Starting and scaling an app business goes beyond just a brilliant idea or an exceptional product. It requires visionary leadership, a well-thought-out business strategy, and a talented team to execute it.

But above all, it hinges on early-stage capital – often the most challenging to secure.

Developing an app comes with a hefty price tag. Even the simplest ones can cost between $25k to $50k. Factor in marketing, hiring, and operational costs, and the figures skyrocket.

The good news? This entrepreneurial-driven economy has made startup fundraising more accessible than ever!

All it takes is building traction, creating a prototype, forecasting data-driven revenue projections, and approaching investors strategically.

This blog is your ultimate guide to app startup fundraising. We cover everything from conducting market research and showing proof of concept to crafting impeccable pitch materials and devising exit strategies to lure potential investors.

So, without further ado, let’s get started!

12-Step Checklist for App Startup Fundraising

The following 12-step startup fundraising checklist is all you need to raise capital for your mobile app:

Market Research & Traction:

Show that you’ve done your homework by presenting comprehensive market research. Highlight the problem your app solves, the demand for your solution, and how you stack up against competitors.

Laser-Focused Business Plan:

A business plan is your compass, guiding you through uncharted waters. Outline your app’s value proposition, target market, revenue model, and growth strategy. A well-crafted business plan signals that you’re serious about your venture.

A Functioning Prototype:

A working prototype isn’t just an impressive tech feat; it’s a tangible representation of your vision. Investors want to see how your app works and how users will interact with it.

- Get Your Prototype Ready Within 12 Weeks!

- Our user interface design team can help you build a solid, functioning prototype within 8 weeks.

A Pitch Deck:

Consider your pitch deck the treasure map that leads investors to your startup gold. It should be visually appealing, concise, and engaging. Each slide should tell a compelling story about your app and its potential.

Revenue Projections & Fund Utilization Plan:

Numbers speak volumes. Present realistic financial projections that outline how you’ll use the funds you raise. Show that you’ve thought through the financial aspects of your app startup.

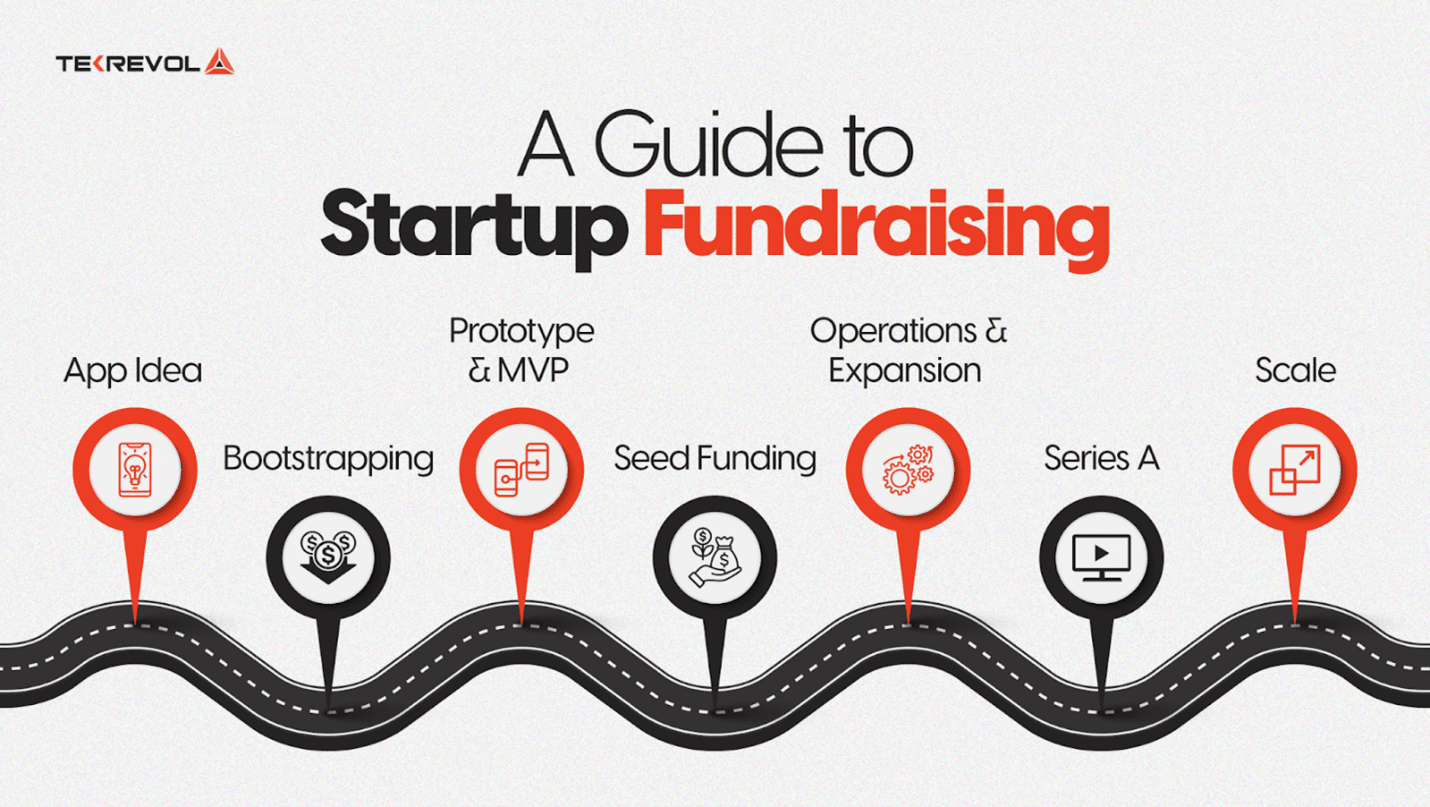

Understanding Funding Options:

Knowing different fundraising options and how they align with your fundraising goals can make all the difference. Learn what fundraising options are available to make an informed decision.

Targeted Investor List:

Identify potential investors who align with your app’s industry and stage. Tailor your approach to different types of investors – angels, VCs, and more.

Legal and IP Framework:

Show that you’ve safeguarded your startup’s intellectual property, including patents, trademarks, copyrights, and any legal agreements needed to protect your interests.

Select the Right Funding Type:

Fundraising is simple if you know the stages and needs of your business and evaluate potential funding sources. Outreaching large venture capital firms for an idea-stage startup would take you decades to finally get a reply, while an angel investor from the same industry as yours could see the potential of your startup and fund your venture in exchange for equity.

A Winning Team:

Investors invest in people as much as ideas. Introduce your dream team – individuals with the skills and passion for driving your app to success. A strong team inspires confidence and builds credibility for raising capital.

Exit Strategy

Prepare a clear and concise exit strategy for potential investors about how they will get investment returns. It can help influence their decision to invest in your app startup.

Due Diligence Documentation:

Anticipate investor inquiries by preparing due diligence documentation, including financial statements, legal contracts, and any relevant industry certifications.

- Acquire Funding with Confidence!

- Book your free consultation with a funding specialist and secure investment with confidence.

How to Conduct Market Research for App Startup Fundraising?

Market research is not about clichés like “know your audience” but about deep insights that guide you to make winning decisions. Here’s your streamlined guide to conducting impactful market research to build proof of concept and pre-launch traction for your app startup:

Define Your Uniqueness:

Before diving into research, pinpoint what makes your app truly unique. What problem does it solve that no one else does? This clarity will sharpen your research focus.

Leverage Competitor Data:

Skip cliché competitor analysis; aim for actionable data. Track competitors’ customer reviews and ratings to identify pain points. Use this to build a better user experience.

Customer Interviews:

Opt for in-depth interviews with potential users. Ask about their daily challenges and how your app can solve them. Extract genuine, unfiltered insights.

Micro-Niche Research:

Delve into micro-niches within your target market. Find underserved segments where your app can shine. Narrow focus equals laser precision.

Feedback Mining:

Look beyond social media listening. Dive into forums, Reddit threads, and specialized communities. Uncover candid discussions about what users want.

Behavior Analysis:

Apply advanced analytics tools to your app’s prototype—Unearth user behavior patterns, entry and exit points, and features that engage them most.

Pricing Psychology:

Explore the psychology of pricing. A dollar figure isn’t arbitrary; it influences perception. Research pricing models that resonate with your audience’s value perception.

Tech Trends Radar:

Beyond industry trends, spot emerging tech trends. Incorporate the latest technologies to future-proof your app and outshine competitors.

Beta Testing Brilliance:

Execute beta tests with a select user group. Gather real-world feedback and iterate swiftly. The goal is to refine your app, not just validate it.

Lean on Micro-Experiments:

Embrace micro-experiments for features. Test small-scale versions quickly to gauge user response before committing resources.

UX-Driven Evolution:

Obsess over user experience (UX). It’s not about features alone but how they flow seamlessly within your app. Remember, a stellar UX trumps all.

Embrace MVP Wisdom:

Lean on the Minimum Viable Product (MVP) philosophy. Launch swiftly with core features, then enhance based on real user interactions.

Dissect User Complaints:

Analyze user complaints meticulously. They’re a goldmine of insights for feature enhancement and customer satisfaction.

Key Takeaways

Market research is all about moving beyond clichés to extract invaluable insights that fuel your app’s success. Embrace the unconventional, obsess over user-centricity, and let research drive every decision. The winners are those who dig deeper, explore the uncharted, and fine-tune relentlessly.

How to Craft a Fail-proof Business Plan for App Startup Fundraising?

A well-crafted business plan is your startup’s foundation – a blueprint that showcases your vision, strategy, and potential to investors.

Let’s dive into the intricacies of creating a failproof business plan that conveys the true potential of your app and lays the groundwork for your app startup fundraising and exponential growth.

Executive Summary:

This is your plan’s elevator pitch – a concise overview of your app’s concept, market opportunity, and why it’s a game-changer. Nail this section to hook investors instantly.

Company Description:

Delve into your startup’s essence. Explain your app’s purpose, the problem it solves, and the value it adds to users’ lives. Showcase your passion and demonstrate why your team is best suited for the task.

Market Analysis:

Dive deep into your target market. Identify its size, demographics, and pain points. Analyze competition, highlighting how your app stands out. Convey an understanding of market trends and your app’s potential to disrupt.

Value Proposition:

Articulate what makes your app unique. Highlight its core features, how they solve the identified problem, and the benefits users will enjoy. Emphasize the value users will derive from your app.

Revenue Model:

Lay out your monetization strategy. Explain how you’ll generate revenue through subscriptions, in-app purchases, ads, or other means. Make sure your pricing strategy aligns with the perceived value of your app.

Marketing and Sales Strategy:

Detail how you plan to reach and acquire users. Outline your marketing channels, social media strategies, partnerships, and any other tactics you’ll employ to grow your user base.

Product Development and Roadmap:

Provide insights into your app’s development stages. Describe your prototype or current version and the timeline for reaching key milestones. This shows that you have a clear execution plan.

- Hire the Top 1% of User Interface Designers for Prototype Development

- Let TekRevol help you build a minimal yet fully functional prototype to add credibility to your app startup venture.

Operational Plan:

Explain how your startup will function day-to-day. Outline your team’s roles and responsibilities, operational processes, and any external partners you’ll work with.

Financial Projections:

Present realistic financial projections for the next three to five years. Include income statements, cash flow projections, and balance sheets. Be transparent about assumptions and calculations.

Ask & Use of Funds:

Specify how much funding you’re seeking and how you’ll allocate the funds. Break down expenses, such as product development, marketing, operations, and any other significant costs.

Risk Assessment and Mitigation:

Acknowledge potential risks your startup might face and your strategies to mitigate them. Investors appreciate a candid assessment of challenges and your proactive approach to addressing them.

Exit Strategy:

Explain how investors will eventually realize a return on their investment. Mention potential exit options, such as acquisition or IPO, and demonstrate you’ve thought about their future interests.

Appendices:

Include supplementary materials like your team’s resumes, product screenshots, market research data, and legal documentation. These add credibility and depth to your plan.

Tailoring for Specific Investors:

Customize your business plan for different investors. Highlight aspects that align with their interests and industry focus to create a stronger connection.

Key Takeaways

Crafting a failproof business plan requires dedication and attention to detail. It’s not just a document; it reflects your commitment, strategic thinking, and your app’s potential. Review your plan, seek feedback from mentors and advisors, and ensure it resonates with your startup’s USP.

How to Build a Prototype to Raise Capital for Your App Startup

An app prototype is a dynamic blueprint visually showcasing your app’s core features and functionality. A prototype helps validate your app idea, communicate your vision to stakeholders, and lay the groundwork for exponential growth.

Here’s how to build an app prototype that seamlessly integrates with your vision:

Sketch Your App

Start with pen and paper! Sketch rough drafts of your app’s user interface (UI). This low-fidelity approach lets you visualize layouts, screens, and basic navigation. Don’t worry about details at this stage; focus on the overall flow.

Create Wireframes

Wireframes are basic, static representations of your app’s screens. Use specialized tools like Balsamiq, Sketch, or Figma to create wireframes. Include essential elements like buttons, text, images, and navigation paths to provide a clear structure for your prototype.

Develop Mockups

Mockups are more refined versions of wireframes. They incorporate color schemes, fonts, and visuals to simulate the app’s appearance. This step helps stakeholders visualize the final product and provides a sense of design direction.

Build Interactive Prototypes

Interactive prototypes breathe life into your app concept. Tools like InVision, Proto.io, and Adobe XD enable you to create clickable prototypes. Focus on user interactions: how users navigate, click, swipe, and perform actions within your app.

Test & Gather Feedback

Testing is a critical phase. Share your interactive prototype with potential users, team members, or investors. Collect feedback on usability, design, and overall user experience. Use this feedback to refine your prototype.

Choose the Right Tech Stack

When developing your app after a successful prototype, one of the crucial decisions is selecting the right development path. There are two primary approaches:

Native Development:

This approach involves building separate versions of your app for different platforms, such as iOS and Android. Each platform has its native development languages and tools:

- iOS (Apple)

Swift or Objective-C are the languages commonly used for iOS app development, with Xcode as the integrated development environment (IDE).

- Android (Google)

Java and Kotlin are the preferred languages for Android app development, with Android Studio as the IDE.

Native development offers optimal performance and access to platform-specific features. However, it typically requires more time and resources, as each platform needs separate codebases.

Cross-Platform Development:

Cross-platform development is a viable choice if you aim for efficiency and want to reach both iOS and Android users with a single codebase.

The following frameworks facilitate cross-platform app development:

- React Native

Developed by Facebook, React Native allows you to use JavaScript and React to build mobile apps that look and feel like native ones. It offers a large community and extensive libraries.

- Flutter

Google’s Flutter uses Dart as its programming language. It’s known for its fast development and expressive UI, enabling you to create apps with a native-like experience.

- Xamarin

Owned by Microsoft, Xamarin lets you develop cross-platform apps using C#. It provides access to platform-specific APIs, balancing native and cross-platform development.

Native development ensures top performance but requires more resources. Cross-platform development streamlines development but may involve compromises in some instances. Choosing the right path depends on factors like budget, time constraints, and your target audience.

Add Functionality to Your Prototype

Work with an app development company or hire remote mobile app developers from freelancing platforms like Upwork or Fiverr to add functionality to your app. Investors and VCs prefer to observe the design aesthetics along with the core features and functionalities of the application.

User Testing & Iteration

Once you have a functional prototype ready, ask potential users, stakeholders, and industry experts to beta-test the prototype. Fix design flaws and functional inaccuracies iteratively until you have a refined, pitch-worthy finished product.

Key Takeaways

With a functional app and valuable user data, you’re in a solid position to raise capital for your app startup. Investors often favor startups with validated prototypes and MVPs as they demonstrate a clear path forward.

- Get 50 Development Hours for Free

- Hurry up to claim 50 free development hours and get your app prototype ready within 12 weeks.

How to Craft an Irresistible Investor Deck for App Startup Fundraising?

Here is a data-driven roadmap for crafting an irresistible investor deck that summarizes everything an investor might want to know about your app startup:

Compelling Executive Summary:

Your opening slide, often referred to as the “teaser,” should encapsulate your startup’s essence. Summarize your unique value, market opportunity, and funding ask within a single slide.

Market Analysis

Present data-driven insights about your target market. Highlight market size, growth trends, and pain points your app addresses. Cite reputable sources to support your claims.

Value Proposition:

Explain your app’s core value succinctly. Use clear visuals to showcase how your solution addresses the identified problem. Highlight user benefits and potential outcomes.

Business Model & Monetization:

Provide a clear overview of how your app generates revenue. Break down your pricing strategy, subscription models, or any other revenue streams. Include data on similar successful models, if applicable.

Traction & Milestones:

Demonstrate momentum by sharing traction metrics. Include user acquisition rates, engagement levels, partnerships, and any other growth indicators. Present these data points in visually compelling charts or graphs.

Team Expertise:

Introduce your team’s qualifications and relevant experience. Highlight key members’ achievements and skills. Data points, such as years of industry experience, previous successes, or relevant degrees, add credibility.

Financial Projections:

Present detailed financial projections supported by data. Include charts showcasing revenue growth, expenses, and profit margins. Ensure your projections are realistic and backed by thorough research.

Investment Ask:

Clearly state the amount of funding you’re seeking and how you plan to use the funds. Break down allocation across key areas like product development, marketing, and operations.

Visual Appeal & Consistency:

Use visuals to convey complex information succinctly. Maintain a consistent visual theme throughout the deck. A visually cohesive deck is not only more appealing but also communicates professionalism.

Building Credibility with Data:

Use data to authenticate your claims. Incorporate market research, user testimonials, case studies, and any data that underscores your app’s potential and viability.

Practice the Pitch:

Practice presenting your investor deck multiple times. Seek feedback from mentors, advisors, or colleagues to refine your content, delivery, and overall impact.

Customize for Each Interaction:

While the core content remains consistent, customize your investor deck for each interaction. Highlight aspects that align with the specific investor’s interests or focus areas.

Feedback & Iteration:

Receiving feedback is invaluable. Act on feedback from potential investors to improve your deck. Continuous refinement enhances your deck’s effectiveness over time.

Final Review & Proofreading:

Conduct a thorough review before sharing your investor deck. Check for grammar errors, data accuracy, and consistency. A polished deck reflects your attention to detail.

Accessibility & Distribution:

Share your investor deck in an easy-to-access and download format. PDFs are commonly used. Be prepared to send the deck electronically or present it in person.

Compliance & Confidentiality:

Ensure your investor deck adheres to legal regulations or confidentiality agreements. Protect sensitive information while still providing compelling insights.

Key Takeaways

In crafting the perfect investor deck, data-driven decisions and visual storytelling are your allies. Use research-backed insights, market data, and user metrics to bolster your narrative. A well-structured, visually appealing deck grabs the attention of investors and conveys your startup’s potential with clarity.

Investor Deck vs. Business Plan: What’s the Difference?

An investor deck is a concise, visually engaging tool for capturing investor interest, while a business plan provides a comprehensive, detailed blueprint for your entire business strategy. Both are essential, with distinct purposes and applications in the entrepreneurial journey.

5 Best Investor Decks of All Time: Insights from Successful App Startups

A compelling investor deck can be the difference between capturing investors’ attention and fading into obscurity.

Let’s dive into the stories behind the five best investor decks and pitch presentations of all time and glean insights from their success.

Airbnb – A Vision Beyond Lodging:

Airbnb’s investor deck is renowned for its simple yet powerful narrative. In their early days, founders Brian Chesky and Joe Gebbia created a deck focused on their vision of “a world where anyone can belong anywhere.” The deck walked investors through Airbnb’s journey, from solving the founders’ need for extra income to scaling into a global marketplace.

Key Takeaways:

- Paint a Compelling Vision: Communicate your startup’s broader purpose and how it resonates with the market.

- Tell Your Story: Take investors on a journey, showcasing your startup’s evolution and milestones.

- User-Centric Approach: Highlight how your app solves real problems for users, just as Airbnb provided a solution for both hosts and travelers.

Buffer – Transparent and Impactful:

Buffer’s investor deck stood out for its transparency and value emphasis. Buffer’s founders, Joel Gascoigne and Leo Widrich, openly shared their revenue, expenses, and growth strategy. This data-driven approach created trust and resonated with backers looking for authenticity.

Key Takeaways:

- Transparency Builds Trust: Being open about your financials and operations can set you apart as a trustworthy and credible startup.

- Highlight Core Values: Showcase the principles that guide your startup. Investors appreciate the alignment between values and business strategy.

Tinder – Simplified and Engaging:

Tinder’s investor deck exemplified simplicity and engagement. The deck was minimalistic, featuring clean visuals and concise content. It highlighted Tinder’s massive growth and user engagement, showcasing a thriving community.

Key Takeaways:

- Less is More: A clutter-free deck with concise content and visuals can effectively convey your message.

- Focus on User Metrics: Showcase user engagement, growth rates, and retention to demonstrate your app’s popularity and impact.

Mint – Tackling a Pain Point:

Mint’s investor deck resonated because it addressed a universal pain point – personal finance management. Founder Aaron Patzer’s deck highlighted the complexity of money management and how Mint’s solution simplifies users’ lives.

Key Takeaways:

- Address a Common Pain Point: Investors are drawn to startups that solve widespread challenges.

- Data-Backed Value Proposition: Use data to demonstrate the value your app brings to users’ lives, just as Mint emphasized savings and financial insight.

We Work: Crafting a Narrative of Disruption:

WeWork’s investor deck was impactful due to its narrative of disrupting the traditional office space. The deck showcased WeWork’s rapid expansion and its vision for redefining how people work.

Key Takeaways:

These successful investor decks share common threads that can guide any startup seeking funding. Clear storytelling, data-driven insights, user-centric approaches, and transparency are universal principles that capture investor interest.

- Highlight Disruption: If your app has the potential to reshape an industry, make it the center point of your investor deck.

- Market Opportunity: Showcase the scale of the opportunity your app addresses. Investors want to know the market potential.

How to Project Revenue of an Idea-Stage App Startup for Fundraising?

Revenue projection is the art of foreseeing your app’s financial journey – a roadmap that helps you chart a course, attract investors, and make informed strategic decisions.

Laying the Groundwork:

While historical data might be absent, gather information about similar apps or industries. Study trends, user behaviors, and potential monetization models that could serve as a foundation for your projections.

You can use tools like Similar Web, Sensor Tower, and Data.ai to gather the analytics of your competitors and create a revenue projection on calculated assumptions.

Identifying Revenue Streams:

Envision the primary sources of revenue your app could generate. Explore possibilities such as app sales, subscription models, in-app purchases, or strategic partnerships.

Assumptions and Metrics:

Base your projections on educated assumptions, as you lack historical data. Consider factors like user acquisition rates, conversion estimates, churn rates, and potential user engagement to lay the groundwork for revenue projection.

Market Analysis & Competitive Landscape:

Conduct a thorough market analysis, identifying your target audience’s needs and the competitive landscape. Understanding your market can help you project potential user adoption even at the idea stage.

User Acquisition Strategy:

Sketch out a preliminary strategy for attracting users once your app is developed. While these estimates might be speculative, they give investors an idea of your intentions.

Conversion & Monetization Estimations:

Assume conversion rates based on industry benchmarks or comparable apps. Estimate how many users might convert to paid customers or engage in in-app purchases.

Preliminary Customer Value:

Calculate a rough estimate of Customer Lifetime Value (CLTV) based on your monetization model. This provides a basic picture of the potential revenue each user could bring.

Estimating Average Revenue Per User (ARPU):

Although your app isn’t live, consider the average revenue per user (ARPU) by projecting how much a user might spend on your app over time.

Considering Churn & Retention:

Incorporate a preliminary churn rate estimation. While these assumptions might change, they showcase your awareness of user retention challenges.

Building Sensitivity Analysis:

Given the uncertainty of projections at this stage, construct sensitivity analyses that reflect different scenarios. This demonstrates that you’ve considered potential fluctuations.

Incorporating Feedback & Expertise:

Seek input from industry experts, mentors, and advisors. Their insights can guide your assumptions and lend credibility to your projections.

Creating Multiple Scenarios:

As your app idea evolves, create optimistic, moderate, and conservative scenarios. These diverse projections illustrate your adaptability and understanding of potential outcomes.

Industry Trends &Validation:

Even at the idea stage, if you can validate your concept through surveys, focus groups, or market research, it adds weight to your projections.

Staying Adaptable:

Remember that projections for an idea-stage app are inherently speculative. Be open to adjusting your projections as you gather more data and insights.

Key Takeaways

Creating revenue projections for an idea-stage app startup requires a blend of research, educated assumptions, and adaptability. While these projections might evolve as your app takes shape, they provide a preliminary glimpse into the financial potential of your concept.

Through thoughtful analysis, industry insights, and a data-driven approach, you’ll be better equipped to navigate the financial projection of your app startup.

Revenue Projection – Case Study

FitnessBuddy is an app that offers personalized fitness plans and nutrition advice. Let’s create a linked revenue projection considering user acquisition, engagement, subscription pricing, and potential upsells.

Assumptions:

- User Acquisition: Fitness Buddy aims to acquire users through online advertising and social media marketing.

- Conversion Rate: 15% of acquired users are expected to convert to paid subscribers.

- Subscription Pricing: Monthly subscription costs $9.99.

- Upsell: 10% of subscribers will opt for a premium plan at $19.99 monthly, including advanced features.

Churn Rate: The churn rate is expected to be 5% monthly.

| Month | Users Acquired | Conversion Rate (%) | Subscribers | Monthly Subscription Revenue ($) | Upsell Revenue ($) | Total Revenue ($) |

|---|---|---|---|---|---|---|

| 1 | 1,000 | 15 | 150 | 1,498.50 | 299.70 | 1,798.20 |

| 2 | 1,200 | 15 | 180 | 1,798.20 | 359.64 | 2,157.84 |

| 3 | 1,500 | 15 | 225 | 2,248.25 | 449.65 | 2,697.90 |

| 4 | 1,800 | 15 | 270 | 2,697.90 | 539.58 | 3,237.48 |

| 5 | 2,000 | 15 | 300 | 2,998.50 | 599.70 | 3,598.20 |

| 6 | 2,500 | 15 | 375 | 3,747.75 | 749.75 | 4,497.50 |

In this example, we’ve connected user acquisition, conversion rates, subscription pricing, upsells, and churn rates to project the revenue over six months. As users are acquired, a percentage converts to subscribers, generating revenue. Additionally, some subscribers opt for an upsell, adding to the overall revenue.

This interconnected approach reflects the dynamic nature of revenue projection, considering multiple factors that influence your app’s financial growth.

- Get a Free 24-Months Revenue Projection for Your Startup

- Book your free consultation with our financial experts and get a 24-month financial projection report for your app startup.

12 App Startup Fundraising Options to Raise Capital & Scale

Here are the twelve most popular app startup fundraising options that you can consider for raising capital for your app:

Bootstrapping

Bootstrapping involves using your savings or revenue generated by your app to fuel its growth. While this path requires careful financial planning and discipline, it gives you ultimate control and ownership.

Friends & Family

Your friends and family can be your potential investors if you can convey the true potential of your app to them. Approach this option cautiously, clearly outlining terms and expectations to avoid any buried treasure turning sour.

Angel Investors

Angel investors are high-net-worth individuals who provide early-stage funding in exchange for equity. They often come with a wealth of experience and connections, making them valuable partners beyond just funding.

Venture Capital (VC) Firms

Venture capital firms invest in startups in exchange for equity. VC firms often seek higher returns and look for startups with high growth potential. The journey with VCs involves thorough preparation, pitch-perfect presentations, and rigorous due diligence.

Crowdfunding

Crowdfunding is among the hottest startup fundraising options for app entrepreneurs these days. Crowdfunding platforms like Kickstarter or Indiegogo can help you showcase your app to a broad audience who pledges funds in exchange for rewards or early access.

Incubators & Accelerators

Picture these as training camps for young and ambitious entrepreneurs. Incubators and accelerators provide startups with mentorship, resources, and sometimes seed funding in exchange for equity. It’s a fast-paced journey that can propel your app to the open sea of success.

Grants & Competitions

Government bodies, foundations, and organizations often arrange competitions to support groundbreaking ideas and revolutionary causes. While competition might be fierce, the rewards can be substantial here.

Corporate Partnerships

Form alliances with giant corporations seeking to be among the innovative startups. Corporate partnerships can provide funding, resources, and access to a broader customer base. Just remember, like any alliance, it requires an explicit agreement and alignment of goals.

Debt Financing

Debt financing involves taking on loans or lines of credit to fund your startup. While it might weigh your ship down with debt, it offers a way to secure funds without giving away equity. Approach this option cautiously and prepare a solid repayment plan before doing so.

Strategic Investors

Strategic investors bring more than just gold to the table – they offer strategic value. They might be experts in your industry or have connections that can open doors for your app. Strategic investors often seek a long-term partnership.

Initial Coin Offering (ICO) or Token Sale:

ICO or token sale is the modern way of raising capital in exchange for cryptocurrency. While this option has its own complexities and regulations, it’s a great way to tap into the blockchain and cryptocurrency community while raising capital simultaneously.

Revenue-Based Financing:

In revenue-based financing, investors provide funding in exchange for a percentage of your app’s revenue over time. It’s a flexible option that doesn’t dilute your equity but requires careful consideration of terms.

Key Takeaways

Choose the funding option that aligns with your app’s vision, growth trajectory, and your own preferences. Each option has its merits and challenges, so take the time to chart your course, craft your pitch, and ensure you’re well-prepared for the exciting journey ahead.

Where to Find Investors for App Startup Fundraising?

You can find potential investors for app startup fundraising via:

Online Investment Platforms

Platforms like Angel List, Gust, and Crunchbase are digital investor and VC information treasure troves. These platforms offer detailed profiles, investment focus areas, and contact details of potential investors.

Industry Events and Conferences

Industry events and conferences are goldmines for networking. Attend startup events, tech conferences, and pitching competitions to meet investors face-to-face and gather valuable contacts.

Business Directories

General business directories, both online and offline, can offer a starting point for discovering potential investors. Websites like Yellow Pages or Chamber of Commerce listings might lead you to local investors.

Venture Capital Associations

Many countries and regions have venture capital associations providing member VCs’ directories. Explore these websites to find VC firms that align with your app’s focus.

Incubators & Accelerators

Incubator and accelerator programs often have networks of investors who are interested in startups. Even if you’re not part of a program, these organizations might share their investor lists.

Startup Directories

Platforms like Product Hunt or Beta List showcase startups and their backers. While exploring these directories, you might stumble upon investors who are keen on supporting app startups.

LinkedIn is a powerful tool for professional networking. Search for investors and VCs in your industry and location. Connect with them and personalize your messages to express genuine interest.

Local Angel Investor Groups

Many cities have local angel investor groups that pool funds to support startups. Research and join these groups to access potential backers in your region.

Industry Reports & News

Industry reports and news articles often mention investors who have recently funded startups in your field. Keep an eye out for mentions and build your contact list accordingly.

Social Media & Online Communities

Participate in online communities related to startups, tech, and your app’s niche. Engage in discussions and build relationships that could lead to investment opportunities.

Mentorship Networks

Mentors can be invaluable in introducing you to potential investors. Leverage your mentor’s network and ask for introductions to investors who might be interested in your app startup.

Networking at Conferences

When attending conferences, don’t just focus on the stage; spend time networking in the hallways and during breaks. Meaningful connections often happen in casual settings.

Cold Outreach

Although less conventional, cold outreach can yield positive results. Craft personalized emails or messages to potential investors explaining why your app startup aligns with their interests.

Referrals & Recommendations

Ask fellow entrepreneurs or colleagues for recommendations. Sometimes, a warm introduction from someone the investor trusts can open doors.

Key Takeaways

The key to finding the right investor or VC list for your app startup lies in research, persistence, and networking. As you explore these avenues, remember that building genuine relationships is paramount. Investors don’t just fund ideas; they invest in people who are passionate, driven, and capable of turning those ideas into reality.

How to Choose the Right Funding Option for Your App Startup?

Know Your App’s Stage & Needs

Examine where your app currently stands. Are you at the idea stage, development stage, or ready for market launch? Different funding options cater to various stages of development, so understanding your app’s needs is your Northstar.

Example Scenario: Let’s say you’ve been saving up for a while, and you have $20,000 that you’re willing to invest in your app idea. Bootstrapping allows you to use this money to create a basic prototype and take your first steps toward turning your vision into reality.

Set Clear Goals

Every successful voyage begins with a destination. Define your app’s goals – whether it’s rapid growth, steady expansion, or sustainability. Your goals will shape the funding option that best supports your desired trajectory.

Example Scenario: Your app has gained traction among a niche audience, and you’re eyeing rapid expansion to capture a larger market share. A venture capital investment of $500,000 can provide the resources needed to scale your operations, reach new customers, and increase your app’s visibility.

Evaluate Funding Amounts

Calculate how much treasure you need to sail comfortably. Some options might offer smaller amounts, while others might provide substantial chests. Match your funding needs with the option that can fulfill them.

Example Scenario: With your app’s development complete, you’re ready to bring it to the market. Through a Kickstarter campaign, you offer backers exclusive access to your app before its official launch. Suppose your campaign attracts 500 backers who contribute an average of $100 each, giving you the $50,000 you need to launch with a bang.

Assess Equity Trade-Offs

Each funding option comes with a price – a slice of your app’s ownership. Consider how much equity you’re willing to part with. For example, angel investors and VCs typically demand equity in exchange for funding.

Example Scenario: Your app’s user base is proliferating, but you need funds to enhance its features and user experience. An angel investor believes in your app’s potential and offers $100,000 for a 20% equity stake. This funding provides a financial boost and brings on board an experienced mentor who can guide your app’s growth.

Understand Timelines

Different funding options have varying timelines. Some might offer quick infusions of gold, while others might take longer to secure. Align your app’s timeline with the funding option that suits your pace.

Example Scenario: Your app addresses a significant societal challenge, and you’re eligible for a government grant promoting innovative solutions. The grant application process might be extensive, taking several months for approval. However, once secured, the grant provides a substantial funding boost that enables you to develop your app’s complex features and functionalities.

Factor in Your Risk Tolerance

Every sea has its storms. Consider your risk appetite when choosing a funding option. Some options, like loans, come with debt and repayment obligations, while others might not involve financial risk but could dilute your equity.

Example Scenario: Your app’s user base is growing steadily, and you’ve identified opportunities to enhance user engagement with premium features. Instead of taking on a traditional loan, you opt for revenue-based financing. An investor provides $50,000 in exchange for 10% of your app’s future revenue. This arrangement ensures you have the funds you need without a debt burden.

Analyze Resource Needs

Besides money, consider what other resources you need. Some funding options, like accelerators and incubators, offer mentorship, networking, and resources that can propel your app’s growth.

Example Scenario: Your app’s development has reached a critical stage, and you’re aiming for a successful launch. An accelerator program accepts your app into its cohort, providing $25,000 in funding and intensive mentorship, workshops, and connections to industry leaders. This support accelerates your app’s growth and ensures a strong market entry.

Seek Compatibility with Your Vision

Your app’s vision is your compass. Ensure the chosen funding option aligns with your long-term aspirations. For example, if you value independence, debt financing might be preferable to giving away equity.

Example Scenario: Your app’s unique value proposition has caught the attention of a larger tech company. Instead of seeking traditional funding, you negotiate a strategic partnership. The tech company provides $200,000 in exchange for a minority equity stake, offering valuable resources and distribution channels to fuel your app’s growth while you retain creative control

Research & Network

Scour the maps, gather intelligence, and network with fellow entrepreneurs. Attend industry events, join startup communities, and seek advice from mentors and advisors who have navigated these waters.

Example Scenario: Attending a startup conference, you talk with an experienced investor specializing in mobile app development. By sharing your app’s journey and potential, you pique their interest. This initial connection leads to further discussions, resulting in a funding partnership that aligns perfectly with your app’s needs.

Assess Alignment with Investors

Funding isn’t just transactional; it’s a partnership. Evaluate how well the funding source aligns with your app’s values, goals, and long-term plans. Look for investors who understand the transformative potential of your idea and have the same passion for the industry as yours.

Example Scenario: You’ve found an angel investor excited about your app’s potential. However, before sealing the deal, you engage in detailed discussions to ensure your visions and strategies are aligned. You discover that the investor brings funds and a wealth of experience in scaling tech startups, which perfectly matches your app’s growth trajectory.

Consider Exit Strategy

Even before setting sail, think about your potential destination. Some funding options might require you to eventually sell the ship – your app – through acquisition or other means. Factor this into your decision.

Example Scenario: You’re building your app, intending to position it as an attractive acquisition target for a larger player in the industry. To support this strategy, you opt for venture capital funding, which provides the necessary funds for rapid growth and brings in VC partners with a track record of successful acquisitions and exits.

Plan for Growth

Choose a funding option that meets your immediate needs and supports future growth. You don’t want to outgrow your funding source and find yourself adrift.

Example Scenario: Your app’s user base skyrockets shortly after launch, requiring additional resources to handle the increased demand. By securing funding from a venture capital firm known for its involvement in scaling high-growth startups, you’re well-prepared to handle the unexpected user surge and capitalize on the app’s rapid success.

Key Takeaways

Finding the right funding option for your app startup combines careful analysis, understanding your app’s unique circumstances, and aligning with your long-term vision.

How to Build a Winning Team for Your App Startup?

Ideas are overrated; it’s the execution that makes all the difference. And to flawlessly execute a brilliant idea, you need a winning team – a team of ambitious founding members that can help you navigate the turbulent waters of entrepreneurship.

Here’s how to build one for your app startup:

Identifying Co-Founders

Co-founders often bring complementary skills, shared responsibilities, and the ability to share the financial burden. Look for co-founders who share your passion for the idea and possess skills that complement your own. For example, if you’re a visionary with a business background, consider co-founders with technical expertise who can lead the app’s development.

CXO as a Service

In the early stages, hiring an entire executive team may be impractical. CXO as a service is where you bring in experienced professionals on a part-time or project basis to fill essential leadership roles. This approach allows you to access top talent without the commitment of full-time employment.

Hiring Your Core Team

Beyond co-founders and executive leadership, your core team should consist of individuals with expertise in key areas such as product development, marketing, and finance. Look for people with the necessary skills and share your passion and vision.

- Hire the Top 1% Tech Talent!

- Leverage our dedicated team development and IT staff augmentation services to quickly build the winning team for your app startup.

Technical Leadership

Technical leadership is critical for app startups. Whether it’s a CTO (Chief Technology Officer) or a lead developer, having someone with technical expertise can ensure your app’s successful development and maintenance.

Outsourcing & Freelancers

In some cases, outsourcing specific tasks or hiring freelancers can be a cost-effective way to access specialized skills without committing to full-time employees.

Networking & Industry Events

Attend industry events, conferences, and startup meetups to network with potential team members. These events are fertile grounds for finding like-minded individuals passionate about your niche.

Investors as Advisors

Consider investors who can also serve as advisors. They often bring valuable industry connections, insights, and expertise that can guide your startup’s growth.

Equity & Compensation

Consider equity distribution and compensation packages carefully when assembling your team. Fair and transparent arrangements help retain talent and keep everyone motivated.

Remote Team Dynamics

With the rise of remote work, your team may not be in the exact physical location. Cultivate a solid remote team culture, operative communication channels, and collaboration tools to ensure everyone stays connected and productive.

Continuous Learning & Development

Encourage continuous learning and development within your team. Provide opportunities for skill enhancement and foster an environment where team members can thrive and grow alongside the startup.

Key Takeaways

Building a winning team for your app startup is mandatory to scale with sustainability. By carefully selecting team members, nurturing a positive team culture, and continuously investing in their growth, you’ll be well on your way to building an app startup that thrives in a competitive market.

How to Create an Effective Exit Strategy for Your App Startup

Having an exit strategy for your app startup while raising capital creates a solid first impression and increases the chances of securing funding.

An exit strategy outlines how you plan to provide returns to your investors and can greatly influence their decision to invest in your startup.

Whether it’s acquisition by a larger company, going public with an IPO, or another path, a clear exit strategy is a roadmap that safeguards investors’ interests and guides your startup’s growth.

The Significance of an Exit Strategy

- Investor Confidence: An exit strategy reassures investors that you’re committed to delivering returns on their investment, increasing their confidence in your venture.

- Risk Mitigation: It helps mitigate investors’ risks by providing a plan for how they can eventually cash out their investment.

- Strategic Direction: Your exit strategy can influence critical strategic decisions, such as the direction of your startup and the timing of potential mergers or acquisitions.

- Alignment of Interests: When everyone is on the same page regarding the exit strategy, it reduces conflicts and ensures that both founders and investors work towards the same goal.

Steps to Create an Effective Exit Strategy

Define Your Objectives

Determine your long-term goals. Are you aiming for acquisition, an IPO, or long-term independence? Your objectives will guide your strategy.

Understand Your Industry

Consider the dynamics of your industry. Some industries are more prone to acquisitions, while others are better suited for steady, long-term growth.

Monitor Valuation

Regularly assess your startup’s valuation in the market to identify the right time to exit.

Identify Potential Buyers

Research potential acquirers or partners who might be interested in your app and could provide an exit opportunity.

Align with Investor Expectations

Ensure your exit strategy aligns with your investors’ expectations regarding returns and the timeline for exit.

Seek Expert Advice

Consult with legal and financial experts who specialize in startup exits. Their guidance is invaluable in navigating complex negotiations.

Common Exit Strategies for App Startups

Acquisition

One of the most common exit strategies is being acquired by a larger tech company, providing a quick return for investors through a buyout of shares or assets.

Initial Public Offering (IPO)

Taking your startup public through an IPO offers the chance to raise substantial capital and grow as a publicly traded company.

Management Buyout (MBO)

Sometimes, the existing management team may buy out the investors, allowing the founders to regain control.

Strategic Partnerships

Strategic partnerships with larger companies can provide capital and resources for growth, although it may not involve a complete buyout.

Liquidation

In rare cases where the startup can’t achieve its objectives, liquidation involves selling assets and distributing proceeds to investors.

Challenges in Crafting an Exit Strategy

Timing

Deciding when to exit can be challenging. Exit too early, and you might miss out on potential value. Exit too late, and market conditions may not be favorable.

Negotiations

Negotiating terms with potential acquirers or investors can be complex, often requiring professional guidance.

Market Conditions

Economic and market conditions can impact the feasibility of specific exit strategies, necessitating flexibility and adaptation.

Investor Alignment

Ensure that your investors are aligned with your chosen exit strategy to avoid conflicting expectations.

Key Takeaways

An effective exit strategy is not just a financial plan but a strategic roadmap that influences your startup’s growth and gives investors confidence.

As market conditions and opportunities can change, flexibility is essential, so periodically reassess and adjust your strategy as needed to ensure the best possible outcome for all stakeholders.

How to Prepare for Due Diligence?

Due diligence is like a deep dive into your startup’s operations, finances, and potential. Let’s unravel the ins and outs of due diligence, explore its dimensions, and get practical insights using scenarios and visual aids.

Understanding Due Diligence: The In-Depth Probe

Due diligence is a thorough examination conducted by potential investors or buyers to assess your app startup’s viability, potential risks, and value. It’s a way for them to verify your claims during your pitch and make an informed investment decision.

Types of Due Diligence

Financial Due Diligence:

Analyzing the financial records, including revenue, expenses, projections, and cash flow, to assess the financial health of your startup.

Legal Due Diligence:

Examining legal documents, contracts, intellectual property rights, and potential legal liabilities.

Operational Due Diligence:

Evaluating your operational processes, technology infrastructure, and scalability potential.

Market Due Diligence:

Assessing your target market, competition, and the potential for growth and market dominance.

Technical Due Diligence:

Scrutinizing your app’s technical aspects, architecture, security measures, and scalability.

The Due Diligence Process: Unpacking Each Stage

Initial Assessment:

Initial Assessment:

At this stage, potential investors review your pitch deck and essential information to gauge whether your startup aligns with their investment criteria.

Information Request:

Investors provide a list of documents and information they need for a deeper analysis. This might include financial statements, legal contracts, customer agreements, etc.

Document Review:

Investors examine your documents to ensure they’re accurate, complete, and in order. They’re looking for any red flags or inconsistencies.

On-Site Visits and Interviews:

In-person visits and discussions with your team allow investors to understand your startup’s culture, operations, and potential challenges.

Financial Analysis:

Investors dive into your financial statements, projections, and cash flow to assess your startup’s financial health and potential return on investment.

Legal Scrutiny:

Legal experts review contracts, licenses, patents, and any potential legal issues to ensure your startup is on solid legal ground.

Technical Evaluation:

Tech experts assess your app’s technical aspects, including its architecture, security measures, and scalability potential.

Market and Competition Assessment:

Investors analyze your target market, competition, and your startup’s positioning within the industry.

Decision and Negotiation:

Based on their due diligence findings, investors decide whether to move forward with funding negotiations, adjust terms, or decline the investment.

Benefits of a Thorough Due Diligence

Informed Decisions:

Due diligence equips investors with comprehensive insights to make well-informed funding decisions.

Risk Mitigation:

Identifying potential risks early allows investors to address issues or negotiate better terms.

Valuation Accuracy:

Due diligence helps determine the accurate valuation of your startup, ensuring fairness for both parties.

Operational Improvements:

Feedback from due diligence can guide your startup’s improvements, from financial projections to operational efficiency.

Investor Confidence:

A successful due diligence process instills investor confidence, paving the way for fruitful partnerships.

Common due diligence pitfalls

Inadequate Preparation:

Failing to organize documents and information can slow down the process and create a negative impression.

Overhyping:

If your pitch is far from reality, due diligence can reveal the gap, damaging your credibility.

Legal Ambiguities:

Overlooking legal matters can lead to unexpected legal challenges during the process.

Incomplete Information:

Providing incomplete or inconsistent data can raise doubts about your startup’s transparency.

Market Blind Spots:

Misunderstanding your market and competition can raise questions about your startup’s growth potential.

- Raise Funding with Confidence!

- Book free consultation with our startup fundraising specialists and explore the best funding options for your startup

Partner with TekRevol for Mobile App Development

TekRevol helps startup founders and ambitious entrepreneurs build scalable and sustainable digital products, including software and mobile applications, SaaS products, and more. Our commitment to fostering the entrepreneurial-driven ecosystem leveraging emerging tech has gained us a reputation as the industry leader and a spot in the Inc. 5000 fastest-growing companies in the US.

From app startup fundraising to choosing the perfect tech stack for your app, from designing a fully functional prototype to developing and deploying the final product on the applications stores, TekRevol is your trusted partner for all!

3159 Views

3159 Views September 26, 2023

September 26, 2023

![Mobile App Development Process [Step-by-Step Guide 2025]](https://d3r5yd0374231.cloudfront.net/images-tek/uploads/2023/12/Mobile-App-Development-Process-1.jpg)