“There are three kinds of lies: lies, damned lies, and statistics.” — Mark Twain.

But if Twain had lived to see blockchain statistics, he might’ve added: “…and then there’s crypto charts at 3 a.m.”

Today, blockchain isn’t just trending anymore; it’s transforming everything from banking and identity to bananas and billion-dollar art. But behind all the buzzwords and bold claims lies one the numbers are not just impressive, but they’re borderline sci-fi.

Whether you’re a developer, investor, startup founder, or someone who once accidentally sent ETH to the wrong wallet (we won’t judge), this guide is built to make sense of it all.

Packed with jaw-dropping numbers, real-world use cases, and a few jokes to keep the blockchain blues away, we’re diving deep into what blockchain is, how blockchain works, and, most importantly, why it’s reshaping industries in 2025.

So let’s unpack the blockchain data and trends defining 2026.

Market Size And Growth Trends

Global Market Size (2025)

In 2025, the global blockchain technology market hit a solid USD 31.3 billion, not bad, right? But here’s the mic-drop: it’s projected to explode, with a jaw-dropping 90.1% CAGR between 2025–2030, reaching a mind-blowing USD 1.43 trillion by 2030. If that doesn’t explain blockchain growth, we don’t know what does.

For a slightly gentler (but still explosive) projection, Market.us reports the broader blockchain market rising from USD 20.1 billion in 2024 to USD 248.9 billion by 2029, clocking in at a respectable 65.5% CAGR.

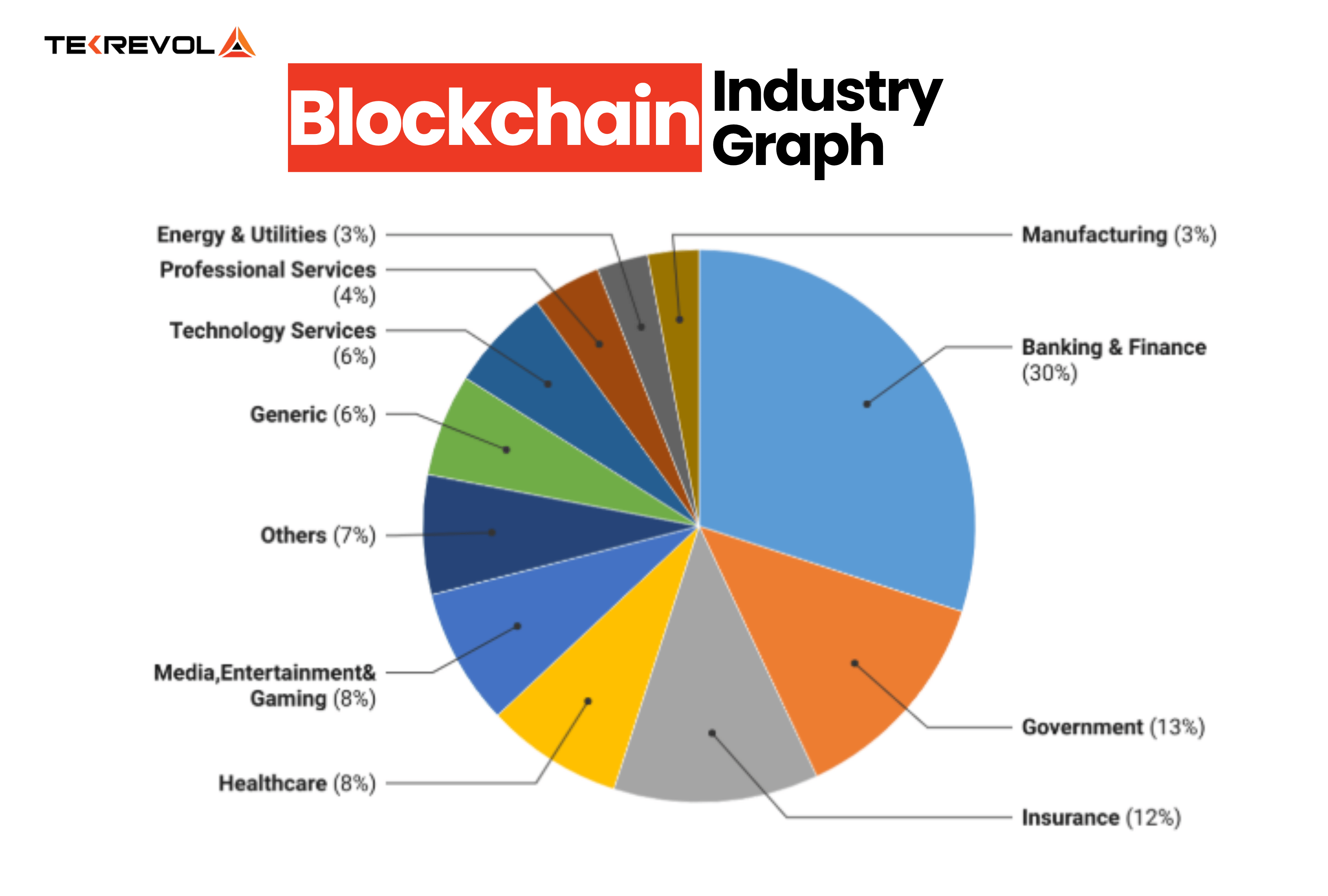

Industry Specific Breakdown

Here’s where it gets interesting: Blockchain technology isn’t a single-purpose tool; it’s a Swiss Army knife:

- Financial Services: The heavy lifter. Between payments, trade finance, cross-border remittances, and DeFi, this sector may claim around 30–35% of total market revenue.

- Healthcare: Steady but strong, USD 214.9 billion expected by 2030 in blockchain healthcare tech, growing at 63.3% CAGR. You know why? Tamper-proof patient records and drug traceability, anyone?

- Supply Chain: Transparency lovers, take note, traceability tech, anti-fraud measures, and inventory tracking are fueling massive blockchain activity.

- Gaming & NFTs: From USD 4.6 billion (2022) to USD 65.7 billion by 2027, recording a phenomenal 70.3% CAGR in blockchain gaming. Plus, Fortune projects the gaming side rocketing from USD 154 billion (2025) to USD 615 billion by 2030 (21.8% CAGR)

Regional Snapshot: Who’s Leading the Charge?

- North America: Reigns supreme, about 37–42% of global blockchain market share, and still growing strong.

- Asia-Pacific: A dark horse that’s turning heads, China, India, and South Korea are fueling adoption in both public and private blockchain networks.

- Europe: Backed by strong regulation, especially with MiCA and green-energy blockchain.

- This tech is outgrowing your last 5 investments combined - it's time for you to try now!

How The Financial Sector Adopted Blockchain Technology?

Banks and fintechs aren’t just testing the water with blockchain technology; they’re cannonballing in.

Here’s how the finance world is embracing it, complete with stats and some light on it.

Bank & Institution Engagement

By 2025, roughly 90% of US and European banks had started exploring blockchain’s potential, from streamlined payments to raid-proof recordkeeping

And get this: 74% of tech-savvy exec teams believe blockchain technology holds a massive business opportunity.

Financial institutions alone dropped USD 552 million on blockchain pilot projects, and that’s just the tip of the iceberg.

| Metric | Value | Insight |

| Banks exploring blockchain | ~90% | Banks and big financial institutions are fully onboard |

| Exec confidence | 74% | Leadership sees real blockchain growth potential |

| Industry spend | USD 552 m | Serious investment in blockchain activity |

| CeFi loans (end 2024) | USD 11.2 b | Centralized crypto lending market size in the top platforms |

| DeFi borrowing jumps | +959% (since 2022) to USD 19.1 b | DeFi’s explosive rise takes trends mainstream |

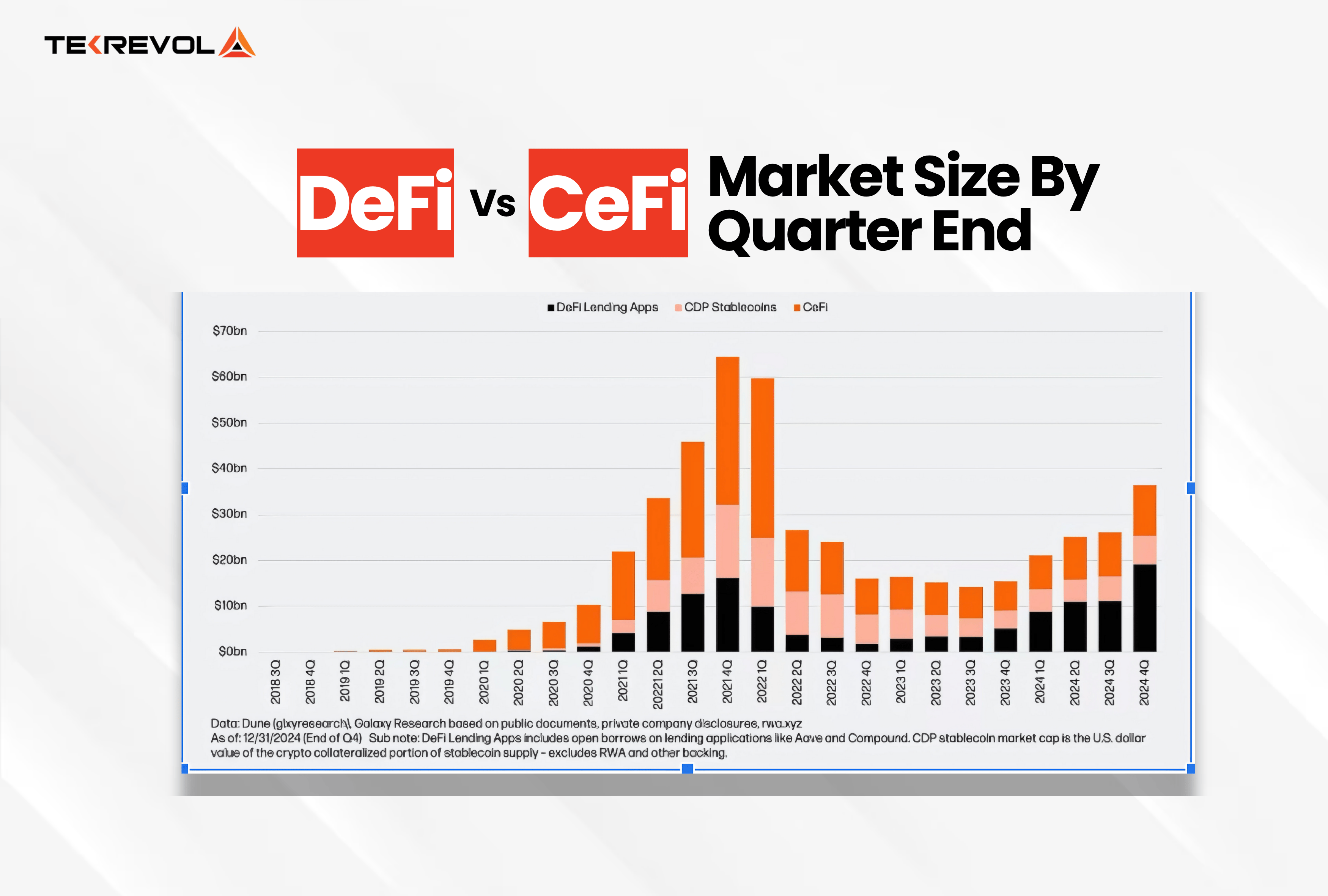

CeFi vs DeFi: Story in Two Words

- CeFi (Centralized Finance): Still gouty, chatty bankers. CeFi lending was around USD 11.2 billion by late 2024, with giants like Tether, Galaxy, and Ledn controlling ~90% of that pie.

- DeFi (Decentralized Finance): The feisty underdog. Its total borrowing has exploded by 959% since 2022, hitting USD 19.1 billion across 20 protocols on 12 blockchains.

DeFi Rebound & Financial Interplay

Q1 of 2025 saw DeFi rebound, borrowing shot up 30% from the slump earlier in the year. Aave, an Ethereum-based lending protocol, held a dominant 45% market share in DeFi as of May 2025, with TVL (Total Value Locked) of USD 25.41 billion, which is serious financial blockchain activity.

Meanwhile, Bitcoin DeFi is maturing too: Rootstock layer-2 now secures 81% of Bitcoin’s hashrate, giving Devs confidence in smart contracts on Bitcoin networks.

Why This Matters?

- Efficiency & cost savings: Blockchain slashes intermediaries, speeds up cross-border remittance, and tracks payments in a tidy and secure manner.

- Institutional hedge: DeFi’s resurgence and CeFi’s strong players mean financial institutions aren’t ignoring blockchain statistics; they’re leaning in.

- Track crypto transactions: With more giants using blockchain networks, there’s more transparency in tracking crypto transaction flows, huge for audit, compliance, and tech-driven finance.

Blockchain Usage & Demographics

Here, we’ll jump straight into the people behind the blockchain data, exploring blockchain activity, user profiles, and who’s really using blockchain technology.

Wallets & User Base

There’s no single official count for blockchain wallets (because, well, one person can own many), but the scale is jaw-dropping:

| Metric | Value |

| Active blockchain wallets (2025) | ~83 million |

| Bitcoin-specific wallets | ~85 million on Blockchain.com; Coinbase claims ~108 million more |

| Total cryptocurrency users | 560 million (≈6.8% of world pop.) by 2024; expected to hit 861 million in 2025 |

Here’s a fun stat: more people have crypto wallets than hold American Express cards. That’s a power move for blockchain growth!

Demographics By Age, Gender, And Income

Who’s actually engaging with the blockchain network and diving into blockchain activity?

- Age: Millennials lead the pack, around 34% of crypto owners are 25–34-year-olds. According to JPMorgan, 20% of millennials, 11% of Gen X, and just 4% of Boomers use crypto.

- Gender: Roughly 61% male, 39% female among global crypto holders; in the U.S., men are nearly 3x more likely than women to use crypto (11% vs 4%).

- Income & Education: Higher-income individuals show more crypto involvement: transfers by men average $1,000 vs $400 for women. JPMorgan also notes that crypto users tend to be college-educated.

Geographic Usage Patterns

Here’s the global landscape of blockchain technology adoption:

| Region | Users/Owners | Notable Stats |

| North America | 57–65 million expected in 2025 | Largest trading volume |

| Europe | ~31 million crypto users | 17.5% of global volume |

| Asia | ~263 million users, led by India & China | 32% of global digital asset dev |

| Latin America | Fastest growth: +117% YoY, ~9% of volume | ~24 million users |

| Africa | 38 million, heavy on small-value P2P | Nigeria tops with ~6% holding crypto |

Why Demographics Matter?

- Targeting & personalization: Brands and platforms know how to woo millennials, educated users, and regions like Asia & Latin America for deeper engagement.

- Education gap: With 70% of crypto users male and heavily educated, there’s a major opportunity to onboard women & older users safely.

- Trust issues: In the U.S., about 63% have low confidence in crypto’s reliability, especially older adults and women.

Which Industry Is Using The Power Of Blockchain?

Now that you’ve seen the overall blockchain statistics landscape, let’s zoom in on specific industries, like a blockchain detective on a data-driven mission.

We’ll explore blockchain technology applications in Healthcare, Supply Chain, and Gaming/NFTs with tables to keep things crystal clear and engaging.

Healthcare: Keeping Patients & Data Healthy

Blockchain isn’t just for crypto; it’s also revolutionizing healthcare by securing patient records, streamlining claims, and tracking drug authenticity.

| Metric | Value | Insight |

| Market size (2025) | USD 7.04 billion | Rough baseline of blockchain growth in healthcare |

| 2024 Market | USD 831.5 million | Early signs of explosive adoption |

| Forecast (2030) | USD 214.9 billion @63.3% CAGR | Blockchain’s prescription for future growth |

| Forecast (2034) | USD 193.4 billion @35.1% CAGR | Adjusted forecast amid regulatory push |

What’s going on here? From what blockchain technology is, to how blockchain works, it’s clear healthcare organizations are in full-on adoption mode. Imagine tamper-proof patient records, bulletproof drug supply tracing, and almost zero billing fraud, yes, please.

That’s exactly what’s driving this blockchain growth.

Supply Chain: From Farm to Table (and Beyond)

No more “half the shipment is missing.” With blockchain, traceability gets real. Consumers and regulators demand answers, and transparency sells.

| Metric | Value |

| 2025 Market | USD 2.2 billion |

| 2032 Forecast | USD 25.2 billion |

| CAGR | ~31% |

Why does it matter?

From Prada tagging authenticity to avoid counterfeits, to farms logging produce journeys, blockchain charts turn bits into verified truths. This is full-blown blockchain activity, not just hype.

Gaming & NFTs: When Pixels Become Paychecks

Want in-game items you actually own, or resell for real cash? Yep, that’s blockchain flex in gaming and NFTs.

| Segment | 2025 Size | CAGR | Forecast |

| Gaming NFT | USD 4.8 billion @24.8% (2025–34) | 24.8% | USD 44.1 billion by 2034 |

| Blockchain Gaming | USD 128.6 billion (2022); USD 154.5 billion (2023) | 21.8% | USD 614.9 billion by 2030 |

| NFT Gaming | USD 540 billion (2025) to USD 1.08 trillion (2030) @14.8% | 14.8% | USD 1.08 trillion |

Talk about leveling up: the blockchain gaming market is already bigger than many countries’ GDPs. When you see “play-to-earn” games and resellable NFT skins, that’s the blockchain network turning digital creativity into cold, hard cash.

Wondering what industries blockchain hasn’t crashed yet?

From healthcare to handbags, blockchain is shaking up every sector. Join the disruption before your competitors do.

Claim Free Consultation Now!

Blockchain Infrastructure: Tech Fundamentals

Alright, time to pop the hood and see what’s powering this beast. We’ve talked about the what and the who, but now let’s get into the how.

Because understanding how blockchain works is like understanding how your favorite pizza is made, it makes you appreciate it even more.

Types of Blockchains: One Size Doesn’t Fit All

These distinctions aren’t just academic; they directly impact blockchain trends, especially around scalability and privacy.

- You’ve got your public blockchains (like Bitcoin and Ethereum), which are open to anyone and everyone, no bouncer at the door.

- Then there are private blockchains, where only a few trusted entities can get in (think VIP club).

- Consortium blockchains fall somewhere in the middle, often used by banks or enterprises for secure transactions.

- Finally, hybrid blockchains combine the best of both worlds.

Data Storage: Not Just a Fancy Spreadsheet

At its core, blockchain is a distributed ledger. Picture a super nerdy Google Sheet, but instead of just one owner, every participant in the blockchain network holds a copy. Data is stored in “blocks,” which are chained together (hence the name, clever, right?).

Each block contains a timestamp, transaction data, and a cryptographic hash of the previous block. That makes it tamper-proof and a dream for those wanting to track crypto transaction history securely.

Efficiency Metrics & Infrastructure Stats

Now, if you’re a fan of blockchain statistics (who isn’t?), you’ll love this: Ethereum averages around 1.5 million transactions per day, while Solana handles 65,000+ transactions per second (yes, per second!). These infrastructure stats aren’t just flexes, they’re key indicators of real-world blockchain activity.

So next time someone asks, “What is blockchain and why’s everyone obsessed with it?”, you can hit them with both tech specs and a smirk.

Security, Crime & Regulatory Trends

Let’s be honest, blockchain technology might be a genius-level innovation, but it’s no stranger to its shady alleyways. From billion-dollar breaches to fast-evolving regulations, the numbers paint a vivid picture.

So buckle up, we’re diving into the hard-hitting blockchain statistics around crime, security, and the legal lines keeping it all (hopefully) in check.

-

Blockchain Isn’t Unhackable

Contrary to popular belief, how blockchain works doesn’t make it invincible. It’s decentralized, yes. Transparent, sure. But secure? Not always.

| Incident Type | 2025 Data Snapshot | What It Means |

| Total stolen via hacks | $2.1 billion (YTD) | A 3x increase over 2024 levels |

| Smart contract exploits | $953 million in 2024 | Often caused by poor access controls |

| Exchange & wallet attacks | Bybit lost $1.5 billion | Human error + phishing = bad news |

That transparency that allows you to track crypto transaction activity? It also means cybercriminals have a clear window into wallet behavior. And they’re using it to drain wallets, exploit contract vulnerabilities, and disappear faster than your last paycheck.

-

Smart Contracts:

Smart contracts are the engine of many blockchain apps, but one bad line of code and, boom, millions gone.

- In 2025 alone, smart contract vulnerabilities accounted for over 40% of all blockchain-related financial losses.

- Most breaches? Caused by bad logic, unaudited code, or oracle manipulation.

These aren’t minor bugs. They’re massive roadblocks to blockchain adoption, especially when you’re dealing with multi-million dollar DeFi protocols.

-

Regulations

While the Wild West phase of crypto is fading, regulators are still learning to ride the blockchain bronco.

| Regulation | Region | Purpose |

| MiCA | EU | Unified crypto regulation across Europe |

| NCET (DOJ) | USA | Special crypto crime task force |

| FATF travel rule | Global | Tracking wallet-to-wallet movement |

Governments are realizing that blockchain statistics, especially around crime and tax evasion, are just too big to ignore.

The ability to track crypto transactions is being weaponized for good, with blockchain analytics firms partnering with enforcement to trace illicit funds.

What do These Trends Mean for Blockchain’s Future?

The takeaway here? What is the purpose of blockchain technology if not to bring security and accountability? But that only works if users, coders, and lawmakers all evolve together.

The good news? Despite the $40+ billion in illicit activity tied to blockchain over the past few years, the percentage of criminal use has decreased year over year.

Why? Because the system works, it just needs oversight and better infrastructure. And guess what? That’s exactly what the latest blockchain trends are building toward.

Use Cases & Real‑World Deployments

Sure, blockchain started as Bitcoin’s sidekick, but it’s grown into the MVP of enterprise innovation. From voting booths to global shipping ports, real-world use cases are exploding across industries.

These aren’t hypothetical scenarios; these are working models solving real problems, powered by the same decentralized tech that tracks your favorite dog-themed coin.

Let’s unpack some of the most impactful, data-backed applications of blockchain technology, complete with the blockchain statistics to prove this isn’t hype, it’s happening.

Cross-Border Payments

If you’ve ever sent money overseas, you know the pain: fees, delays, currency conversions, and unexplained “handling” costs. Blockchain fixes all that.

Companies like Ripple, Stellar, and JP Morgan’s Onyx are already running blockchain networks that settle cross-border payments in seconds, not days.

- RippleNet alone connects 300+ financial institutions in over 45 countries, enabling instant settlements.

- Blockchain reduces remittance costs by up to 60%, according to World Bank estimates.

- The blockchain-based remittance market is projected to hit $156 billion by 2026.

For emerging economies, this isn’t just convenience, it’s lifeblood.

Digital Identity And E-Governance

Ask Estonia how blockchain technology can change a country; it’s been using blockchain for e-governance since 2008. And now?

- Over 98% of Estonians have blockchain-secured digital IDs.

- India’s Aadhaar 2.0 is exploring blockchain to secure the identity of 1.4 billion citizens.

- In Sierra Leone, blockchain was used in elections to ensure transparent vote tallying.

The power here? Immutability. Once data is stored on a blockchain, it can’t be changed, not even by your least favorite politician.

That’s how blockchain works, and why it’s trusted for voting, land titles, and public record-keeping.

Web3, Metaverse, and Social Ownership

Say goodbye to rented likes and algorithm games. In Web3, users own their data.

- Platforms like Lens Protocol, Mastodon, and Farcaster are enabling decentralized social networks where your content, followers, and even username live on-chain.

- Virtual land sales on platforms like Decentraland and The Sandbox crossed $1.9 billion in 2023, up from $500M in 2021.

- In Web3, digital identity is verified through wallets, and assets are transferred peer-to-peer, with no middlemen, no logins stolen.

Web3 isn’t just a trend; it’s a restructuring of internet ownership, powered by open blockchain networks and fueled by smart contracts.

Enterprise & Supply Chain Adoption

Yes, blockchain is glamorous in crypto, but it’s also a logistics hero.

- IBM and Maersk’s TradeLens recorded 30 million+ container shipments before retiring in 2022, proving that blockchain can manage large-scale global logistics.

- Walmart uses blockchain to track mangoes from farm to shelf in 2.2 seconds (down from 7 days pre-blockchain).

- The global blockchain supply chain market is expected to reach $25 billion by 2032.

This is the part where blockchain statistics stop being theoretical and become measurable outcomes, faster delivery, fewer fraud cases, and cleaner audits.

- Still think blockchain is just a buzzword?

- Witness how real businesses, real governments, and real people are using blockchain.

Investment, Funding & Corporate Involvement

Blockchain isn’t just a tech trend; it’s a full-on financial ecosystem attracting serious dollars.

From venture capital to corporate cash and unicorn valuations, the blockchain statistics here verify that this revolution isn’t just theoretical, it’s capital-backed and booming.

Q4 2025 VC & Crypto Funding

In Q4 2025, startups in the crypto and blockchain technology space raised a massive USD 3.8 billion across 220 deals, more than double Q4 2024 and nearly triple Q1 2024 levels.

Hold on, one deal alone (Binance’s USD 2 billion raise) nearly overshadowed the whole sector. But even without it, project-level investment reached USD 1.8 billion, a clear signal that capital is flowing into foundational infrastructure, not just tokens.

Funding Breakdown Table

| Category | Q4 2025 Total | Share of VC Activity | Notes |

| Crypto & blockchain | USD 3.8 b | – | 138% QoQ jump |

| Binance mega-round | USD 2 b | – | Largest VC deal in crypto history |

| Infrastructure & DeFi | USD 1.8 b | ~60 % of the total | Excluding the Binance round |

Blockchain Unicorns: Privately Valued Powerhouses

Unicorns, startups valued over USD 1 billion, are reshaping the ecosystem. As of April 2025:

- There are 1,407 unicorns globally.

- Over 17% (≈240) are blockchain or crypto-related

That’s nearly one in six unicorns backed by blockchain technology, not hype.

Top Investors & Corporate Players

Blockchain is attracting prominent backers and corporates alike:

- Tradeweb teamed up with Goldman Sachs and others in the Canton public‑permissioned blockchain, part of a USD 47 million raise for tokenizing assets.

- Accolade Partners closed a USD 202 million “fund‑of‑funds” targeting blockchain, citing over 500 crypto-focused VC funds.

- Tritemius Capital launched a €21 million early-stage web3 fund in Spain, supporting startups across Europe and LatAm with seed-to-Series A funding.

Why This Capital Matters for Blockchain Growth?

- Trackable investment trends: Seeing blockchain statistics like “USD 3.8B raised” proves motion, not marketing fluff.

- Infrastructural bets: With Binance excluded, focus sharpens on DeFi, tokenization, supply chain, and core tech, chipping off the hype block.

- Corporate validation: When Tradeweb and Goldman Sachs invest heavily, blockchain moves beyond experimental to essential infrastructure.

Future Outlook & Opportunities

The big question now is: where does blockchain technology go from here? If you’re hoping the future looks like a sci-fi movie with decentralized finance hubs orbiting the moon. Well, you’re not totally off.

But back here on Earth, the future of blockchain is full of opportunity and challenges.

Let’s unpack the blockchain statistics and blockchain trends that point to what’s coming next.

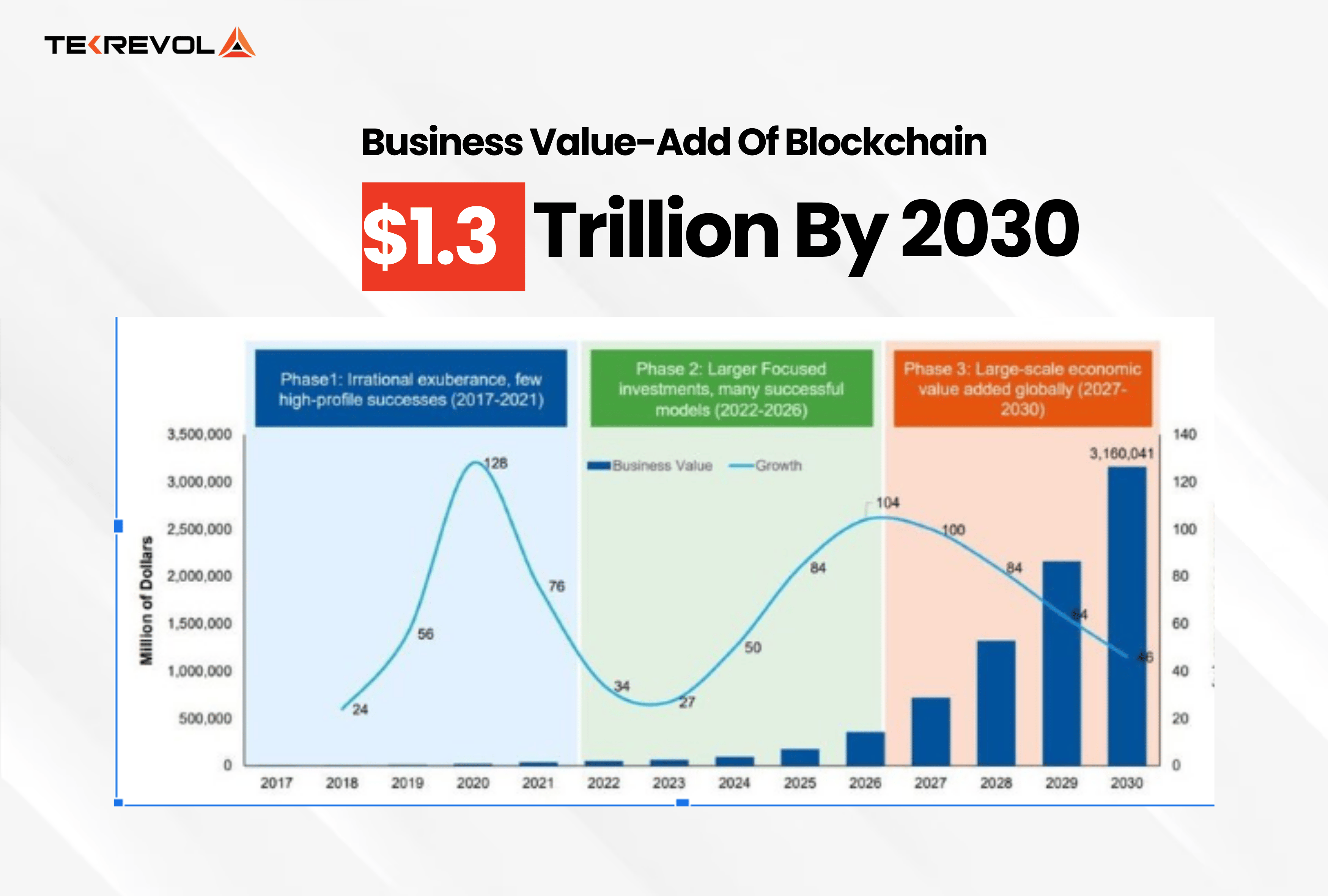

Forecasting Blockchain’s Global Economic Impact

According to PwC, blockchain could add $1.76 trillion to global GDP by 2030, driven by increased efficiency, transparency, and fraud reduction across sectors. That’s not just “crypto bro” optimism; that’s serious macroeconomic potential.

Here are the top contributing use cases:

- Provenance & supply chain transparency: $962 billion

- Payments and financial infrastructure: $433 billion

- Identity & credentials: $224 billion

- Contract and dispute resolution: $73 billion

- Customer engagement: $54 billion

These forecasts aren’t pie in the sky; they’re backed by growing blockchain networks and enterprise investment that prove the real-world viability of these use cases.

Emerging Tech Trends: What’s Next?

Several bleeding-edge developments are shaping the future of blockchain technology:

- Layer-2 scaling solutions like Arbitrum and Optimism are dramatically reducing fees and speeding up transactions on Ethereum, creating room for broader adoption.

- Interoperability protocols such as Polkadot and Cosmos are allowing different chains to talk to each other, expanding what’s possible.

- AI x Blockchain integrations are beginning to surface, offering tamper-proof AI model verification and decentralized model marketplaces.

- Quantum-resistant blockchains are being developed to future-proof crypto infrastructure against quantum computing threats.

These innovations are helping to answer: how does blockchain work in tomorrow’s landscape?

Opportunity Awaits

So, what is the purpose of blockchain technology in the long term? It’s to power a more transparent, efficient, and decentralized world, from how we track crypto transactions to how we vote, shop, and build companies.

And the best part? We’re still early.

If you’re reading this, you’re already ahead of the curve. The blockchain of tomorrow will likely look very different, but thanks to these blockchain trends, stats, and innovations, we can say one thing for sure:

This ride? It’s just getting started.

Witness Blockchain Magic With TekRevol!

So, we’ve crunched the numbers, decoded the trends, and walked through real-world applications that prove blockchain technology is no longer a fringe idea; it’s the foundation of the next digital era.

From blockchain statistics showing trillion-dollar growth, to everyday applications in finance, healthcare, identity, and even social platforms, one thing is clear: the opportunities are massive, but they require the right partner to bring them to life.

That’s where Tekrevol comes in.

We’re not just fans of the blockchain revolution, we’re building it. Whether you’re a startup looking to launch the next big Web3 app, an enterprise modernizing your infrastructure, or a government body aiming to secure digital identity, Tekrevol offers full-spectrum blockchain solutions that make your vision a reality.

- Got a bold idea but no dev team to make it real?

- TekRevol turns blockchain buzzwords into actual breakthroughs that are ready for launch.