For financial businesses and startups looking forward to technology integration or Neobanks in the pre-launch phase, a mobile/web application is the core element to focus on. But before development begins, a basic yet important question needs to be answered – ‘how much does FinTech app development cost?’

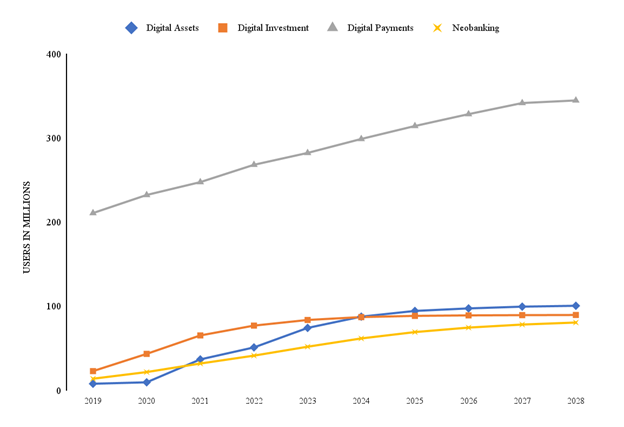

This question is crucial because as user demand surges, so does the need for accessible and innovative financial tools. The FinTech market reflects this perfectly – it’s rocketing at over 13% CAGR and is expected to reach over $882 billion by 2030. Also, the user base is anticipated to expand rapidly at an average growth rate of 10.05%.

Source: Statista

With millions adopting FinTech, a cost-effective yet feature-rich app is key to success, and understanding the right type of app and associated cost is the right approach. To make this step easier here’s a breakdown on estimating the cost to develop a FinTech app.

- Estimated costs are based on general features and functionalities for a baseline FinTech app. The final cost of your app will depend on the specific features you choose to develop.

FinTech App Development Cost Estimate by Type

Although FinTech app development is a specific niche, it’s further categorized into 7 major types. Each specific type is meant for specific operations, users, and regulators.

Knowing your industry, workflow, user, and regulatory needs helps make it easier to get the right app developed along with the necessary customization. So, here is a general overview of the estimated cost for each type of FinTech app development.

| App Type | Development Time | Estimated Cost |

|---|---|---|

| Payment | 1500 Hours | W$30,000-$100,000 |

| Personal Finance | 2000 Hours | $40,000-$120,000 |

| Lending | 2200 Hours | $50,000-$120,000 |

| Banking | 2500 Hours | $50,000-$250,000 |

| Investment | 2400 Hours | $70,000-$140,000 |

| Insurance | 2600 Hours | $50,000-$180,000 |

| Blockchain & Crypto | 3000 Hours | $120,000-$300,000 |

Payment Apps

A payment application is the most basic type used for convenient money transfers. Commonly, payment apps contain features like encryption, transaction processing, and security protocols.

For instance, we have developed a mobile app called Yeppy that is not a typical FinTech app but has more dynamic features, along with easy digital transactions. It attracted 26% of users for its finance/bill payment module during the testing phase.

A basic payment app with features like user registration & login, secure account management, and P2P money transfer may cost from $30,000 to $50,000. Whereas, a complex app with advanced features and technology stack, including in-app billing, QR payments, international transactions, and gamification (loyalty or rewards programs), may cost up to $100,000.

For reference, you can consider apps like Venmo in the basic FinTech payment app category and Cash App or PayPal in the complex category with dynamic options like international payments and in-app financial investment instruments.

Personal Finance Apps

Moving further, personal/consumer finance apps are for seamless user finance management. It’s your digital bookkeeping tool to monitor income and expenses, create a budget, and push you to follow it.

A reliable FinTech application development company normally charges between $40,000 to $120,000 for personal finance apps, depending on their complexity, features, and technology stack.

Single-feature apps like Acorns (focused on micro-investing) require a simpler development process and a smaller budget. However, for multi-feature apps like Mint and Pocket Guard, which offer great options like credit score monitoring and budget visualization, you may need to allocate more time and resources.

Lending Apps

These apps are meant for peer-to-peer lending, debt management, and interest tracking. Along with necessary user registration, authentication, and transaction features it includes credit score, EMI management, and loan management options, making it moderately complex to build.

Basic FinTech lending applications like Brigit or Dave cost approximately $50,000 to $75,000, whereas advanced-level apps cost around $100,000 to $120,000 to develop.

The development budget depends on how dynamic the app you want for users and borrowers. Dynamic FinTech software helps financing firms make faster loan decisions and expand reach at a reduced cost. While it makes it allows borrowers quick and easy access to credit.

Banking Apps

To develop a mobile banking app with an admin panel and user app, you’ll need a budget of around $50,000 to $250,000. This range reflects the extent of customization in a banking app.

From a basic platform for balance checks and money transfers to a complex app with investment tracking, AI-powered chatbot, and e-commerce transactions, complexity decides the final banking app development cost.

For instance, another digital financial service similar to the banking app – Neobanks is operated online. FinTech app for the Neobank industry is more complex as there is no branch banking, so it offers full-fledged banking features digitally, making it more complex and costly to build.

Investment Apps

Investment apps enable users to manage their financial future directly from their smartphones. These apps offer more than money management and hence involve a more intricate development process compared to payment or basic finance apps

People often use FinTech investment for Real-time and historical market data, trading functionality, portfolio management tools, and automated investing. Developing an investment app capable of such financial operations costs from $70,000 to $140,000.

Simple stock trading or basic portfolio tracking apps with limited features may cost around $70,000 to $90,000. (Similar to Stash or Acorns) These apps typically connect to a limited number of investment products and offer fundamental functionalities.

However, apps with extensive functionality like fractional share investing, complex investment analysis tools, and robo-advising cost upwards of $100,000. (Similar to Betterment or Wealthfront) These apps serve bigger investors and require robust development to integrate advanced functionalities and security.

For example, we’ve developed a stock investment tool based on blockchain technology – Rev Coin. This app made it easier for the users to trade company shares and increased loyalty among them through detailed activity evaluation.

Insurance Apps

After banks, insurance companies are in the rat race to provide a convenient way for users to manage their insurance policies and file claims directly using mobile phones. The insurance app feature stack includes:

- Policy Management

- Claims Filing & Tracking

- Agent or Broker Communication

- Quote Comparison & Purchase

- Telematics Integration (For Auto Insurance)

Depending upon the chosen technology, platform, and features cost of developing an insurance app can range from $50,000 to $180,000.

Apps with features like policy management, document access, and basic communication roadside assistance functionalities may cost around $55,000 to $100,000. These apps typically focus on a single insurance line (e.g., Aviva – auto insurance) and offer a limited set of features.

Apps with features like claims filing, telematics integration, quote comparison, and the ability to purchase new policies can cost over $150,000 (e.g., Clover – ML-powered home insurance app).

Blockchain & Cryptocurrency Apps

Blockchain technology offers wide room for innovative FinTech app development. However, technical complexity, the evolving regulatory landscape, and the need for robust security for these decentralized platforms need a bigger budget.

Here is the list of top technologies you might want for your FinTech blockchain and cryptocurrency app:

- Secure Digital Wallet

- Cryptocurrency Exchange Functionality

- Decentralized Finance (DeFi) Integration

- Non-Fungible Token (NFT) Functionality

- Blockchain Network Interaction

Blockchain-based FinTech app development costs between $120,000 to $300,000.

Crypto apps with common features like a secure crypto wallet or basic exchange might cost around $120,000 to $180,000. These apps typically focus on a single coin or a limited number of features.

Apps with complex features like DeFi integration, NFT functionalities, or direct blockchain network interactions would need a budget of over $200,000 for a high level of technical expertise and robust development.

FinTech Software Development Cost Breakdown by Features

Simply the more features you add the more time it will take which eventually affects the overall development cost. Besides the essential FinTech app development process, the following timeline breakdown for each feature will help you estimate the cost before approaching the FinTech app development company.

| Feature | Complexity | Estimated Development Time (Hours) |

|---|---|---|

| ATM & Branch Locator | Low | 30 |

| Reminders | Low | 30 |

| Support | Low | 40 |

| Income & Spending Tracking | Low/td> | 45 |

| Policy Managementt | Low | 50 |

| Car Insurance Management | Low | 50 |

| Health Insurance Management | Low | 50 |

| P2P Lending | Low | 60 |

| Financial Goals & Progress | Low | 60 |

| Analytics | Low | 60 |

| Cards Management | Low | 60 |

So, how do we calculate the final cost to develop a FinTech app? Here’s a simple formula:

FinTech App Development Cost = Sum of Development & Non-Development Time × Per Hour Developer Rate

Note: The average cost of hiring a mobile app developer in the US is $50.

- Stop Guessing, Start Estimating

Uncertain about the cost of your FinTech app idea? Our free quote calculator provides a personalized estimate based on your needs.

8 FinTech Software Development Cost Estimation Factors

Apart from app type and required features, several other factors directly affect the development budget. Here’s a breakdown of some of the most significant elements for creating a realistic budget.

App Complexity

This refers to the range and intricacy of features your FinTech app offers.

Simple Apps

Basic functionalities like account management, money transfers, and basic transaction history typically involve lower development costs.

Medium Complexity Apps

These apps may include features like bill payments, budgeting tools, and basic investment tracking. The development effort increases due to integrations with payment networks, data analysis for budgeting, and potentially managing user investment information.

High Complexity Apps

Complex features like P2P lending, advanced investment platforms, or comprehensive wealth management tools require significant development resources. Integrating with various financial institutions, building secure investment platforms, and ensuring regulatory compliance for complex features contribute to higher costs.

Backend Infrastructure

The backend infrastructure is the backbone of your FinTech app, handling data storage, processing transactions, and ensuring secure communication.

Simple Backend

Basic apps might utilize cloud-based solutions or managed databases, keeping backend infrastructure costs lower.

Complex Backend

High-demand apps or those involving complex functionalities may necessitate custom backend development using robust databases, scalable servers, and potentially blockchain technology for enhanced security. These factors can significantly impact development costs.

Platform Compatibility

Developing your app for multiple platforms (iOS, Android, web) increases the overall development effort. Here’s a breakdown:

Single Platform

Focusing on a single platform (e.g., mobile-only) reduces development costs compared to building for both iOS and Android.

Multi-Platform Development

Choosing to develop for both iOS and Android requires creating and maintaining separate codebases, potentially doubling development resources. Consider cross-platform development frameworks that can help reduce costs while ensuring a consistent user experience across platforms.

Data Security Measures

FinTech apps handle sensitive financial data, necessitating robust security measures to protect user information and transactions.

Basic Security

Implementing standard security protocols like user authentication and data encryption is essential but incurs minimal development costs.

Advanced Security Features

Adding multi-factor authentication, and intrusion detection systems, and following strict data privacy regulations like GDPR or CCPA make the FinTech development app development costlier. But adding these features to a banking or investment app helps businesses gain user and regulator trust.

UI/UX Design Complexity

A user-friendly and intuitive interface is important for user adoption. More dynamic design brings more complexity that results in higher development time and cost.

Simple UI/UX

Basic layouts with clear navigation and essential functionalities require less design effort and incur lower costs.

Complex UI/UX

Apps with custom animations, interactive elements, or integrating gamification features require more design expertise and time, leading to higher costs.

Additional Integrations

Integrating with third-party services like payment gateways, accounting software, or credit scoring providers can enhance functionality but add to development complexity.

Basic apps might not require extensive integrations, keeping development costs lower. While integrating multiple third-party services requires additional development effort to ensure seamless connection and data exchange, impacting development costs.

Here are some examples of common integrations and their impact on development:

Payment Gateway Integration

Integrating with popular payment gateways like Stripe, PayPal, or Braintree allows users to make secure and seamless payments within your app. Development complexity depends on the chosen gateway and its functionalities.

Accounting Software Integration

Enabling additional accounting features using software like QuickBooks or Xero allows users to automatically import and categorize financial data, saving time and effort. Integration complexity varies depending on the specific software’s API and data structure.

Credit Scoring Providers

Integrating with credit scoring providers can enable features like creditworthiness checks or personalized financial product recommendations. Development effort depends on the chosen provider’s API and security protocols.

Biometric Authentication

Integrating fingerprint or facial recognition for secure logins can enhance user experience and security. Development complexity depends on the chosen biometric technology and its integration with the app’s backend infrastructure.

Blockchain Technology

While not commonly used yet in all FinTech apps, blockchain technology can offer enhanced security and transparency for specific use cases like P2P lending or secure asset management. Integrating blockchain requires specialized developers and can significantly impact development costs.

Team Structure & Considerations

The success of your FinTech app development project relies heavily on building a proficient and seasoned development team. A standard FinTech development team typically comprises the following roles:

- Project Manager

- Business Analyst

- Mobile App Developers (iOS and/or Android)

- Backend Developers

- UI/UX Designers

- QA Testers

- Security Experts

- Financial Specialists

The location and experience of your development team can significantly impact development costs.

Offshore Development

Hiring development teams in regions with lower average developer rates can reduce overall costs. However, communication challenges, time zone differences, and potential quality control issues need to be considered.

Nearshore/Onshore Development

Hiring teams closer to your location often means higher developer rates but offers advantages like easier communication, better cultural understanding, and potentially faster development cycles.

Experience Level

A pro-level development team delivers complex features efficiently but may command higher rates compared to less experienced teams. Finding the right balance between experience and cost is crucial for project success.

Regulatory Compliance

FinTech apps operating in specific regions or dealing with certain financial instruments need to comply with relevant regulations.

Minimal Regulations

Apps with limited financial activity might face fewer regulatory hurdles, keeping development costs focused on core functionalities.

Strict Regulations

Apps dealing with investments, securities, or international money transfers must adhere to stricter regulations, potentially requiring additional development efforts to ensure compliance. This can include integrating with regulatory reporting systems or implementing specific security protocols mandated by regulations.

- Unsure About FinTech Regulations? Let our expert business analysts guide you through!

FinTech App Development Challenges

Transforming finance with your FinTech app idea is great! But between the vision and the real product, there can be hurdles. Knowing what to expect can help make development hassle-free.

First, consider the strategic part. Can your app stand out in a crowded market? What value does it offer? Remember, regulations are there to protect users, so understanding them is crucial to avoid delays.

Then, there are the technical challenges. Security is necessary– user data needs top-notch protection. Many FinTech apps rely on other services like banks, and ensuring they work together seamlessly can be tricky. Finally, consider scalability. Your app might take off – can it handle the extra users?

By planning for these strategic and technical hurdles upfront, you set your FinTech app up for success. Remember, a clear strategy, robust security, and a scalable design are key to thriving.

FinTech App Development by TekRevol

Building your first FinTech application? TekRevol is known for comprehensive mobile software development services across the US. When we say comprehensive, we mean enabling businesses of different natures with done-for-you mobile app development.

FinTech is a significant part of our mobile development prowess. We value product growth through extensive goal analysis, actionable strategy mapping, and goal-focused development.

Whether you need a full-fledged financial product, want to discuss your vision, or just need to know how much FinTech software development costs, our business analysts are here for your assistance.

- FinTech on a Budget? MVP is Your Answer. Launch, Learn, Grow.

4322 Views

4322 Views August 1, 2024

August 1, 2024