Risks & Build a BenefitPay-Style Finance App

Building a fintech app isn’t just about writing code. It is about earning trust and ensuring security from day one. At TekRevol, we understand the unique challenges of finance solution app development in Bahrain.

Whether you’re cloning BenefitPay or launching something fresh, our fintech software development services back you. We built with local context, user habits, payment APIs, and compliance rules.

Our team already knows the ins and outs of Bahrain’s banking systems, design norms, and regulations. You don’t just get an app, you get a fintech product built for traction, trust, and growth.

- Ready to build your own BenefitPay-style app?

- We help you define features, map out an MVP, and a launch plan that fits Bahrain’s market.

![How Does Hybrid App Monetization Work For Houston [Strategies, Models & Trends]](https://d3r5yd0374231.cloudfront.net/images-tek/uploads/2026/02/Hybrid-App-Monetization.jpg)