You are standing in a line at a Dubai cafe on a busy morning. Everyone is waiting for their turn. Suddenly, your name is called out to get your latte, but, instead of grabbing it and walking away, you are stuck there and fumbling with cash and coins. That too in 2025…. Really?

Time has changed, and digital wallet apps are at their peak, especially in a place like the UAE, where everything moves at the speed of light. Just a quick tap of your phone, a small “beep”, and you are done without someone telling you to “move fast, dude!”.

Well, this is how a UAE wallet app works, built to make payments fast, secure, and so effortless—something every mobile app development company in Dubai now prioritizes while building fintech solutions. No more fumbling with cash or cards, no more panicking while standing in front of a long line.

Today, the digital wallet in UAE is becoming a new lifestyle for secure and easy payments. More than just convenience, an E-wallet has now become a necessity for anyone living in the fast-paced life cycle of the Emirates.

In this guide, we will explore the best payment apps in UAE, and how they are making payments easier and secure. By the end of it, we will also tell you each and every step of how you can build one of your own.

What is a Digital Mobile Wallet App?

It can be a bit confusing when you hear people talk about wallet apps and online payments. You may catch yourself asking, “What exactly is a digital mobile wallet app?”

In simple words, it is a mobile application that securely stores all of your financial details like credit and debit cards, bank accounts, and even loyalty points. Instead of carrying a leather wallet, all of your payment essentials live happily and safely inside your cellphone.

On top of that, a digital wallet UAE also lets you transfer money to your friends and redeem loyalty rewards with just a simple tap. These applications use tech like NFC, QR codes, and multi-layer authentication, making them more secure and reliable.

Types of Digital Wallets:

These E-wallets come in different types depending on where and how they are used:

- Closed-loop wallets: Work only within one brand.

- Open-loop wallets: Can be used at different banks, shops, and even worldwide apps.

- Multi-brand wallets: Run on one system but are shared by different brands or regions.

Rule the UAE Wallet App Market Now!

Don't wait anymore and get a fully secure and performing digital wallet that beats the competition.

Claim Your Free Call Today!Top 10 Digital Wallet Apps in UAE

You will notice that people use their phones than using cash for making payments everywhere, like in a cab or in a cafe. In fact, a study revealed that almost 39% of residents use a digital wallet in UAE daily. This says a lot about e-wallets, right?

It’s so clear that online payments are becoming a huge part of everyday life. Below is the list of the top 10 UAE wallet apps to show you what each of them offers to people living or visiting the UAE.

e& money (Etisalat Wallet)

e& money (Etisalat Wallet) is the first licensed UAE wallet app approved by the Central Bank of the UAE. This approval stamp alone indicates how safe and regulated this Etisalat Wallet is.

You can top up your wallet easily through UAE debit or credit cards, bank transfers, kiosks, or even Apple Pay. It also supports multicurrency transfer across more than 200 countries.

Apart from transferring money, you can also use it for paying bills, recharging your phone credit, or even getting a prepaid card linked to your account.

PayIt

There is a high chance that you might hear of PayIt in Dubai as an easy source for online payments. This digital wallet UAE is powered by the First Abu Dhabi Bank (FAB), making it one of the most trusted e-wallets in the region.

Its versatility makes it special. You can quickly send money to anyone with just their phone number, pay your bills, or scan merchant QR codes to pay.

Additionally, PayIt also integrates with government platforms, making fee payments faster and easier.

Apple Pay

Apart from a global trend, Apple Pay is considered one of the best mobile wallet apps in UAE. Most major banks in the Emirates support Apple Pay, which allows you to link your debit or credit card and pay at places accepting contactless payments.

All you need is just your iPhone or Apple watch, a quick Face or Touch ID verification, and just like that, you are done. This e-wallet uses tokenization for added security and does not store your card details.

Google Pay

If you are an Android user, then Google Wallet UAE is the best fit for you. It is a complete UAE wallet app that works for in-store, in-app, and online purchases.

Google Pay also supports NFC-based tap-and-go payments as well as QR-based, making it the right choice for you. This app also integrates with the banks of the UAE, which makes the process of linking your debit or credit card easier.

Apart from payments, you can store tickets and even boarding passes in the e-wallet. The great thing is that Google Wallet UAE offers strong security features that provide peace of mind to users.

Alipay

The roots of AliPay might emerge from China, but you cannot ignore how quickly it is growing in the UAE. Many merchants across different cities, especially in tourist zones, accept AliPay as a payment method. This makes it one of the most used UAE wallet apps for Chinese expats and tourists.

It offers QR-based transactions so that users can enjoy the familiar smooth experience as they are used to back home.

On top of everything, it also supports many e-commerce and loyalty features. So, if you are a growing business in the UAE that accepts payments through AliPay, know that you have already tapped into a large customer base of tourists.

Klip

Klip is one of the newest UAE digital wallets in the UAE fintech app market, built as a hassle-free option for users who want to completely cut off all types of traditional banking drama.

It is set up by the UAE’s digital wallet LLC and works jointly with 15 national banks to reduce the use of physical money.

What makes Klip cool among other UAE wallet apps? Well, you can do anything related to money within one app.

Let’s say you need to send, receive, spend, and even pay bills outside of the Emirates, just trust Klip and watch everything get done. The fee is lower than that of other e-wallets.

PayBy

PayBy provides a really practical way to shift from cash payments to an online payment app. This UAE wallet app allows users to do everything, like pay bills by scanning QR codes, topping up phone credits, and even digitally giving gift money during festivals.

Big and well-known supermarkets like LuLu and many 5-star hotels allow users to pay through PayBy, making it the best choice for retail businesses in the UAE.

Another feature that makes it stand out the most is its simple eKYC (electronic identity verification). All you have to do is just upload your Emirates ID and some professional selfies, and you are done.

Samsung Wallet

Samsung Wallet, also previously known as Samsung Pay, has been reintroduced in the Emirates as a complete digital wallet UAE platform. It supports NFC contactless payments, tokenization of cards, and multilayer security.

So, in this case, you can easily link your Emirati cards and use them anywhere if you have a compatible Samsung Galaxy device.

What’s new is that it also allows P2P payments, letting you send and receive money directly from your peers, all within the same secure system.

Careem PAY

Careem has grown from a taxi app to a UAE wallet app for everyone, and not just for drivers. It is authorized by the Central Bank, working with FAB and Magnati.

As we all know, Careem Pay comes straight from Careem itself; it is no wonder that you can use the e-wallet to pay for all of the services provided by Careem.

Add here comes the interesting part, they recently integrated Mastercard Send and Checkut.com for near real-time top-ups.

Beam Wallet

Beam has become one of the most familiar names in the UAE wallet apps. It also supports digital assets, making it possible to manage NFTs and even DeFi transactions in the application.

It also gives options focused on rewards, cashbacks, and perks at places where users visit regularly.

One fascinating thing about Beam is that it is the first digital wallet UAE that lets you pay for fuel from your car through beacon technology.

Comparing the Best Digital Wallets in the UAE

Searching for the right UAE wallet app can feel a little tricky, but here, we are making it easy for you by presenting a quick table, so you can pick the e-wallet app that matches your style.

| Wallet App | Origin | Security & Compliance | Unique Perks |

| e& money (Etisalat Wallet) | Etisalat, Central Bank licensed | Licensed by the Central Bank of UAE, regulated | Prepaid card linked to a wallet, broad acceptance |

| PayIt | First Abu Dhabi Bank (FAB) | Bank-backed, highly trusted | Integrated with UAE government platforms for fee payments |

| Apple Pay | Apple Inc. | Tokenization, biometric authentication | Works smoothly on iPhone/Apple Watch |

| Google Pay | Google Inc. | Strong encryption and authentication protocols | Supports boarding passes, event tickets |

| Alipay | Ant Group, China | PCI-DSS compliant, global trust | Popular with Chinese expats and tourists |

| Klip | Digital Wallet LLC (UAE) | Backed by 15 UAE banks | Lower fees compared to competitors |

| PayBy | PayBy Tech (UAE) | eKYC with Emirates ID verification | Accepted at LuLu and 5-star hotels, simple onboarding |

| Samsung Wallet | Samsung | Multi-layer security, biometrics | Full integration with the Samsung Galaxy ecosystem |

| Careem Pay | Careem + Central Bank, FAB | Central Bank authorized, Mastercard Send | Real-time top-ups, built into the Careem super app |

| Beam Wallet | Beam Wallet LLC | Encrypted, regulated | First in the UAE with beacon tech for fuel payments; supports digital assets |

What are the Must-Have Features to Look for in Digital Mobile Wallet Apps

E-wallets are not just fancy add-ons anymore; they are everyday essentials. In fact, research shows that the UAE’s prepaid card and digital wallet market is expected to grow at a rate of 12.7% annually, projected to hit USD 8.28 billion by 2025. These stats show how rapidly everyone is adopting digital wallet in UAE.

So, the thing is, what separated the best mobile wallet in UAE from the others? Let’s check it out.

Core Features Every UAE Wallet App Should Include

- Secure login and authentication: Secure the e-wallet account through PINs, OTPS, or fingerprint/face ID, and an auto logout feature to avoid any kind of misuse.

- QR code and NFC transactions: Fast and contactless payment methods at shops and transport through scanning a QR code or just tapping your smartphone on a POS terminal, possible through a trusted custom software solution.

- P2P payments: Instantly send or receive money by using your phone number or wallet ID, and have additional features such as splitting bills.

Advanced Features for Better User Experience

- Multi-currency support: Allow users to store and spend in AED as well as other currencies, making it perfect for tourists visiting the UAE.

- AI-based fraud detection: Implementing machine learning and natural language processing models to detect unusual user activity and prevent fraudulent transactions beforehand.

- Cashback and reward programs: Built-in reward programs that provide user points, discounts, or unique deals when they make payments using online payment apps in UAE.

Security and Compliance Features

- Biometric authentication: Using fingerprints or face scans for quick and secure verification.

- PCI-DSS compliance: Makes sure that the e-wallet app follows the international payment industry standard for protecting sensitive cardholder information.

- End-to-end encryption: Keeps the data safe by encrypting it during storage and transmission.

Take your digital wallet to another level..

Get a UAE wallet app loaded with NFC payments, P2P transfers, and global-level security in just one tap.

Let's Start a Strategy Session Now!How to Build a Digital Wallet App? Step-by-Step Development Guide

If you are thinking of creating your own UAE wallet app, then you are not alone. The fintech industry in the UAE is booming, as 89% of consumers are using digital-first bank accounts, showing that people expect smooth and secure transactions in the future. We think that this is the perfect time to introduce your own “digital wallet UAE” in the market.

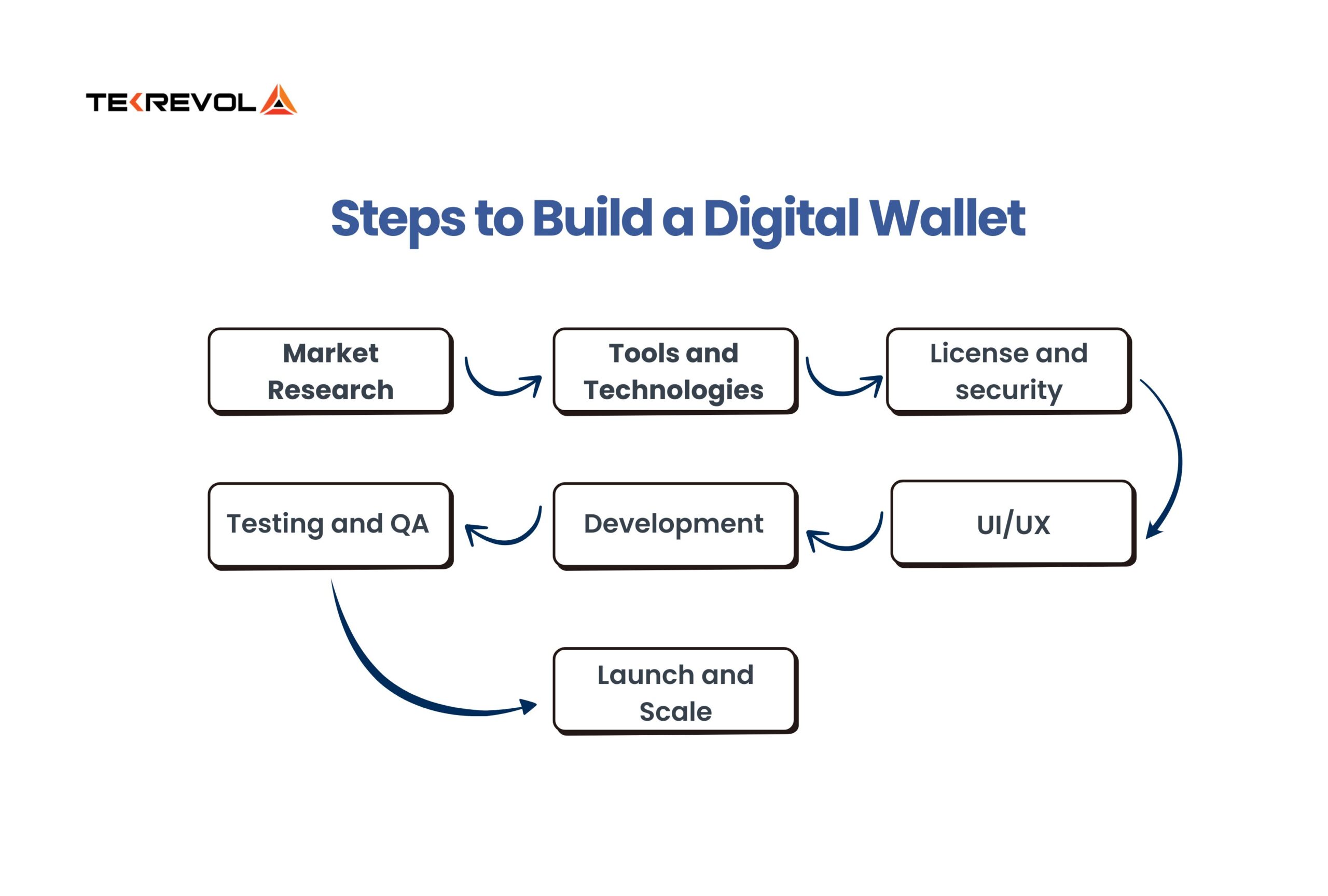

Below is a step-by-step guide to help you build one of the best online payment apps in the UAE.

Step 1: Market Research and Business Model

The first step to building a UAE wallet app is to understand the needs of the local market. With immigrants making up more than half of the total population, the demand for multi-currency support and cross-border payment is huge.

You have to decide if your app will allow an open-loop model or a closed-loop model.

Step 2: Choosing the Right Tech Stack and Architecture

The next step in building a digital wallet UAE is to choose a secure and scalable tech stack. For example:

- Frontend Development: Flutter or React Native for cross-platform apps.

- Backend development: Node.js or Java Spring Boot for performance.

- Databases: PostgreSQL or MongoDB for real-time transactions.

- Architecture: Use microservices so that features like P2P payments or loyalty rewards can be easily updated without shattering the complete system.

Step 3: Licensing and Security Compliance in UAE

This is one of the most important parts where many startups stumble. You will need approvals from the Central Bank of the UAE and compliance with PCI-DSS standards to legally run a UAE wallet app. On top of everything, pay special attention to GDPR-style data protection and biometric authentication features to meet global and local security standards.

Step 4: Designing the UI/UX

Now, begin by creating an attractive interface for your UAE wallet app. People living in Dubai, Sharjah, and Abu Dhabi highly expect applications to be responsive and multilingual. So, in this case, your e-wallet app must support Arabic and multiple languages, offer a dark/light mode, and keep the payment process to three or fewer taps. Try combining minimalism with rich features.

Step 5: Development and Integration

This is the part where your UAE wallet app starts taking a proper face. Local mobile app developers integrate APIs for payment gateways, banking systems, and AML checks to avoid fraud. Smooth integration with Apple Pay, Google Wallet UAE, and Samsung Pay instantly increases the value of your app.

Step 6: Testing and Quality Assurance

A bug in your e-wallet is not a simple bug, but a huge question mark on the security of your app. Run penetration, load, and usability testing across iOS and Android devices. Also, make sure to test in low-network conditions, since 5G coverage is not available in every part of the UAE.

Step 7: Launching, Marketing, and Scaling

Once you are done with development and QA of your UAE wallet app, soft-launch it in one part before introducing it nationwide. Partner with local banks, malls, restaurants, and food delivery applications. Offer cashback rewards to encourage sign-ups. Lastly, plan for adding features like crypto wallets or BNPL for the growing fintech market in the UAE.

Cost Breakdown and Timeframe Based on Features and Complexity

The cost for building a UAE wallet app does not stop at a fixed number. It keeps shifting as per your choices. Everything from the type of features you add to the security system impacts the final budget. Even the pace at which you want your app launched in the market plays a huge part in shaping the costs.

Simply saying, each tier of a digital wallet UAE has its own price tag and timeline, ranging from basic build to advanced systems.

| Tier | Cost (AED) | Cost (USD) | Timeline | Key Features |

| Basic | 90,000 – 150,000 | 24,500 – 40,800 | 2 – 4 months | Registration, eKYC, secure login, P2P transfers, QR/NFC payments |

| Moderate | 150,000 – 300,000 | 40,800 – 81,600 | 5 – 8 months | Multi-currency, loyalty programs, cashback, enhanced UI/UX, stronger security |

| Advanced | 300,000 – 550,000+ | 81,600 – 149,700+ | 9 – 12+ months | AI fraud detection, biometrics, blockchain/crypto, large-scale integrations |

Build the Next UAE Wallet App with TekRevol

As we all know by now, the UAE wallet app market is booming more and more by each passing day, and there’s never been a better opportunity to create your version of Etisalat Wallet, PayIt, or something completely innovative.

At TekRevol, we develop wallet apps that match the security and compliance of the UAE’s Central Bank and global standards. Every feature, from biometric authentication to KYC, is carefully created to deliver trust and performance since the very beginning.

While everyone is joining the race to launch the next UAE wallet app, our team makes sure you stay ahead of the competition. These aren’t just our words; it is what we are always committed to delivering to you.

Get Your Custom Wallet App in a Few Days

Create a feature-packed and secure UAE wallet app fast and effortlessly with TekRevol.

Claim Your Free Payment App Consultation

![How Does Hybrid App Monetization Work For Houston [Strategies, Models & Trends]](https://d3r5yd0374231.cloudfront.net/images-tek/uploads/2026/02/Hybrid-App-Monetization.jpg)