Have you ever wondered why the cloud market will have the most impact on the digital economy in 2025? Well, the cloud is the main hub of today’s era. Cloud market share statistics globally reveal cloud infrastructure spend hit just shy of $99 billion in Q4 2025, growing 25% year-over-year. Revenues each year are likely to cross $400 billion, making cloud computing the foundation of the modernization of enterprises and transformation through AI.

It should come as little surprise, then, to hear these numbers announce two key trends: consolidation towards the big cloud service providers and all-time growth driven by AI, and specifically generative and data-intensive workloads. Understanding cloud market share is not merely an analytical exercise; it defines vendor strategy, business model, and innovation roadmapping.

For CTOs, architects, and business executives, the question has long stopped being “To the cloud or not to the cloud” but now becomes, “How should our cloud provider market share decisions catalyze innovation and ROI within an AI-enabled digital economy?”

The 2025 cloud share report encapsulates the latest data, worldwide spend trends, geo-specific trends, and real-world architectures, providing actionable insights that a professional cloud application development company can leverage to optimize app performance, scalability, and integration in the cloud ecosystem.

What Is the Current State of the Global Cloud Market Share?

The global cloud market share distribution in 2025 reveals a mature yet highly dynamic industry characterized by sustained growth and increasing consolidation. The cloud computing market generated $752.44 billion in revenue in 2025 and is forecast to reach $2.39 trillion by 2030. This remarkable trajectory underscores why understanding cloud market share has become imperative for business strategy.

The Big Three Cloud Providers: Competitive Analysis

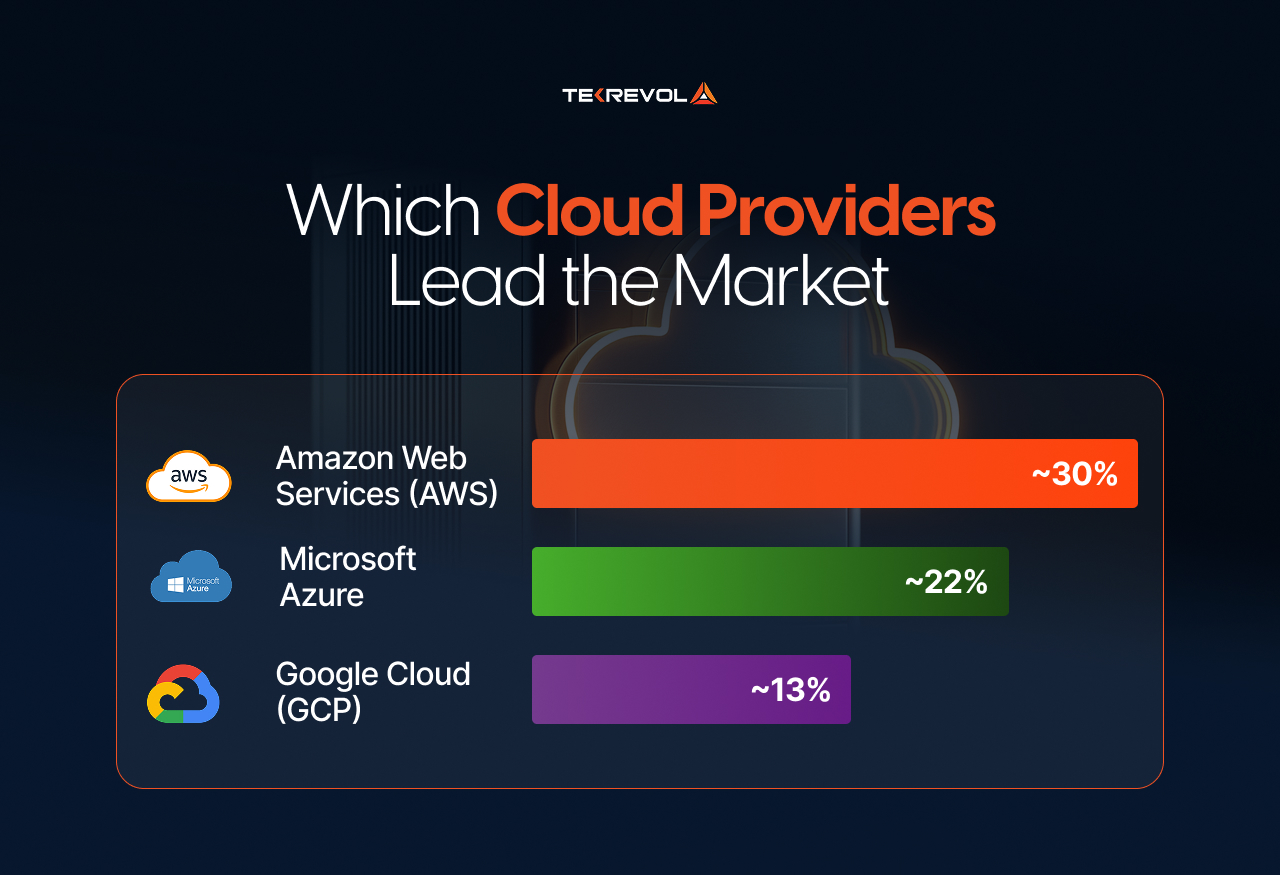

When considering the market share of cloud providers, three companies are definitely above the rest. According to Statista, AWS market share in Q4 2025. In Q4 2025, AWS had a whopping 30% of the total cloud infrastructure market, which is the estimated size and growth trajectory in the future as well. Microsoft Azure has a market share of 20%, while Google Cloud has a market share of around 13%.

With these three cloud providers accounting for the largest share of the market, it is clear that there are significant barriers to entry in the hyperscale cloud business, such as immense capital costs for data center infrastructure assets, global network reach, and a complement of services. While the top three own the market, everyone else is “stuck in the low single digits” of market share, with companies like Oracle, for example, scraping along and emerging players CoreWeave taking anything beyond going to AWS, Google Cloud, or Azure.

Cloud Computing Market Share Analysis

The cloud market share landscape is not set in stone, but rather extremely fluid. According to Statista, global cloud infrastructure service spending grew by more than $20 billion in 2025 from the same quarter a year earlier for 25% year-over-year growth. And this growth rate has, in fact, re-accelerated over the last few quarters, largely owing to AI and the extreme level of computing that comes along with generative workloads.

The Amazon Web Services market share, although still the largest, is increasingly being chased by Microsoft and Google, whose markets are growing faster and are slowly eating into the lead. According to N2WS’ public cloud market share numbers, AWS, Azure, and Google Cloud now command 66-71% of the public cloud infrastructure market compared to 65% around 2025. This growing concentration would indicate that mid-tier suppliers are struggling to compete on a scale.

Market Value and Revenue Projections

The economic stakes in the battle for share of the cloud market are vast. Global spend on public cloud by end users will be $723.4 billion in 2025, an increase of 21.7% from $595.7 billion this year, Brightlio says. “In the long term, it could be projected that global cloud services revenue might reach $1.614 trillion by 2030”.

The IaaS (Infrastructure as a Service) market is the most lucrative and also fastest fastest-growing segment in cloud computing. IaaS is expected to grow faster than any other cloud service model through 2030. This growth is propelled by organizations migrating their legacy applications, containerizing, and running AI/ML workloads that are demanding flexible, scalable compute.

Cloud Market Share by Region

The worldwide market share for cloud is dominated by North America: By 2025, 39% of all global cloud revenue is expected to hail from North America, according to Grand View Research. Only in the U.S. would public cloud revenues totaling an estimated range of $457,71 billion between 2015 and 2025 (its largest single-country market), according to Statista.

In the meantime, the emerging markets are booming even more. Cloud computing will be the fastest-growing technology application in India between 2025-2030, with cloud demand experiencing significant growth across the sub-continent, thanks to a combination of digital transformation projects & government initiatives. The Asia Pacific region as a whole is also growing explosively, and cloud providers are fighting for market share in countries like China, Japan, Singapore, and Indonesia.

Ready to Harness AI-Driven Cloud Innovation?

TekRevol blends intelligence and scalability for real results.

Connect with Our Cloud InnovatorsGlobal Cloud Provider Market Share (2026)

| Cloud Provider | Market Share (Q2 2025) | 2024 Market Share | Year-over-Year Growth | Key Strengths |

| Amazon Web Services (AWS) | 30% | 31% | +12% | Scale, ecosystem depth, enterprise reliability |

| Microsoft Azure | 20% | 18% | +18% | Hybrid cloud, enterprise integration, global reach |

| Google Cloud Platform (GCP) | 13% | 11% | +20% | AI/ML innovation, data analytics, Kubernetes leadership |

| Alibaba Cloud | 6% | 6% | +10% | APAC leadership, cost efficiency |

| Oracle Cloud | 2% | 2% | +8% | Database strength, enterprise software integration |

| IBM Cloud & Others | 3% | 4% | +6% | Hybrid/multi-cloud solutions, regulated industries |

Which Company is on Top of the Cloud Market Share Rankings?

In the decade leading up to the year 2025, the market share of cloud service providers showed that Amazon Web Services, AWS, was at the top. Microsoft was next. Google was after Microsoft. A plethora of smaller providers focused on niche markets.

AWS Cloud Services Market Share Dominance

In 2025, no companies challenged AWS profitability. Reports showed that AWS dominated the market with 30% of the revenue available for the cloud infrastructure market. N2WS projects that revenue will be over one hundred billion dollars in 2025. This dominance is in large part due to the first-mover advantage realized in 2006, coupled with a streak of innovative cloud infrastructures.

It is noted that AWS dominates the market with over 200 unique services that offer computation, analytics, networking, machine learning, internet of things, databases, storage, applications, and a host of other supporting services. These services are found in 84 data centers, or availability zones, positioned in 26 regions around the world. This allows AWS to have the low latency required by customers.

AWS is using its active users on the cloud services platform as a competitive advantage. More than 3.2 million businesses, from small startups to Fortune 500 giant corporations, are active on the platform. One of the most recognizable is Netflix, which in the course of seven years successfully moved its entire streaming infrastructure to AWS, which gives a good demonstration of the ability of the platform to handle the most complex demands at a global scale.

Microsoft Azure Cloud Computing Market Share

Stats estimates that Azure holds around 20% of the global infrastructure market, which places Microsoft Azure in second position for the Microsoft Azure Cloud Computing Market Share. Azure is growing faster than AWS, which allows it to build market share through hybrid cloud competitive advantages, enterprise-level relationships, and advantages from Microsoft’s software platform.

As reported by Dedicatted, Microsoft has more geographic coverage than AWS, with a count of 60 regions and 116 international availability zones. This extensive coverage allows Azure to cater to industries with stringent data residency compliance.

Microsoft Azure’s cloud strategy is more than just infrastructure services. Results claim that Microsoft, as of the 1st quarter, 2025, earns more than half of its total revenue from the cloud, which includes Azure’s infrastructure services and the Microsoft 365 suite. Microsoft’s position is unique due to the differentiation strategy, which offers infrastructure, platform, and software-as-a-service components.

Google Cloud Platform (GCP) Market Share Position

By the last quarter of 2025, according to a Slickfinch report, the Google Cloud Platform is predicted to hold roughly 13% of the cloud infrastructure market. Although this is still considerably less than the volume held by AWS and Azure, GCP’s market share is expanding as Google uses its advantages in data analytics, machine learning, and Kubernetes to grow its business.

GCP market share sustains its growth owing to the presence of robust infrastructure within 34 regional and 103 availability zone locations. Such cloud infrastructure is critical for supporting market expansion in the Asia-Pacific regions, where aggressive data center construction out follows Google’s substantial investments.

Rather than focusing on one-upping AWS with each set of services, Google aims to position strategically with Novelties. This is evident from the foundation of Google’s analytics products. Many cutting-edge technologies, such as the Kubernetes machine learning orchestration originally developed as Google’s internal Borg system, TensorFlow, and data analytics pioneers with BigQuery, were created. Businesses with highly advanced analytics, machine learning, and data science needs are drawn to the company’s strong technical capabilities.

Secondary Cloud Service Providers Market Share

Beyond the “Big Three,” several secondary providers maintain meaningful cloud service provider market share in specific regions or market segments. Alibaba Cloud holds approximately 6% of the market, with particular strength in China and other Asia-Pacific markets. The platform operates from 27 regions with 84 availability zones.

Oracle Cloud represents approximately 2% of the cloud provider market share according to Fierce Network, with presence in 38 regions and 46 availability zones. Oracle’s cloud strategy focuses on its database heritage and enterprise application workloads, particularly for customers running Oracle Database, ERP, and other enterprise software.

IBM Cloud, while accounting for a smaller percentage of the overall cloud computing market share, maintains a presence in 11 regions with 29 availability zones.

Regional Cloud Market Share & Growth (2025)

The global cloud landscape shows clear regional disparities, with each market growing at a unique pace depending on digital maturity and infrastructure investments.

The table below highlights how regional cloud market share and value projections are evolving from 2024 to 2025.

| Region | 2025 Market Share | 2025 Projected Market Value (USD) | Growth Rate (YoY) | Key Trends |

| North America | 39% | $457.7 Billion | +15% | Mature adoption, strong AI/ML workloads, enterprise dominance |

| Asia-Pacific | 28% | $320.5 Billion | +23% | Fastest growth, AI/data centers expansion |

| Europe | 22% | $258.9 Billion | +13% | Hybrid adoption, sustainability leadership |

| Middle East & Africa | 6% | $68.2 Billion | +18% | Telecom and fintech-led growth |

| Latin America | 5% | $49.1 Billion | +16% | Digital transformation, SMB adoption surge |

How does the Public Cloud Market share vary by service model?

The public cloud market share is highly differentiated by service model. Software as a service (SaaS), Infrastructure as a Service (IaaS), and Platform as a Service (PaaS) each have distinct competitive structures and growth paths.

SaaS Public Cloud Market Share

The Software as a Service (SaaS) is the most dominant segment in the public cloud market and is expected to generate around 55% of the total global cloud revenue in 2024, which amounts to $505.34 billion. This shows the extensive proliferation of cloud-based applications facilitating various business functions.

As stated by Unifycx, the total revenue of the SaaS market in 2023 is around $250 billion and is expected to reach $299 billion by the year 2025. This growth comes as a result of the shift from on-premise to cloud-based systems in various fields, including customer relationship management, enterprise resource planning, human capital management, and even in collaboration and industry-specific applications.

Compared to infrastructure services, the market share of SaaS public cloud is more fragmented. The most important public SaaS company is Salesforce, with a market value of $231.4 billion. And yet, competing within a variety of application categories spans thousands of different SaaS providers, ranging from horizontal platforms to vertical-specific solutions.

The average enterprise uses around 1,295 cloud services, with 120 for the marketing department, human resources around 100, the finance department 51, while development teams leverage 38 different cloud services. Proliferation like this, while beneficial for SaaS application providers, poses heavy management challenges for IT organizations.

Infrastructure-as-a-Service (IaaS) Cloud Market Share

IaaS is positioned as a key pillar of the rapidly expanding cloud computing market, with the technology arms of competing firms vying at the top of the IaaS value chain. IaaS represents the single segment that will grow the fastest due to migration of work, containerization, and deployments of AI/ML.

The IaaS market is the fastest growing segment in the market where the Cloud will grow from $117 billion in 2022 to 234 billion in 2025, which is a noted 53% growth.

The market of IaaS cloud providers contains heavy endorsements of AWS, Azure, and Google Cloud, with a noted 68% of the public IaaS market. Their dominance is indicative of the high levels of global capital and expertise for building and managing infrastructure at hyperscale and the associated cloud operations.

Market Share of Cloud Service Providers Offering Platform-as-a-Service

With revenue still coming, platform-as-a-service sits in the mid-range of the cloud computing market and is one of the fastest-growing PaaS categories. The global PaaS market is reported to be worth $117 billion by 2023 and is predicted to be worth $244 billion by 2028, representing a spend at a compound annual growth rate of less than 16%, as reported by WebFX.

PaaS accounts for around 16% of the projected $27 billion cloud market across the Asia-Pacific region in 2026. The PaaS market in Europe was worth €22.14 billion in 2025, which Statista reports is expected to grow by 2027 to €42.11 billion, and to a 2027 estimate.

The major PaaS cloud providers, such as AWS, Azure, and Google, offer horizontal platforms as well as specialized platforms focused on specific use cases to other cloud service providers. PaaS AI platforms are forecasted to be the fastest growing in the category with a 5-year compound growth rate of 51.1%.

Within the PaaS cloud market share dimensions, data platforms are especially lively sections. Per Reuters via N2WS, unified data cloud platforms reflect robust enterprise usage, giving Databricks the highest value at $62 billion. Enterprise adoption has been strong. Snowflake, an advanced data platform, has also been growing rapidly as companies merge data warehousing and analytics.

What are the 2026 Drivers of Cloud Market Share?

The 2026 cloud market share is propelled by numerous high-velocity growth drivers, which are transforming the manner in which enterprises deploy and exploit cloud migration services.

1. AI and Generative AI as Core Accelerators

AI, and specifically generative AI, represents the largest growth trigger by far. Cloud spend associated with AI workloads increased by more than 150% year-over-year. That growth ripple affects every element of the public cloud market share, ranging from GPU/TPU purchases to sophisticated data pipelines. Those suppliers capable of scaling AI effectively, such as AWS and Google Cloud, are enjoying dramatic revenue accelerators.

2. Multi-Cloud and Hybrid Approaches Become the Standard

Nearly 89% of businesses are multi-cloud today, and 73% are hybrid. These architectures help to shield businesses from vendor lock-in and build agility, but bring increased architectural complexity. Those providing seamless cross-cloud integration and governance tooling are those increasing cloud provider market share.

3. Cloud-Native Modernization and Digital Transformation

Companies are accelerating modernization through the substitution of traditional systems with the use of microservices, containers, and serverless. These shifts not only increase the cloud providers’ market share but also bring new FinOps, observability, and resilience requirements.

4. Edge Computing Expansion

Edge computing extends the market share of cloud computing beyond the data centers and gets the devices and services closer together through the IoT and 5G networks. Distributed cloud network-investing vendors see greater growth within the latency-sensitive segment, including manufacturing, logistics, and healthcare.

5. Sustainability and Regulatory Pressure

Sustainability now directly affects the cloud consulting service providers’ market share. Enterprises are increasingly prioritizing green data centers, carbon tracking, and transparent ESG metrics when choosing cloud vendors.

Is Your Cloud Infrastructure Ready for the AI-Powered Future?

TekRevol bridges cloud and AI to future-proof your digital journey.

Connect with Our Cloud InnovatorsHow Much Are World Cloud Investments and How’s the Future Looking? (2025-2030)

The expansion of cloud market share worldwide parallels growing infrastructure investment.

Q4 2025 Spend Highlights

- Infrastructure spending on cloud worldwide hit $99 billion, a 25% annual growth rate.

- The market value by 2025 is estimated to be $912.77 billion.

- Forecasts put the cloud economy of the world beyond $5 trillion by 2034 with a CAGR of 20% and higher.

Regional Spending Trends

- Asia: Low to medium workload density and maturing FinOps capabilities.

- Asia-Pacific: Fastest CAGR, driven by massive data center build-outs.

- Europe: Balanced growth; hybrid cloud takes the lead.

- MEA and LATAM: Spearheading the charge through telecom and fintech industries.

Financial Implications

The cloud market share grows rapidly, and it both provides opportunities and gives rise to cloud app development challenges. With growing demands for GPUs, fluctuating spot prices, and higher sustainability costs, the new source of competitiveness is operational efficiency.

How Should Companies Select the Ideal Cloud Provider of 2026?

Selecting the right vendor in the highly competitive cloud provider market is a business-critical decision. Tekrevol, a cloud app development company, uses a seasoned, tried-and-true seven-step methodology.

Step 1: Priorities of Business Define

Determine where most matters, cost optimization, performance, security, or global reach, and align the cloud strategy accordingly.

Step 2: Match Workloads and Provider Strengths

- Compute-intensive tasks: AWS and GCP.

- Enterprise applications: Azure.

- AI Serving and analytics: GCP.

- Regional compliance: Assess the region’s vendors.

Step 3: Calculate Total Cost of Ownership

Work out all the costs within three to five years: calculate data storage, data movement, managed cloud services, and personnel.

Step 4: Security and Compliance Assurance

Include ISO, SOC2, and encryption requirements, and data residency guarantees.

Step 5: Plan for Portability

Embraced Kubernetes, containers, and infrastructure-as-code to avoid vendor lock-in and guarantee operational scalability.

Step 6: Operational Readiness Maintenance

Define support SLAs, managed service availability, and the maturity of the ecosystem.

Step 7: Pilot, Measure, and Iterate

Perform pilot workloads by cost and performance KPIs before full-scale implementation. Pilot methodology validates long-term reliability and cost management.

By embedding this detailed roadmap to cloud app development, companies are able to make data-informed, business-outcome-oriented, and technically informed decisions aligned with specific cloud requirements.

What are the Strategic Bets of the 2026 Cloud Market Share Trends?

Numbers alone won’t drive business outcomes, but their interpretation does. The 2025 cloud market landscape indicates some practical modifications for service providers and businesses.

1. Cloud as a Competitive Lever

Organizations that exploit the cloud market share landscape strategically for innovation toward AI have huge first-mover benefits.

2. Operational Complexity and Governance

Growth begets complexity. FinOps maturity, governance, and observability enable you to avoid cost surprises.

3. Cloud-Native and AI-First Design Requirements

Cloud-native, AI-enabled cloud computing services give real-time analytics, scalability, and cognitive automation.

4. Multi-Cloud: Balance and Complexity

Multi-cloud minimizes reliance but requires greater architecture discipline. Strategic diversification performs best alongside seasoned DevOps and automation practices.

5. Sustainability and Ethical AI as Differentiators

It seems companies are increasingly favoring sustainability improvements and responsible strategies of AI, which are increasingly impacting cloud service providers‘ share dynamics.

Tekrevol Insight: Future Directions of Business After the Paradigm Shift of Cloud Market Share

2025 represents the cloud market share dynamics inflection point globally. Hyperscalers are still the leaders, but the competition focuses on hybrid flexibility, localized compliance, and infrastructure for artificial intelligence.

Tekrevol, being a leading mobile app development company, and Rev AI help businesses capitalize on the full capabilities of this expanding cloud computing market share through the following three transformation pillars:

- Strategy and Architecture: We co-design scalable, highly secure architectures aligned with your growth strategies, with an emphasis on cloud optimization, resilience, and performance.

- Artificial Intelligence and Cloud Engineering: We build cloud-native, AI-ready environments that deliver the best compute efficiency and lowest time-to-market for next-generation workloads.

- Migration and Modernization: from lift-and-shift migration to extensive refactoring, Tekrevol facilitates seamless modernization and undertakes cost discipline through FinOps.

Whether you are scaling your future roadmap by increasing your capabilities for AI, expanding globally, or making effective spending within a competitive cloud share game, your end-to-end transformation go-to partner should be Tekrevol.

Ready to rethink your cloud strategy?

Collaborate with Tekrevol and construct a future-proof, cognitive infrastructure to convert your cloud investment into tangible business outcomes.

Unsure How to Scale Securely in 2026’s Cloud Landscape?

TekRevol’s secure frameworks protect and empower your business.

Partner with Us to Lead Innovation