In a world drowning in complex financial products and overwhelming data, managing wealth has become a modern-day struggle. Shockingly, 77% of people admit they feel lost when it comes to handling their investments and finances. This is the urgent problem wealth management apps are designed to solve.

If you want to build a wealth management application that solves real problems, helping users gain control and achieve financial peace of mind, there’s no better moment than now.

But building an app that truly empowers users, not just another confusing dashboard, is easier said than done.

In this blog, we’ll guide you through the essentials of building a successful personal asset management app, covering its key benefits, must-have features, the right technologies, the best wealth management apps, and what you can expect in terms of costs.

What is Wealth Management Software?

A wealth management application is a software that assists users in monitoring, managing, and increasing their finances, directly from their mobile phones. Such applications make intricate financial operations such as portfolio monitoring, investment tracking, setting objectives, and financial planning easy and simple.

The Rise of WealthTech Apps: Key Highlights

- Quick Market Expansion: The market for wealth management software is expected to grow to $1.57 billion in 2027.

- Increased Mobile Usage: 6 out of every 10 clients find it ideal to manage their finances using the mobile apps.

- Easy to Use & Accessible: Simple interfaces on new wealth management apps make it easy for customers to view their assets and make educated decisions anywhere.

- Digital Transformation: The growth of digital financial services and international mobile uptake stimulates growing demand for these apps.

To gain more insight into the evolving fintech landscape and the innovations shaping financial services, don’t miss our blog, “How Fintech is Reshaping the Future of Finance.”

How to Develop the Best Wealth Management App: The Complete Process

The key to building a great wealth management app is a simple, user-friendly, and technically powerful focus to deliver real value. The following is a checklist of how an application concept can be made into a hit product:

1. Understand Requirements and Set Goals

At this stage, extensive stakeholder discussions will define how the app will assist in advancing wealth management: through budgeting tools or integration with a financial advisor app-to ensure it solves the financial challenges of its users effectively.

- Identification of the Target Audience: align app strategies to achieve and accomplish the business goals, such as increasing user engagement or turning profits through subscriptions, or customer retention for the business.

- Feature Prioritization: Decide what features are optional and which ones have to be included; make sure the first release meets the most important user needs.

2. Perform consumer and market analysis.

Research is vital for testing your app concept and market fit. This entails:

- Competitor Analysis: Conduct an analysis of other expense tracking applications in order to find out what they lack, the features they have done best, and their shortcomings. This brings about creativity because there is a limited possibility of committing mistakes.

- Trend Identification: The ever-changing nature of financial technology calls for a close watch on trends such as generative AI in financial services, blockchain security, or social trading features.

- Gathering of User Feedback: Surveys, interviews, and focus groups of prospective users identify their pain areas, needs, and expectations.

3. Designing User Experience with Focus on Core Features

A great app balances simplicity with functionality. At this stage, outline and design the user interface and experience, keeping usability and engagement front and center.

Here’s a breakdown of essential features categorized by complexity:

| Core Features | Premium Features | Advanced Features |

| User Profile | Multi-factor Authentication | Biometric Authentication |

| Portfolio Tracking | Detailed Asset Allocation & Performance Metrics | Real-Time Market Updates |

| Financial Planning | Goal Setting | AI-Powered Personalized Advice |

| Notifications and Alerts | Account Aggregation | Push Notifications for Market Changes |

| Budget and Expense Tracking | Gamification | Robo-Advisory Services |

| Registration & Login | Expenses Categorization | Financial Coaching |

| Basic Asset Overview | Automated Rebalancing | Reporting and Analytics |

| Basic Alerts | Customizable Alerts Based on User Preferences | Goal-Based Financial Planning |

4. Design user experience and make wireframes

Creating a fluid user experience is crucial, particularly in finance, where complexity might overload users. This phase involves:

- User Journey Mapping: Map out every potential interaction a user could have with the app, from signing up through goal tracking to support. This covers all bases.

- Wireframing: Low-fidelity sketches or digital wireframes show which screens the app contains and what the navigation will be. This helps to see the design and operation of the app.

- Usability focus: Focus on simplicity and clarity so that the users can comprehend and are able to use features like investing tracking, budget creation, and notifications easily.

5. Frontend Development — Turning Designs into Reality

This move entails the translation of UI/UX designs into responsive and interactive screens. The ideal outcome is a smooth user interface that will operate flawlessly on whichever device or platform.

The areas of focus are:

- Responsive mobile and tablet-optimized layouts

- Interactive graphs and charts for portfolio analytics

- Seamless navigation and rapid loads

6. Backend Development

The backend powers your wealth management app by managing data, processing transactions, and ensuring security. Key focus areas include:

- Efficient data storage and management

- Integration with banks and financial data providers via APIs

- Implementation of business logic for portfolio tracking and analysis

- Strong security measures like encryption and secure authentication

- Scalability to handle growing user data and activity

7. Data Integration and Real-Time Synchronization

A wealth management application greatly relies on timely and accurate information. This process means connecting to:

- Financial Data Feeds: Linking to respected sources for stock prices, foreign exchange rates, news, and portfolio values.

- Account Synchronization: This allows the user to link various accounts so that balances and transactions are synchronized automatically.

- Notification System: Alerts could confirm a market update, a confirmatory transaction, or a goal progress update.

- Offline Support: Users can view some data offline where possible and sync automatically when they restore connectivity.

Real-time synchronizing allows users always to view their current portfolio value and market situation.

8. Enforce Security Controls

Financial information being highly sensitive, the security of it should never be an add-on:

- Data Encryption: Ensure that data that is not in use or transit is encrypted through strong encryption algorithms.

- Authentication Techniques: To avoid undesired access, apply a powerful password policy and multi-factor authentication (MFA).

- Compliance: The application must stick to specific financial and data privacy legislation such as GDPR, PCI DSS, or country-specific law.

- Frequent Audits: Carry out routine security audits and penetration testing so that vulnerabilities can be detected and eliminated early enough.

Robust security defends user confidence and shields against expensive breaches.

9. Test and Collect User Feedback

Testing is ongoing and complex:

- Functional Testing: Every feature must be tested against any external factors that could impact its performance.

- Performance Testing: Test the working of the application under heavy load and multiple concurrent users.

- Security Testing: Tests against vulnerability and the response of security mechanisms to various intrusion attempts.

- Usability Testing: Observe real users using the application to find where they experience pain and confusion.

- Bug Fixing and Refinement: Resolving issues promptly and refining as needed before release.

User feedback is golden in the creation of an app that really meets user expectations.

10. App Launch and Continuous Support

The final step in the process is release and maintenance for the app:

- App Store Submission: Prepare the app for submission to stores like Apple App Store and Google Play Store, in accordance with all rules.

- Marketing and Onboarding: Market the app and deliver clean onboarding, enabling new users to rapidly start running.

- Monitoring and Analytics: Look at user activity, performance, and usage to spot possibilities for improvement through monitoring and analytics.

- Regular Updates: Publish new feature upgrades, security fixes, and bug fixes depending on user feedback and market trends.

- Customer Support: Maintain customer satisfaction by resolving their problems quickly via phone, chat, or email.

Long-term consistent support ensures that the application remains relevant, safe, and competitive.

Looking to partner with experts for your Financial Advisor app development?

We have experience developing FinTech solutions and would be delighted to assist you in this endeavor.

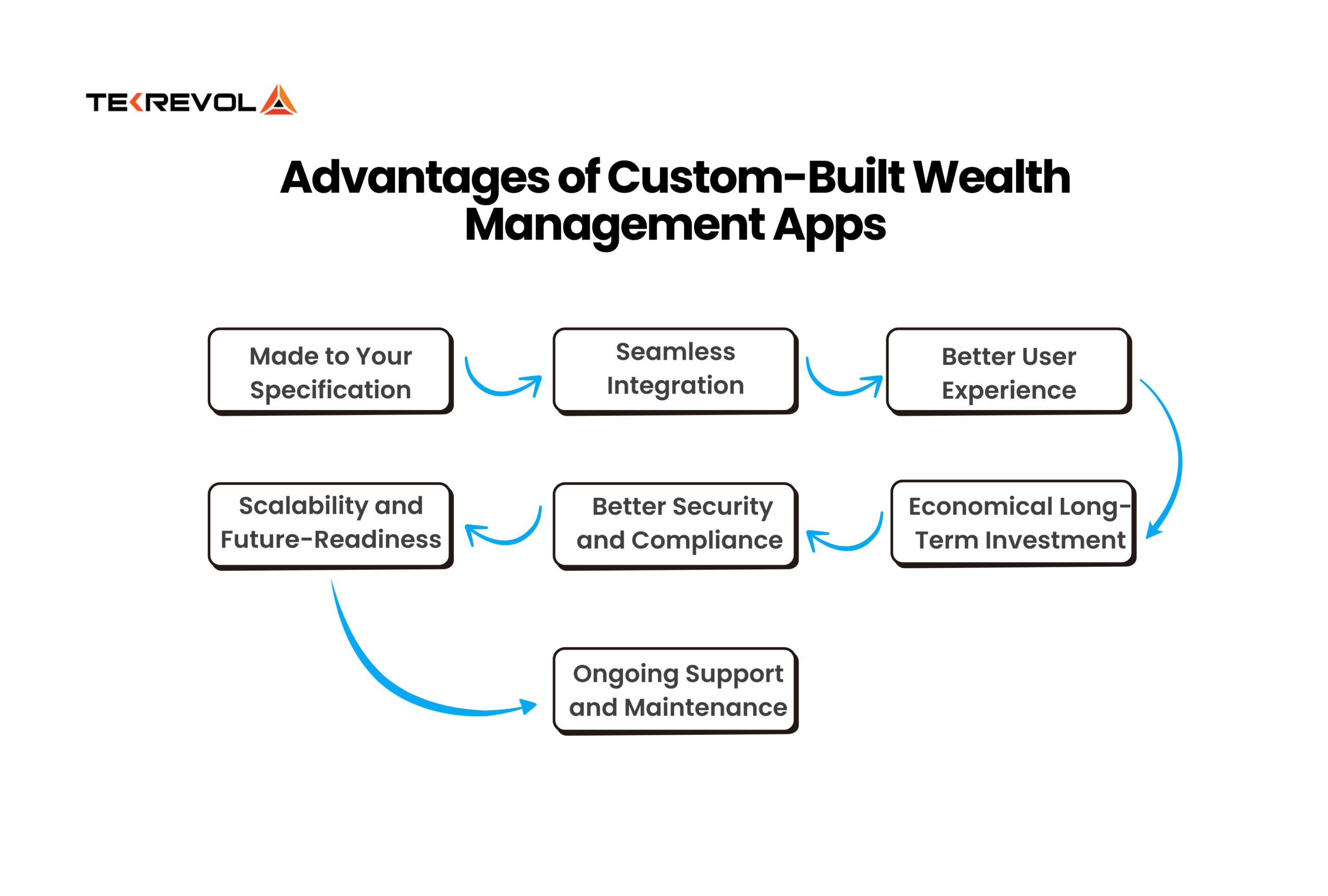

Let’s Connect!Advantages of Custom-Built Wealth Management Apps

If you haven’t started planning your wealth management app yet, now is the perfect time to consider a custom-built solution. Here’s why going custom could be the smartest move for your financial goals.

1. Made to Your Specification

Custom apps are created to work based on your particular business needs and objectives, so that you get exactly what is most crucial to you in the features. Under this personalized approach, you will not get unneeded add-ons or excessively complex functionality.

2. Seamless Integration

To ensure that your transactions are secure and your financial information is up to date, wealth management software safeguards current linkages with banks, payment gateways, and market data providers. This smooth connection allows you to manage everything by being on one place and not experience any inconveniences.

3. Better User Experience

Designed with ease of use in mind, these applications allow even beginners to navigate their finances without confusion. A clear layout, engaging visuals, and smooth interactions keep users interested and encourage them to continue using the app regularly.

4. Scalability and Future-Readiness

With solid technology foundations, there is a strong basis for customization apps to expand with your business. If you want more features or anticipate more users, your app can easily scale without slowing down or requiring a full rebuild.

5. Better Security and Compliance

Custom-developed solutions adhere to rigorous security standards and comply with industry regulations such as GDPR, KYC, AML, and PCI DSS to ensure your data security. This degree of safeguarding instills trust and confidence in you and your users.

6. Economical Long-Term Investment

While custom applications might cost more to start with, they pay for themselves in the long term by not having you spend money on unnecessary upgrades and features. You ultimately receive a solution tailored to your business objectives.

7. Ongoing Support and Maintenance

The custom app also includes access to continuous support, e.g., in the form of updates, bug fixing, and proactive monitoring to ensure that everything is running without any problems. This implies that you will never be in the dark in case of problems or when improvements are required.

How Much Does It Cost to Develop a Wealth Management App?

The cost for developing a personal finance app or personal asset management app varies greatly depending on the complexity of the app, its features, and the experience of the development team.

To provide you with a better understanding, here is an outline of estimated costs, so you can plan your budget and objectives more effectively.

| Aspect / Features | Basic App | Mid-Level App | Complex App (Enterprise) |

| App Complexity | $10,000 – $20,000 | $20,000 – $50,000 | $100,000+ |

| Platform | $5,000 – $10,000 | $15,000 – $30,000 | $50,000+ |

| UX|UI Design | $3,000 – $7,000 | $10,000 – $20,000 | $30,000+ |

| Backend Development | $5,000 – $15,000 | $25,000 – $50,000 | $100,000+ |

| Third-Party Integrations | $2,000 – $5,000 | $10,000 – $20,000 | $50,000+ |

| Security Features | $3,000 – $5,000 | $10,000 – $20,000 | $30,000 |

| Total Estimated Cost | $20,000 – $50,000 | $50,000 – $150,000 | $200,000+ |

Note: The above costs are rough estimates and can differ. These numbers provide a broad framework to guide you in the planning of your budget.

Planning your app budget?

Try our cost calculator and see your project’s estimate instantly!

Calculate Now!Best Wealth Management Apps to Watch in 2025

As there are different kinds of wealth management applications, such as financial planning apps, progressive wealth management tools, and financial advisor apps, users can choose solutions that best fit their needs.

Examining some of the best apps will help you see more clearly if you’re still not certain which wealth management app would best fit your needs. A brief summary of the best wealth management applications to evaluate in 2025 is:

| App Name | Best For | Key Features | Pricing Model |

| Empower | Comprehensive financial planning | Account linking, retirement planning, and fee analysis | Free, with optional advisor services |

| Betterment | Automated investing | Robo-advisor, portfolio management, risk assessment | Tiered fees based on assets managed |

| Mint | Budgeting & multiple accounts | Expense tracking, savings tips, bill alerts, and credit score | Free, ad-supported |

| Honeydue | Couples’ financial management | Joint budgets, shared accounts, expense tracking | Free, no monthly fees |

| Wealthfront | Simple automated investing | Automated portfolio management, tax strategies, and retirement planning | Management fees based on portfolio size |

Build Your Wealth Management App With TekRevol

As you are aware, wealth management apps are fast turning into one of the most promising areas in FinTech. More individuals than ever desire intelligent, simple methods of gaining control over their money. If you’re intending to create a wealth management app, you’re entering a rapidly expanding market with much potential.

TekRevol, as a top FinTech app development company, is here to make your dream a reality. With extensive industry know-how and a customer-centric approach, we build robust, secure, and easy-to-use apps that enable users to manage their wealth comfortably and effortlessly.

Ready to bring your wealth management app idea to life?

Let’s collaborate to build a secure, user-friendly solution that truly empowers your users.

Book A FREE Call Now

![How Does Hybrid App Monetization Work For Houston [Strategies, Models & Trends]](https://d3r5yd0374231.cloudfront.net/images-tek/uploads/2026/02/Hybrid-App-Monetization.jpg)