Here’s a number that might stop you mid-scroll: In 2025, the global Buy Now, Pay Later market is on track to pass $560 billion in transaction value..

That’s a staggering leap for a payment method many of us only started noticing a few years ago. It’s not hype but a shift in how we pay for the things we want and need.

For a lot of people, that first taste of BNPL came through Afterpay, which offered four straightforward payments over six weeks, no interest as long as you stayed on track.

But the BNPL world has grown up fast. Today, there are apps like Afterpay that go beyond the basic offering of longer repayment terms, wider store coverage, or even rewards that work like credit card perks.

In this guide, we’ll compare the leading options in 2025, highlight their strengths and trade-offs, and share a behind-the-scenes look at how you could build a BNPL app of your own. Some of these may suit your shopping habits better.

Buy Now, Pay Later (BNPL) Market in 2025

A few years ago, BNPL was this shiny new payment option that popped up on online checkout pages. Now?

It is a multi-billion-dollar industry with an ecosystem of applications, rules, and passionate followers.

By 2025, buyers, particularly Gen Z or Millennials, will actively select their retail locations based on whether they provide payment options. And businesses know this. Retailers that integrate apps like Afterpay or its competitors often see higher conversion rates and bigger average order values.

The Numbers Paint a Clear Picture

- Adoption rates are soaring: BNPL’s popularity is climbing high as recent data shows that Buy Now, Pay Later loans accounted for about 6% of all U.S. e-commerce sales in 2024, up from just 2% back in 2020.

- It’s not just online: In-store BNPL usage is rising, with many other apps like Afterpay offering QR codes or tap-to-pay solutions right at the register.

- Bigger industries are joining in: We’re seeing BNPL expand into travel, healthcare, education, and even home improvement.

And What’s Driving This Growth?

- Economic uncertainty: With inflation still affecting budgets, spreading payments over time feels more manageable for shoppers.

- Consumer demand for control: As people like the idea of interest-free, predictable payments without the commitment of a credit card.

- Tech improvements: Instant credit checks, smoother onboarding, and integration with digital wallets make BNPL easier than ever.

Thinking about integrating BNPL into your online store?

Our fintech team can help you design a custom payment solution that keeps your customers coming back.

Reach out to us today.Why Look Beyond and go for Other Apps like Afterpay?

Afterpay does a lot right. Its interface is clean, approvals are quick, and repayment terms are simple. But… It’s not perfect.

- Limited merchant variety compared to some competitors.

- Less flexibility in payment schedules.

- Fewer integrated shopping perks than platforms like Klarna.

That’s where other apps like Afterpay fill the gap by offering different terms, bigger merchant networks, and unique features.

Top Competitors & Alternatives to Afterpay

Here’s a quick comparison of the apps like Afterpay(top BNPL players) in 2025:

| BNPL App | Unique Selling Point(USP) | Key Feature | Ideal For |

| Klarna | Multi-payment flexibility & in-app shopping. | Pay in 4, financing up to 36 months, built-in deals. | Shoppers wanting deals + financing. |

| Affirm | Transparent pricing with no late fees. | Flexible payment terms, no compounding interest. | Large purchases and tech. |

| Sezzle | Focus on socially conscious shopping. | Pay in 4, rescheduling options, and Sezzle Up credit reporting. | Younger shoppers & credit building. |

| PayPal Pay in 4 | Instant merchant trust via the PayPal ecosystem. | 4-installment plan, PayPal Buyer Protection. | Frequent PayPal users. |

| Zip (Quadpay) | Cross-border BNPL. | Pay in 4, global merchant reach. | International shoppers. |

How To Choose the Right BNPL App for Your Needs?

The “best” app depends on your needs. If you want in-app shopping and deals, go for Klarna. If you’re making a large purchase, Affirm’s transparency is unmatched. For trust and security, PayPal Pay in 4 wins.

Apps like Klarna and Afterpay might seem similar, but their features and merchant partnerships can be very different. With that being said, if you really want to explore money-making apps, Klarna can be the option you’ve been searching for.

Comparing Features and Benefits

When deciding between apps like Klarna and Afterpay, here are the core features to compare:

| Feature | Afterpay | Klarna | Affirm | Sezzle | Zip | Paypal pay in 4 |

| Interest-Free Plans | Yes | Yes | Some | Yes | Yes | Yes |

| Long-term Financing | No | Yes | Yes | No | No | No |

| Rewards program | Limited | Yes | No | No | No | No |

| Credit Reporting | No | No | Yes | Yes | No | No |

| Merchant Network | Large | Very large | Large | Medium | Medium | Large |

How to Create Your BNPL App in 2025?

As BNPL’s growth accelerates, consumers are not the only ones interested in apps like Afterpay; entrepreneurs, fintech, and even legacy banks are exploring how they can create their versions of fintech solutions.

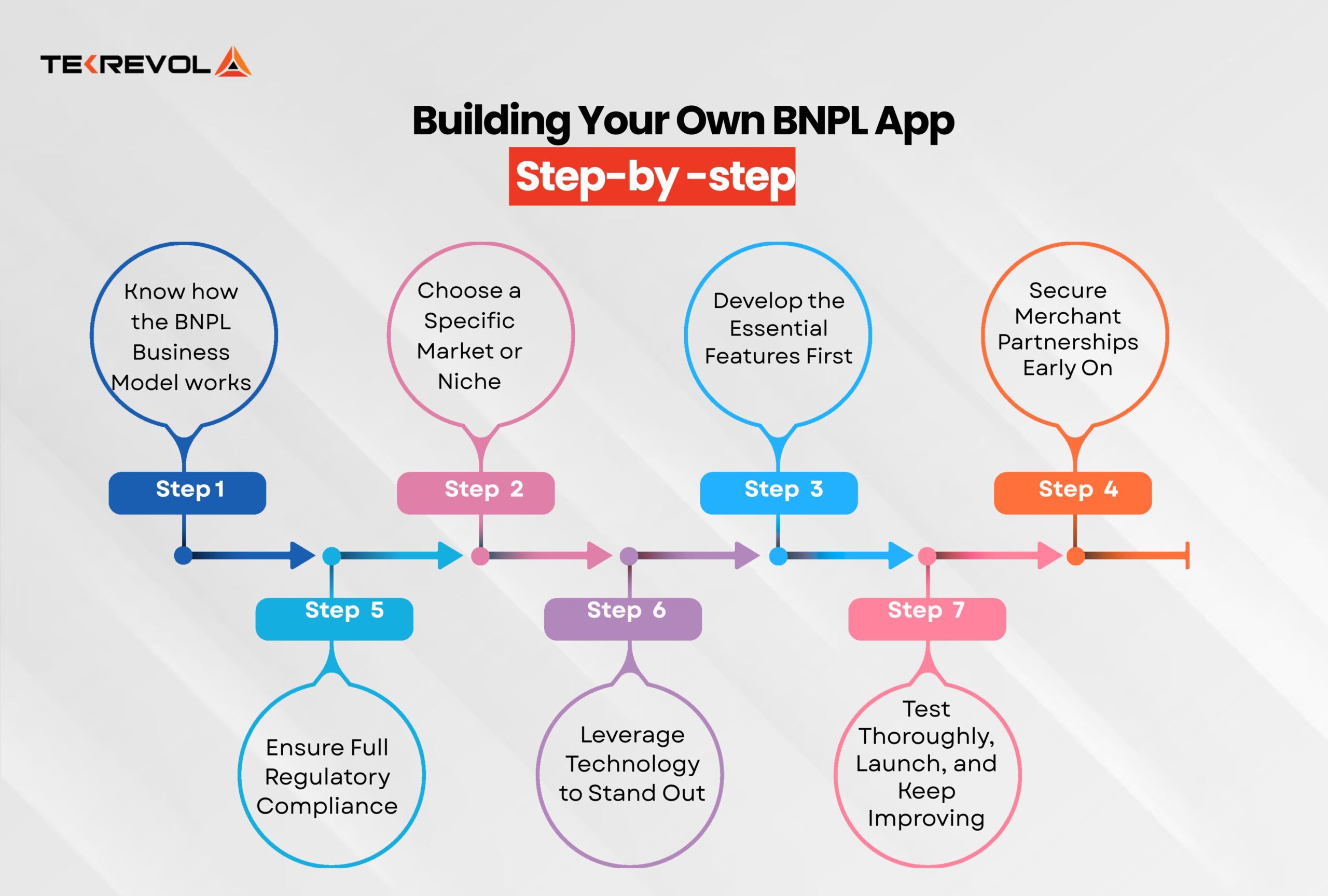

If you’re interested in developing your own BNPL platform from scratch, here is a how-to.

Step 1: Understand the BNPL Business Model

At its core, Buy Now, Pay Later (BNPL) combines two elements:

- Consumer Credit: Shoppers split purchases into several installments, typically four interest-free payments, making it easier to manage costs. BNPL loans are often not reported to credit bureaus, keeping credit scores unaffected unless payments are missed Consumer Financial Protection Bureau.

- Merchant Services: Retailers offer flexible payments, which can boost sales. For example, Klarna reported a 45% increase in average order value among retailers using installments Embryo.

BNPL revenue sources include:

- Merchant fees: Providers charge retailers a fee, typically 2–8% of each sale, which is higher than traditional card fees.

- Interest on extended plans: Some providers offer longer-term financing with interest beyond the short-term, interest-free model.

- Late fees: While still present, these are often capped. Afterpay, for example, caps late fees at 25% of the order value or $68, whichever is lower.

Step 2: Decide On Your Niche

Instead of competing against the giant apps like Afterpay, Klarna, or Affirm, you can serve a niche.

Some examples include:

- Healthcare and dental financing.

- Educational courses and skill training.

- Luxury goods and high-end fashion.

- Subscription services.

From here, your small, niche BNPL app can become the #1 choice for that niche audience.

Step 3: Build Core Features

Your BNPL app will need to have:

- Easy checkout integration (both online and in-store).

- Multiple repayment plan options (short-term, interest-free, or longer-term with interest).

- A clear fee structure attaining full transparency.

- Credit-check options (soft checks to determine approval, full checks for long-term plans).

- Spending limits that move based on user history.

- Rewards & perks for customer loyalty.

Step 4: Partner with Merchants Early

A BNPL app will only be as good as the number of places you can spend available funds. Therefore, starting with partnerships with small-to-medium businesses in your niche market will help kickstart momentum. Once done, you are all set to expand to large retailers and spread your business within your niche.

For merchants, one of the biggest attractions of apps like Afterpay is reduced transaction costs, so offering lower fees during the early phase is a smart way to get them on board.

Step 5: Comply with Regulations

In 2025, there is heightened government scrutiny over BNPL. You will need to:

- Follow consumer credit laws in all countries you operate in.

- Have clearly disclosed repayment terms and amounts to your users.

- Disclosed dispute resolution processes.

- If you don’t, your app might be forced to close before your business can grow.

Step 6: Use Technology to Differentiate

You do not have to build the same experience that already exists in the market. Many apps like Afterpay are popular because they make payments easier, but if you want to stand out, you need to bring something fresh.

- You could add AI tools that guide users with smart budgeting so they avoid overspending.

- You could also gamify rewards for customers who pay on time.

- Integrate cryptocurrency or digital wallets to meet the needs of modern users.

For a more socially conscious audience, offering carbon footprint tracking for each purchase can make your app both practical and sustainable.

Step 7: Test, Launch, and Iterate

When you are building something new, it is smart to start small.

- Launch a beta version for a limited group of users and gather feedback.

- Ask them how easy the app is to use, whether the approval speed feels fair, and if the terms are transparent.

- You should also check how satisfied merchants are with the process.

Many apps like Afterpay earned trust by testing early and refining before scaling. Once you improve the features and performance based on this feedback, then you can confidently expand your marketing.

Want to integrate a BNPL solution into your business or create your app?

Tekrevol builds scalable, regulation-ready fintech products.

Let’s explore your idea today.Pros & Cons of BNPL in 2025

| Pros | Cons |

| Interest-free options for short terms | Can encourage overspending |

| Easier approval compared to credit cards | Late fees can add up |

| Helps spread out big costs | Limited acceptance across all stores |

| Rewards with certain providers | Missed payments may affect your credit |

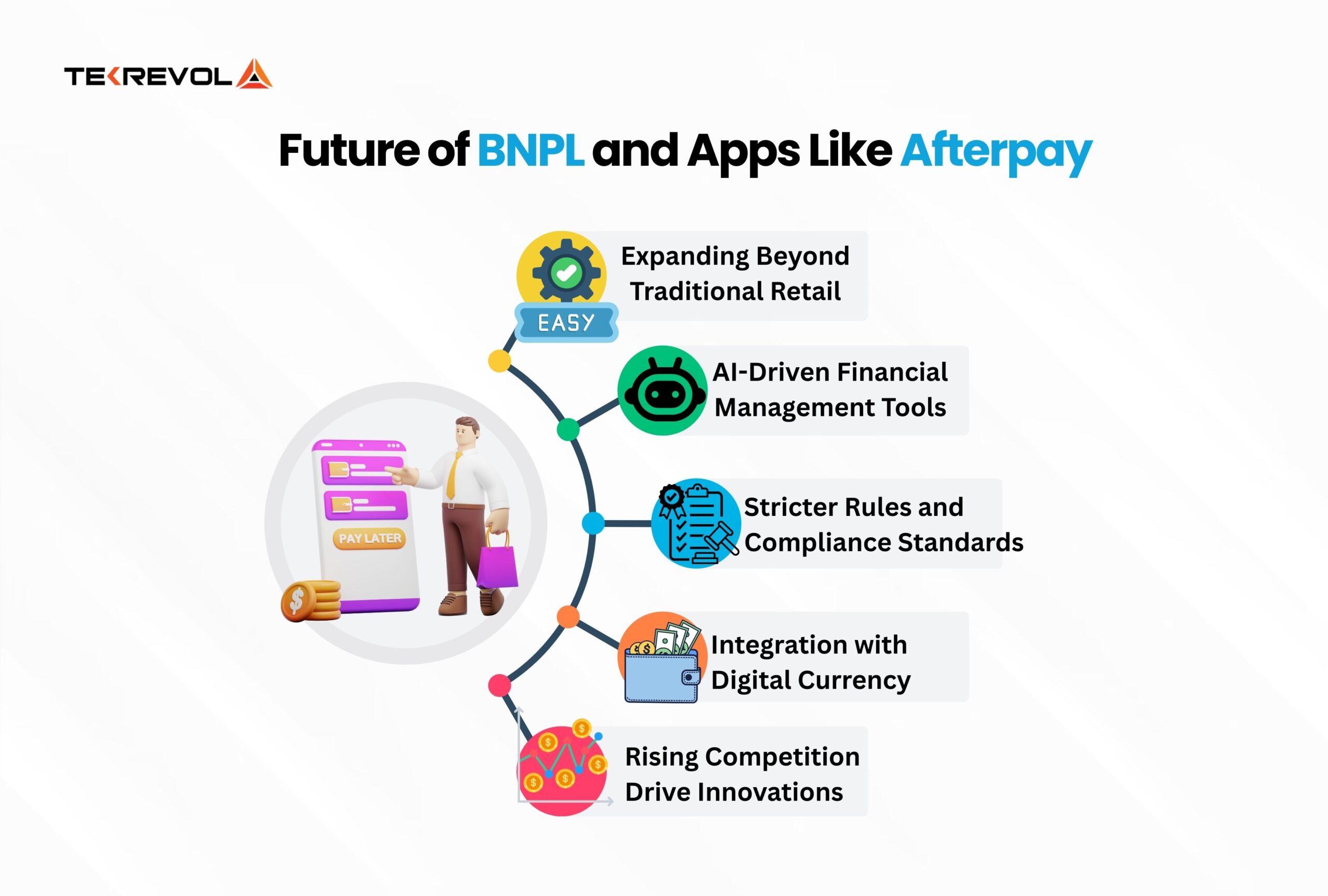

The Future of BNPL and Apps Like Afterpay

If the past five years are any clue, apps like Afterpay aren’t slowing down anytime soon. The BNPL market is projected to grow even faster between 2025 and 2030, with more players entering the space and new features changing how we shop, borrow, and budget.

Here’s what we can expect going forward.

1. BNPL Beyond Retail

Right now, most BNPL apps are tied to fashion, electronics, and home goods. But in the next few years, we’ll see:

- Travel BNPL: Spreading vacation costs over months instead of paying up front.

- Education BNPL: Financing short courses, certifications, and skills training.

- Service BNPL: From dental visits to car repairs, flexible payment options will become standard.

2. AI-Powered Financial Tools

Future BNPL platforms won’t just split your payment schedule but help customers make smarter financial decisions. Expect:

- AI-driven budgeting suggestions.

- Spending alerts before you risk overextending yourself.

- Personalized payment plan recommendations based on your income cycle.

3. Tighter Regulations

By 2025, regulators will have already started treating BNPL more like credit cards. This means:

- Clearer disclosure of fees and terms.

- Limits on how much you can borrow based on your financial history.

- Better consumer protections in case of disputes.

While some worry this could slow BNPL adoption, it’s actually a good thing—it builds trust with shoppers and merchants.

4. Integration with Digital Wallets and Crypto

BNPL apps are already partnering with Apple Pay, Google Pay, and PayPal. Soon, we might see:

- Instant BNPL checkout via tap-to-pay in physical stores.

- Crypto-based BNPL lets users pay with stablecoins or convert crypto to fiat over installments.

5. More Competition, More Innovation

The biggest change? Competition will force providers to innovate.

We’ll see other apps like Afterpay adding:

- Gamified savings challenges.

- Cashback boosters for paying early.

- Subscription-based “premium BNPL” with perks like lower fees or extended payment terms.

How TekRevol Can Help?

If you’re intending to create an app like Afterpay, you’ll need more than good developers. You need a collaborative partner that understands financial technology, user behavior, and how trust influences each and every digital commerce transaction. That’s what we do at TekRevol.

When developing an app like Afterpay, we are focused on what is most important to your users – flexibility, transparency, and ease of use. Our process begins with strategy. We take the time to understand your business model, target consumer, and what you’ll need to launch and make your platform stick out.

So if you want passive ownership in an app like Afterpay, we can walk you through the entire process.