Build Your Own Payit App

Discover the real cost and features of creating a Payit Dubai digital wallet.

Get My Cost Breakdown

Imagine handing your phone to someone and them paying for your coffee, the taxi, or splitting rent, not with cash, but with a smooth tap or a quick scan. That slick moment? That’s the promise of a modern digital wallet. If you’re thinking about launching something that vibes like the payit app, you’re not alone, UAE users are hungry for fast, frictionless payments and taste technology that just works.

Creating a wallet that users trust and use daily takes more than nice-looking screens. You require iron-strong security, lightning-fast transactions, intelligent integrations, and loyalty hooks that bring users back for more. Whether you have a minimal payit app dubai clone to explore product-market fit or a full-stack fintech competitor, this guide decomposes the entire journey tech, expense, timelines, revenue models, and an unambiguous roadmap for the UAE in 2026.

I’ll take you through actual cost brackets, the absolute necessities, sneaky charges no one ever informs you about, and what it takes to beat big players in the UAE digital wallet space. This isn’t hypothetical fluff, it’s real, experience-backed advice so product owners, founders, and fintech teams can make informed decisions about Payit Dubai. Ready? Let’s create something people actually love to use.

Users may pay bills, replenish cell credit, send money P2P, scan merchant QR codes, and access government services all via the Payit app, a mobile wallet designed specifically for the United Arab Emirates. It was well-liked by Dubai and other UAE customers because to its simplicity of use, integration of local banks and government agencies, and incentives features (cashback and discounts).

The success of Payit Dubai isn’t just luck. It’s built on smart strategies and local trust. Here’s why users instantly adopted the app:

In short, the Payit app Dubai model proves that when you combine local insight with strong security and real benefits, adoption happens fast.

From food delivery to ride-hailing, UAE customers want frictionless checkout. The digital wallet trend is fuelled by urbanized lifestyles, high smartphone penetration, and digitally savvy consumers who expect instant payments, quick refunds, and rewards.

UAE’s smart city and digital economy have pushed both consumers and merchants towards cashless options. Integrations with government portals and acceptance of wallets for government services enhance legitimacy for apps such as the Payit app.

Merchants adore digital wallets that reduce checkout friction and enable new marketing channels (offers, loyalty, analytics). An efficiently designed Payit app Dubai clone will enable quick payment acceptance for small/medium businesses and provide data-driven upsell opportunities.

| Feature | Benefit for User | Business Benefit |

| KYC & Secure Login | Trust + compliance | Reduces fraud & regulatory risk |

| QR Payments | Fast checkout | Increases merchant acceptance |

| Cashback & Rewards | Repeat usage | Higher transaction volume |

| Merchant Analytics | Better campaigns | Merchant retention & fees |

| AI Expense Insights | Better money habits | Increased engagement |

Budget between AED 90,000 and AED 550,000+, depending on whether you’re building an MVP or a fully-featured, enterprise-grade app. That’s roughly $50,000 to $300,000+ in USD terms. These estimates account for compliance, security, integrations, and cloud infrastructure.

The price varies based on team location/hourly rates, security & compliance (PCI-DSS, local licensing), integrations (banks, payment gateways), and feature complexity (real-time settlements, AI modules, blockchain). Third-party licensing or government integrations may add one-off charges, too.

Here is the estimated breakdown table:

| Component | Estimated Cost (AED) | Notes |

| UI/UX Design | 15,000 – 40,000 | User flows, prototypes |

| Frontend (iOS + Android) | 40,000 – 150,000 | Native or cross-platform |

| Backend & APIs | 60,000 – 200,000 | Security, scalability |

| Integrations (Banks, KYC, Gateway) | 10,000 – 80,000 | Depends on fees |

| QA & Testing | 10,000 – 30,000 | Manual + automation |

| Compliance & Legal | 5,000 – 60,000 | Licensing, audits |

| DevOps & Hosting (1 year) | 5,000 – 30,000 | Cloud costs |

| Marketing & Launch | 10,000 – 60,000 | Go-to-market budget |

| Total | 155,000 – 650,000+ | Range for planning |

Note: Actual quotes vary; many UAE-focused estimates fall between AED ~88,000 and AED ~600,000 depending on scope. Use these ranges to plan and validate with developers.

From MVP to full launch, see what it really costs in the UAE market.

Calculate My Wallet CostAn MVP with primary flows (KYC, top-up, QR pay, P2P) can be released in about 4–6 months. A wallet with complete features like loyalty engines, AI expense analysis, merchant portals, and cross-border support can take 9–14+ months. Schedules vary with scope and team size. Industry estimates typically lay out these expected timelines.

Tokenization & PCI compliance, data encryption (in transit + at rest), secure key management (HSM), and WAF/CDN for protection.

Pen testing, vulnerability scanning, and security audits before launch and on a regular basis thereafter. Annual audits and insurance are planned for by many well-established digital wallet initiatives.

Cloud expenses escalate with user count and transaction volumes anticipate spikes and redundancy.

Prioritize core payment flows and core compliance to test product-market fit before investing in high-end features.

Flutter or React Native can save time and cost for multi-platform delivery while maintaining great UX.

Employ proven KYC, payment gateways, and fraud engines to save development time and reduce compliance burden.

Prioritize features that have a direct impact on activation and retention merchant discounts, loyalty programs, and top-up convenience.

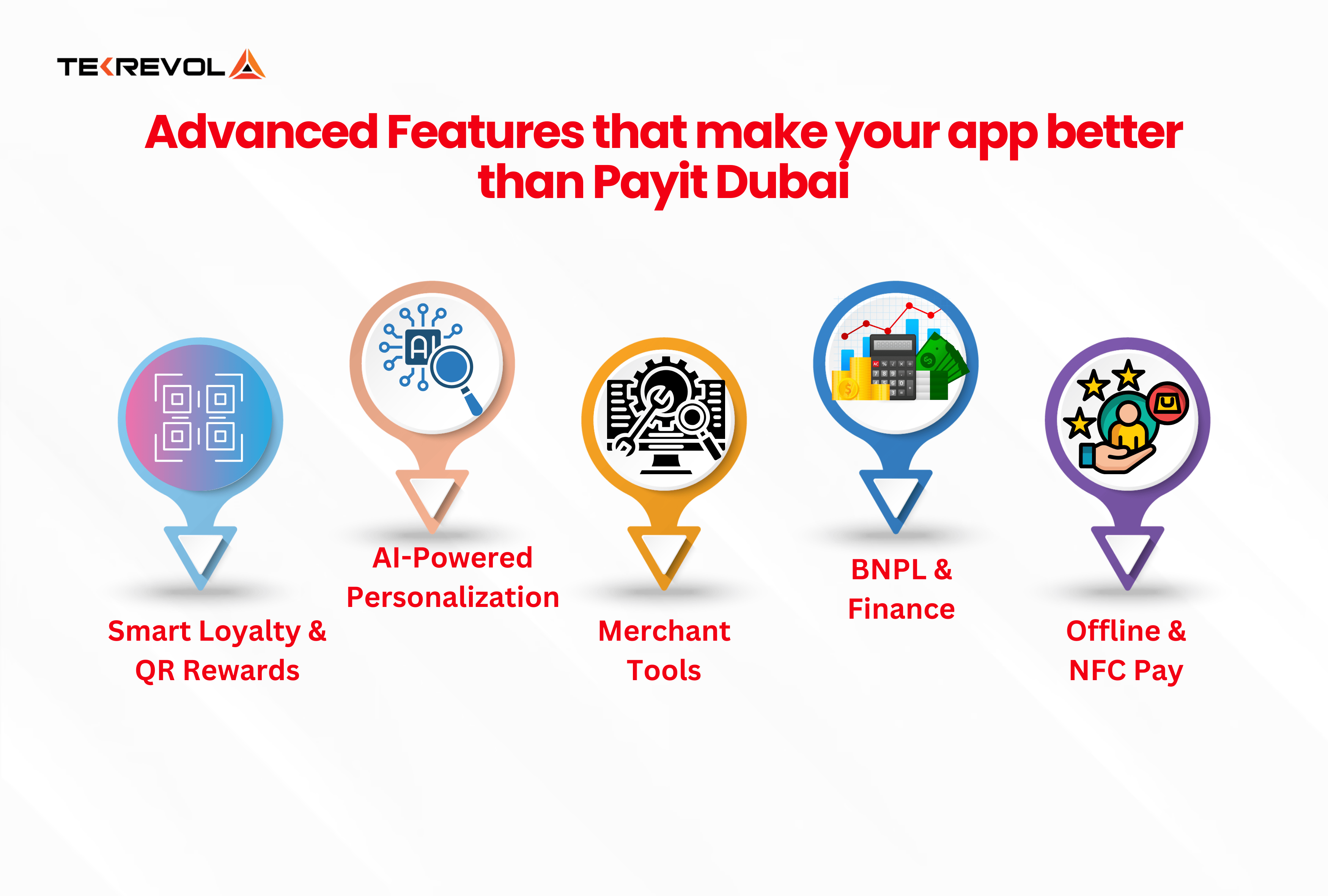

Envision a Lays cashback QR code-style campaign where users scan to get instant rewards add gamified cashback and targeted promotions to drive stickiness.

Provide personalized offers, spending insights, and bill reminders based on predictions to boost engagement.

Offer merchant dashboards, reconciliations, and quicker settlements to attract large vendors.

Introduce micro-loans or BNPL alternatives for buys, prudently under regulatory oversight.

Support NFC or offline QR modes for low-connectivity settings to expand acceptance.

Market players typically pair transaction revenue with merchant partnerships and value-added services to generate diversified income streams. The preliminary CAC (customer acquisition cost) from promotions and cashback benefits is offset by this mix.

Users are more likely to move their funds to a new wallet if the company has a solid reputation, is transparent, and has excellent customer service.

Regulatory Difficulties

Adhering to AML/KYC and local financial regulations can retard launches and incur costs.

Competing banks, telcos, and wallets already exist merchant incentives are vital but expensive.

Real money apps draw sophisticated fraud; invest early fraud detection and monitoring.

Reserve 10–30% of initial development expenditure for go-to-market (paid ads, merchant offers, PR, influencer promotions). Early-stage wallets tend to subsidize cashback substantially this is typical but must be modeled into the runway.

Balance organic (merchant partnerships, co-marketing, referral programs) with paid (grow fast) channels. In UAE markets, mall, telco, and UAE brand partnerships can drive higher LTV users.

Prefer those with existing wallet, banking, or payment experience they’ll understand the corner cases (reconciliations, disputes, PCI).

A web development partner who is well-versed in UAE compliance, local bank integrations, and government APIs will save you time and dollars.

Design + development + DevOps + security + post-launch support that stack is crucial to a money app.

Building a Payit app Dubai-style solution takes more than coding, it requires market knowledge, fintech expertise, and a reliable partner who understands UAE regulations. That’s where Tekrevol comes in.

We’ve helped startups and enterprises design secure, scalable, and user-friendly apps that stand out in a competitive market. Here’s how we as a custom mobile app development company do it:

With Tekrevol, you receive more than simply a Payit clone; you get a smarter, future-ready wallet designed specifically for UAE consumers and intended for long-term success.

Tekrevol helps you create Payit-style wallets with innovation, security, and growth in mind.

Start With Tekrevol

Founded in 2018, TekRevol is a trusted tech company delivering ISO 27001-certified digital solutions

Read MoreYes, a minimal MVP with core payments and QR/P2P can be in the lower band, but anticipate trade-offs on resilience, integrations, and long-term scalability. Always account for compliance and security before developing a Payit app.

Generally, 4–6 months for an MVP; full-fledged apps 9–14+ months based on integrations and features.

Yes, technically, but it requires merchant coordination, fraud regulations, and funds. Design the promotion mechanics and fraud protection prior to deployment.

Developing an app for a digital wallet usually ranges from AED 90,000–AED 550,000+ (around $50,000–$300,000). The actual cost varies based on features such as P2P transfers, QR code payments, loyalty points, and enhanced security. Those wallets aimed at digital wallet UAE users tend to have additional compliance checks, which contribute to the final price.

Although customers may download and use the Payit app for free, it makes money through premium features, transaction cuts, and merchant fees. If you’re wondering how much it would cost to create an app similar to Payit Dubai, you should budget between AED 200,000 and AED 600,000 for a complete solution that includes all of the services Payit now provides.

For AED 80,000 to AED 250,000, a payment app with the following essential features may be created: bank cards, QR payments, registration, and basic KYC. The budget can rise to AED 400,000+ by adding advanced modules like biometric login, cross-border payments, or AI-driven fraud detection. The more you wish your product to mimic the Payit app Dubai experience, the more investment you need.

While the AI landscape is constantly shifting, many providers are still relying on standard AI solutions that only check the boxes for automation and deployment. But meeting standards is not enough when you build your business future on artificial intelligence....

Read More

The mobile gaming industry is undergoing a major transformation, and so are the ways through which developers generate their revenue. Free-to-play games will dominate app stores by 2026, with ads taking over as the main source of revenue. The ability...

Read More

The mobile gaming industry has reached a point where building a great game is only half the battle. As 500,000 apps fight for a tiny slice of the share, mobile game marketing becomes the primary bottleneck for game growth rather...

Read MoreGet valuable consultation form our professionals to discuss your projects. We are here to help you with all of your queries.

Collaborate with us and become a trendsetter through our innovative approach.